Operations

GW Pharmaceuticals focuses on discovering and developing cannabinoid prescription medicines using botanical extracts. The company’s lead product is Epidiolex, an oral medicine for the treatment of refractory childhood epilepsy, as well as Dravet syndrome, Lennox-Gastaut syndrome, tuberous sclerosis complex, and infantile spasms.

Over 7,600 patients have received Epidiolex prescriptions since launch. The company also develops and markets Sativex, an oromucosal spray for the treatment of spasticity due to multiple sclerosis. Separately, it develops various product candidates for the treatment of glioblastoma, neonatal hypoxic-ischemic encephalopathy, and schizophrenia.

The company has submitted a regulatory

application in Europe for the adjunctive treatment of seizures associated with

LGS and Dravet syndrome. It continues to evaluate Epidiolex in additional rare

epilepsy conditions including Tuberous Sclerosis Complex (TSC) and Rett syndrome.

For the most recent quarter, revenues from Epidiolex

totaled $33.5 million.

Market

and competition

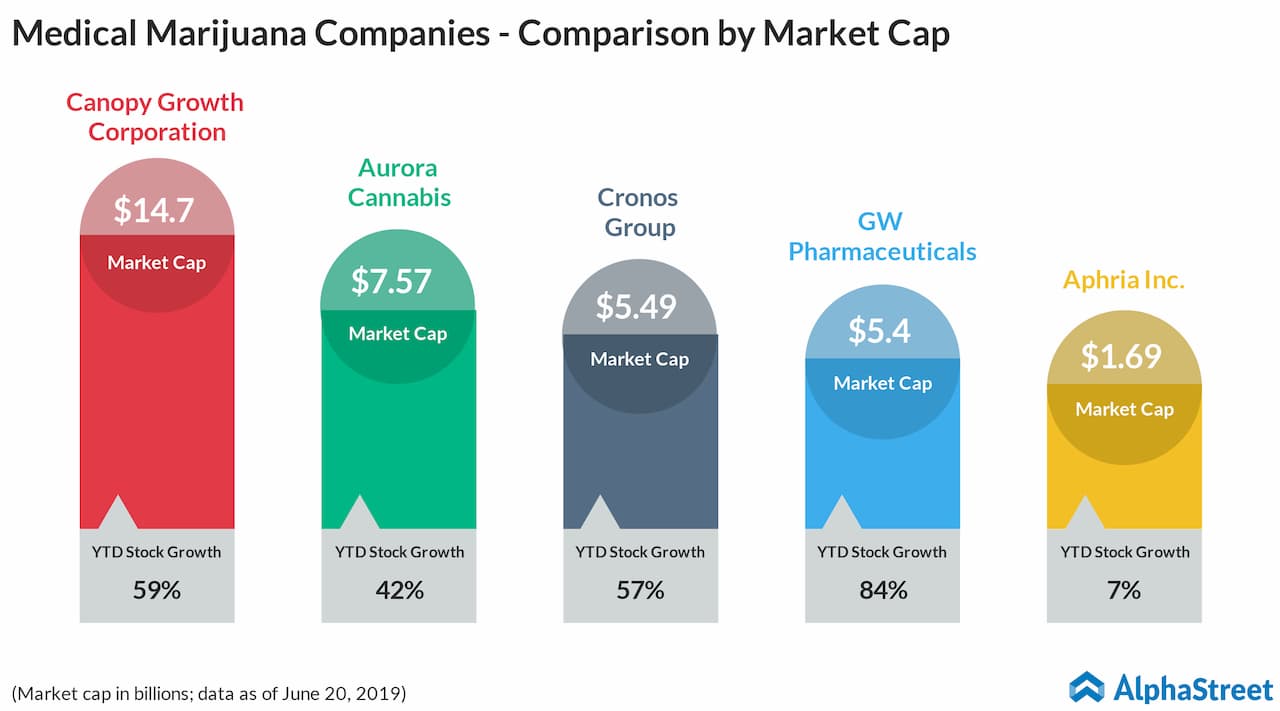

GW Pharmaceuticals competes with a number of medical marijuana companies that include Canopy Growth Corporation (NYSE: CGC), Aurora Cannabis (NYSE: ACB), Aphria Inc. (NYSE: APHA), and Cronos Group (NASDAQ: CRON).

These companies have been identified as

major players in the global medical cannabis market, which is projected to grow

at a CAGR of 22.9% during 2019-2024 to reach a value of $44.4 billion by 2024,

according to a report

by imarc.

The report states that cannabis is a preferred treatment option as it is safer and has fewer side effects. Cancer is the biggest area of application for medical cannabis while others include arthritis, migraine, and epilepsy. North America is the largest market for medical cannabis while other key regions include Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Financials

GW Pharmaceuticals has reported losses in all four trailing quarters, though it has surpassed Wall Street consensus in three of the quarters. Revenues have been increasing over the years, though not really in a steady manner.

For the current financial year, Wall Street expects GW Pharma to report revenues of $213 million, compared to just over $15 million last year, helped by its cannabis-based products. The topline is projected to more-than-double in 2020 to $511 million. These projections are clear evidence for the market’s optimism over the company’s growth potential.

On the

other hand, it might take some time for the company to jump into profitability,

though it is likely to cut down its losses. For the current fiscal year, losses

are projected to be $4.18 per share, less than half of what it reported in

fiscal 2018. For fiscal 2020, we might see further cut down in losses to $2.34.

Cash Flow

Over the past one year, high operating costs, especially research and development expenses, have impacted the UK-based pharma firm’s cash flows, which remained in the negative territory in each of the four trailing quarters.

Liquidity is expected to remain under pressure even as the company’s key drug candidate Sativex is getting ready for the final approval after successfully completing the clinical trials. Going forward, contributions from Epidiolex will help GW Pharma improve bottom-line performance while easing the strain on cash flow.

At the end of the

March quarter, cash and cash equivalents came in at $521.7 million, down 12%

from the same period of 2018. During the three-month period, operating cash

flow improved to (-) $58.4 million from (-) $65.4 million in the same period of

last year. Cash flow benefitted from an improvement in accrued liabilities to

$6.7 million from last year’s negative figure. The progressive reduction in

debt in recent times also bodes well for the cash position.

Street

view

According to TipRanks, all the 10 analysts who are tracking the stock have a “Buy” rating with a 12-month target of $219. This is an upside of about 25% from today’s trading level of $176. The bullishness of the stock is pivoted on solid sales growth expected from its lead cannabinoid product Epidiolex.

Guggenheim analyst Yatin Suneja in his research note states, “GWPH reported a solid Epidiolex sales beat ($33.5MM vs. Street ~$15MME) on significant demand and better than expected uptake in the marketplace. While management did try to caution investors by highlighting “unusual” benefits from bolus/pent-up demand in 1Q, we expect continued robust and broad uptake for the drug.”

Get access to timely and accurate verbatim transcripts that are published within hours of the event.