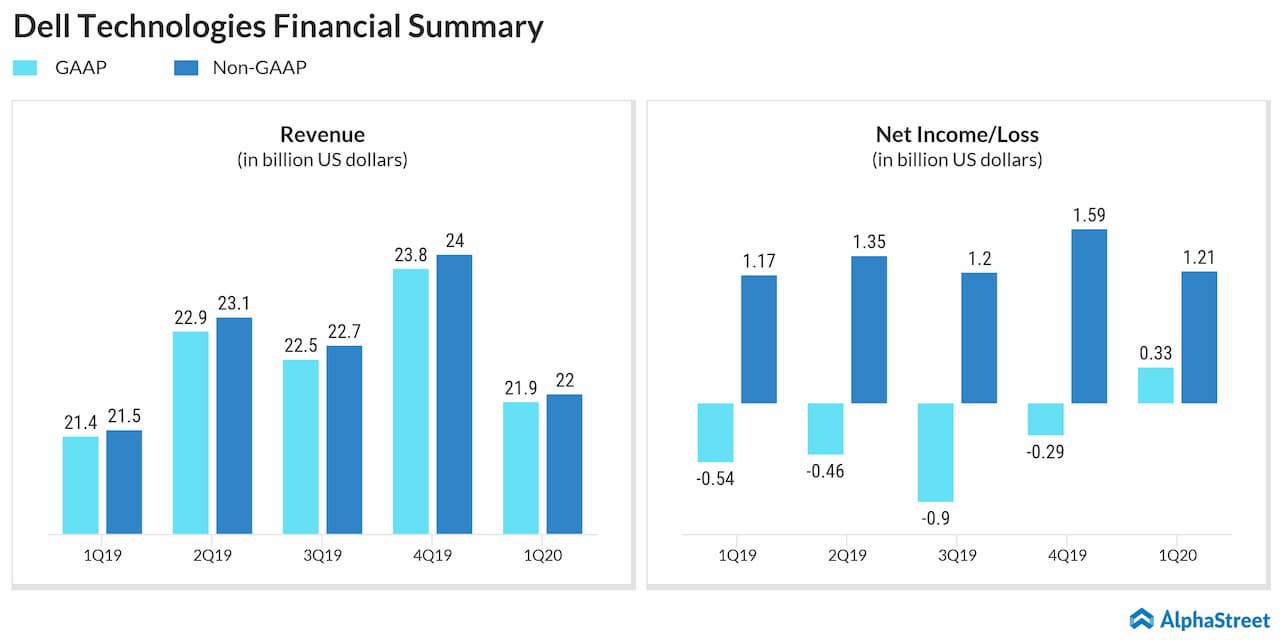

During the first quarter of 2020, Dell’s GAAP revenue grew 3% year-over-year to $21.9 billion and non-GAAP revenue grew 2% to $22 billion. GAAP net income was $329 million or $0.38 per share and non-GAAP net income was $1.2 billion or $1.45 per share in the first quarter 2020. Infrastructure Solutions Group revenue decreased 5%, while Client Solutions Group revenue increased by 6%.

Read: Microsoft (MSFT) surpasses Q4 earnings and revenue estimates; stock gains

Last Thursday, VMware (NYSE: VMW) in which Dell owns approximately 81% stake, reported its second quarter 2020 results. While earnings and revenue beat market’s estimates, VMware stock plunged as it announced that it will be totally paying $4.8 billion to acquire both Pivotal Software (NYSE: PVTL) and Carbon Black. Since Thursday, VMware stock had dropped 12% and Dell stock slipped 7%.

Challenging macroeconomic and IT spending environment, as well as ongoing trade discussions between the US and China remains to be headwinds for the Round Rock, Texas-based technology firm.

According to Gartner, Dell recorded its sixth consecutive quarter of PC shipment growth in the second quarter of 2019. Dell’s PC shipments increased 2.1% with a market share of 16.9% in 2Q19. According to IDC, Dell Technologies maintained the third position with healthy 3.1% growth during the second quarter.

When Dell announced its Q4 2018 results, it had projected FY20 non-GAAP revenue to be between $93 billion and $96 billion and non-GAAP EPS attributable to Dell Technologies common stock to be between $6.05 and $6.70. When reporting Q1 2020 results, Dell stated that it is trending toward the midpoint of the GAAP and non-GAAP revenue ranges for FY20 and non-GAAP EPS outlook to be better the high end of the range.