Strong performance

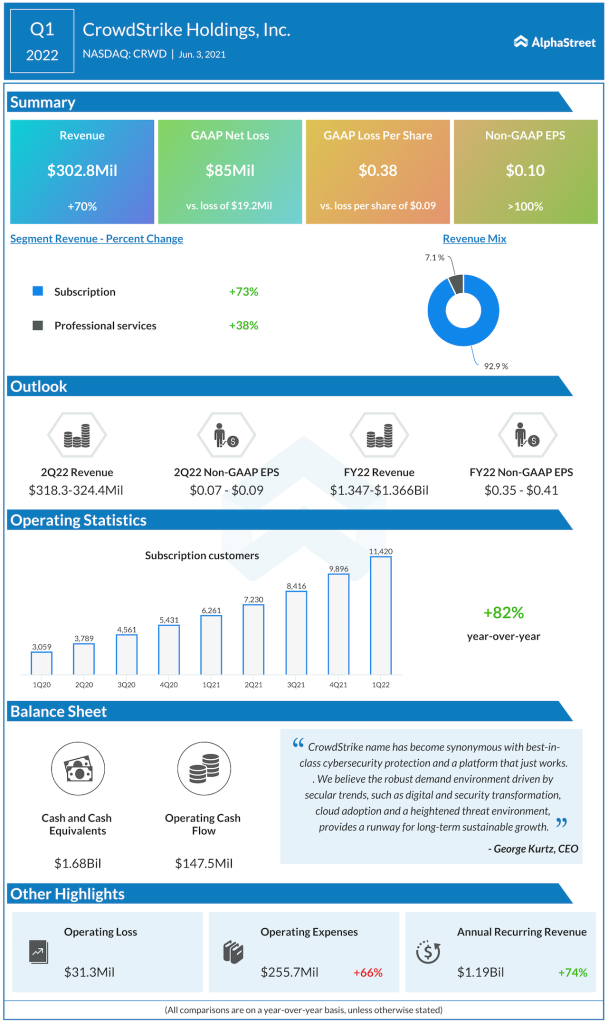

CrowdStrike delivered strong results for the first quarter of 2022 with both the top and bottom line numbers surpassing market expectations. Revenues grew 70% year-over-year to $302.8 million while adjusted EPS jumped 400% to $0.10.

Subscription revenue rose 73% to $281 million in Q1. Annual recurring revenue (ARR) stood at $1.19 billion as of April 30, 2021, reflecting a YoY growth of 74%. Net new ARR added during the quarter was $143.8 million. This strong performance allowed the company to raise its revenue guidance for the full year of 2022 to a range of $1.34-1.36 billion, which reflects a YoY growth of 54-56%.

Robust demand trends

CrowdStrike mentioned on its earnings conference call that it is seeing strong demand trends driven by digital and security transformation, cloud adoption and an increase in cyber threats. The rising incursions from ransomware have made it necessary for companies to look for effective cybersecurity solutions to protect themselves from breaches and vulnerabilities.

In addition, the COVID-19 pandemic brought about a change in the current work environment where people have started working remotely and organizations are currently transforming their businesses in order to facilitate this trend. Companies are also moving their critical applications and workloads to the cloud. These factors have led to a huge demand for cybersecurity solutions which in turn has benefited CrowdStrike.

CrowdStrike added 1,524 net new subscription customers during the first quarter bringing the total number of subscription customers to 11,420 at quarter-end, reflecting a YoY growth of 82%. The company’s success in driving module adoption is another key point to note. Subscription customers that have adopted four or more modules, five or more modules and six or more modules increased to 64%, 50% and 27% respectively during the first quarter.

For the second quarter of 2022, CrowdStrike expects total revenues to grow 60-63% YoY to $318.3-324.4 million. The majority of this growth is expected to come from subscription revenue.

Solid balance sheet

CrowdStrike has a strong balance sheet with cash and cash equivalents of $1.68 billion as of the end of the first quarter of 2022. Cash flow from operations stood at $147.5 million. The company had debt of $738.4 million at quarter-end.

Click here to read the full transcript of CrowdStrike’s Q1 2022 earnings conference call