Buy JNJ?

Right Strategy

Johnson & Johnson, the largest healthcare firm in the world, has a diversified business model – operating through the key segments of pharmaceuticals, consumer products, and medical devices – that helps it combat most of the problems affecting the market and the broad economy. The medical devices division witnessed a slowdown during the pandemic period due to a drop in surgical procedures, while the other two segments performed well. However, the former is quickly getting back on track, aided by the procedure stabilization linked to pandemic recovery.

Meanwhile, the New Brunswick, New Jersey-based company came under the lens of regulators on multiple occasions, amid allegations that some of its products did not comply with the prescribed safety standards. While the company managed to sail through the setback, its recent performance indicates that the legal issues did not go well with investors. Legal costs and penalties continue to eat into profit, offsetting the benefits of overall business growth. It is estimated that legal costs had a $1.50-per share impact on earnings in 2019.

Q3 Numbers Beat

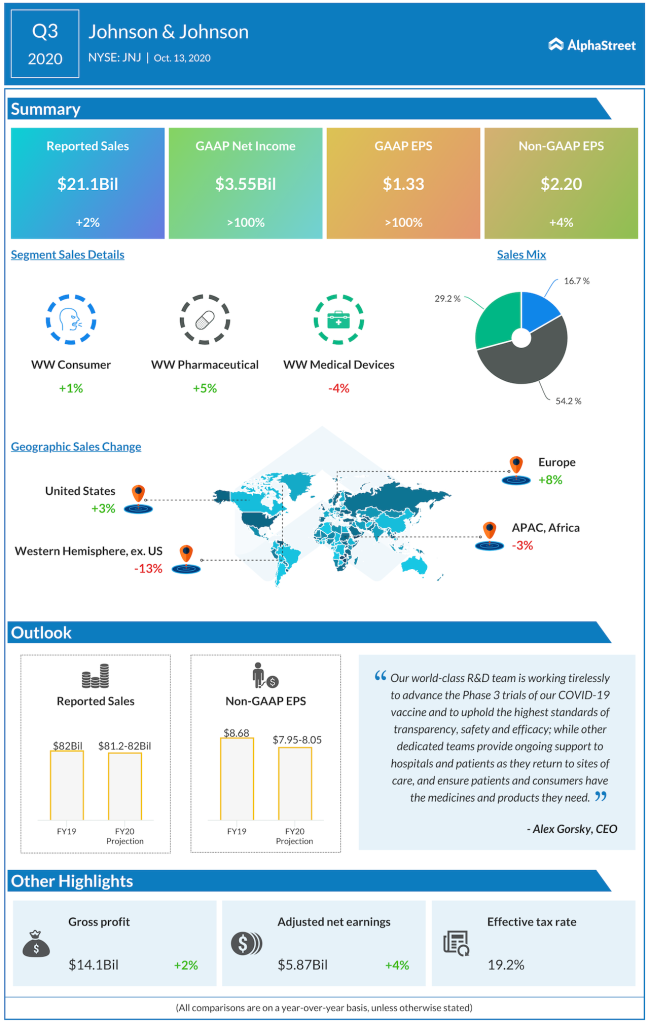

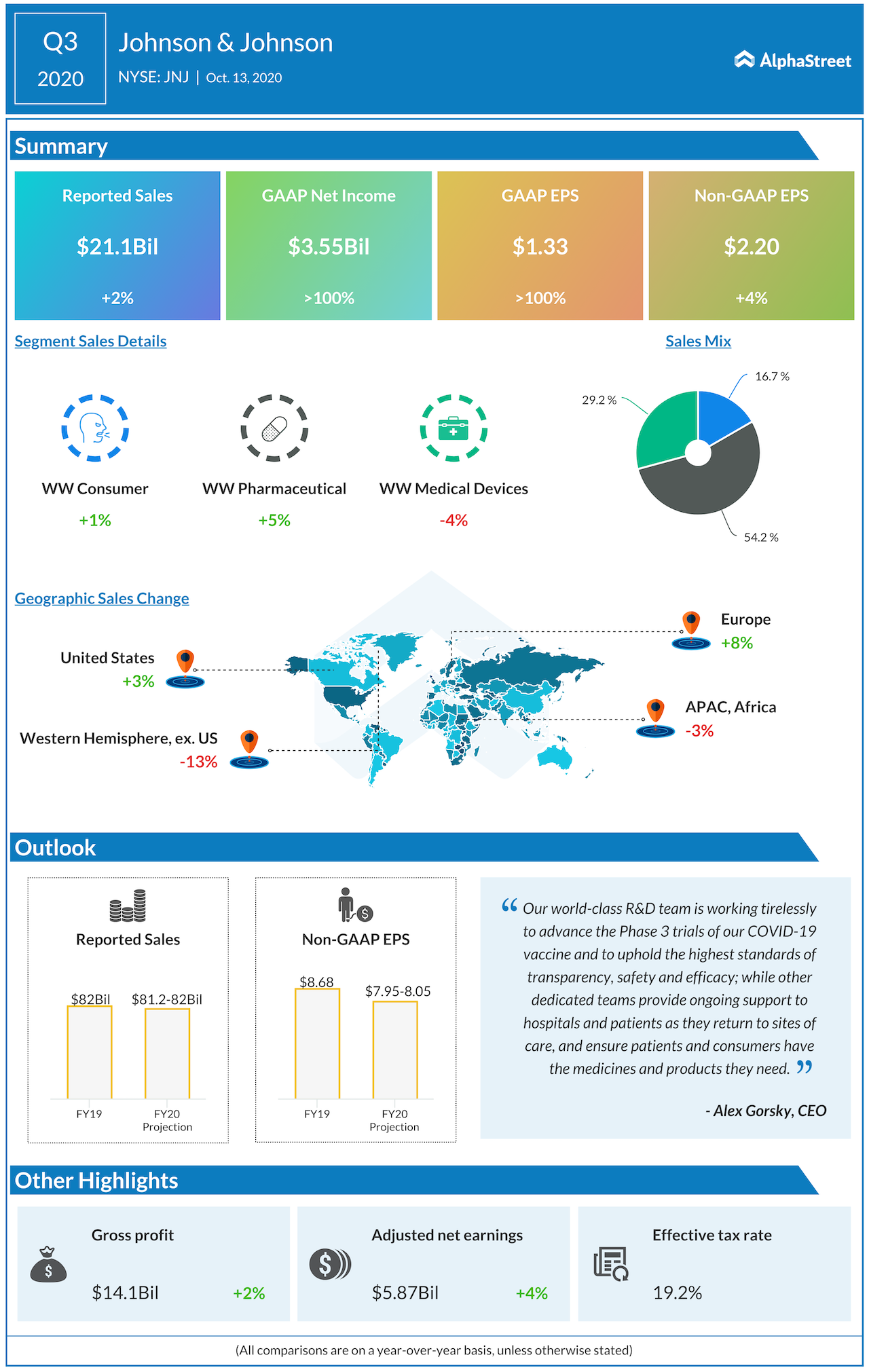

In the third quarter, both profit and sales increased year-over-year and came in above analysts’ forecast. At $21 billion, sales were up 2% while earnings rose to $2.20 per share. The top-line grew in the U.S and Europe but decreased in the other geographical regions.

Each of our business segments performed well in the third quarter despite COVID-19-related headwinds. We believe our Pharmaceutical segment once again outperformed the market, recovery in our Medical Device business was faster than anticipated, and in Consumer, our strategy focused on science-based products led to solid growth. While COVID dynamics continue to make the outlook fluid and perhaps not linear, we are encouraged by this progress and believe that we will continue to see improvement through the end of the year.

Joseph Wolk, chief financial officer of Johnson & Johnson

Single-Dose Advantage

With the vaccine trial reaching the final stage, the management is currently looking to seek emergency approval from the FDA and catch up with rivals and frontrunners Moderna, Inc. (MRNA) and Pfizer, Inc. (PFE). The company expects that the single-dose regimen and affordable price would give its vaccine an edge over others. The advanced-stage trial of JNJ-78436735 was announced in September.

Read management/analysts’ comments on JNJ’s Q3 earnings

Though the stock bounced back after slipping to a six-month low early this year, it underperformed the market. It has gained 10% in the past six months. The shares traded slightly above the $150-mark on Monday.