Demand

With the receding of the pandemic and lifting of restrictions, the airline has seen demand bounce back strongly. At a recent analyst event, the company said leisure travel is seeing strong momentum while business travel is witnessing a nice rebound as more offices reopen. On the back of this recovery, the company expects to see a robust travel season.

Delta expects corporate travel to be about 65% revenue recovered versus 2019. The company’s business travel has two components. One is corporate contracted, which involves the large corporations that the company has corporate agreements with that control the pricing for those corporate clients. The second is small and medium-sized enterprises, which make up more than half of Delta’s corporate business.

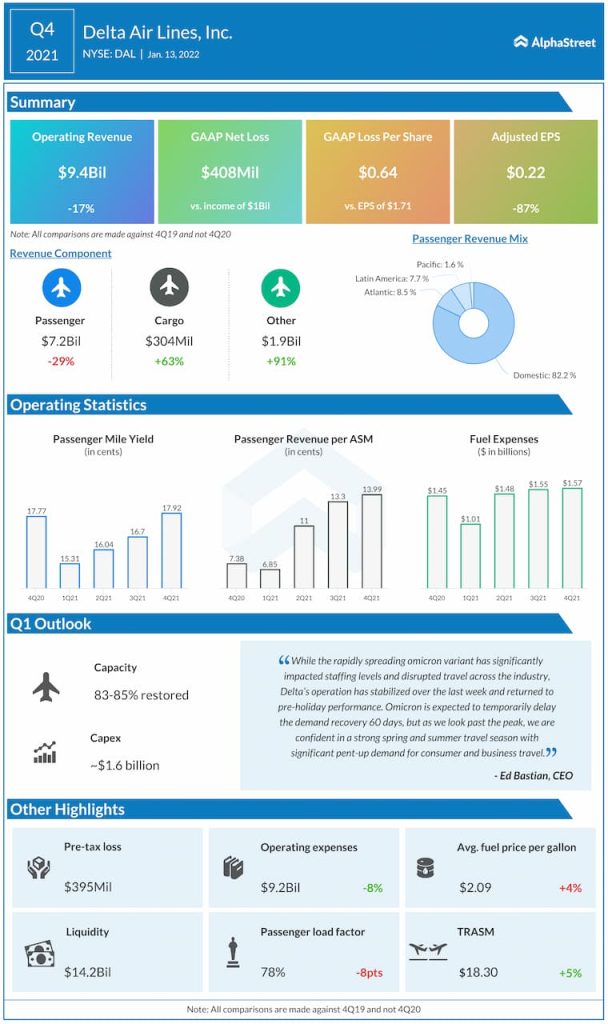

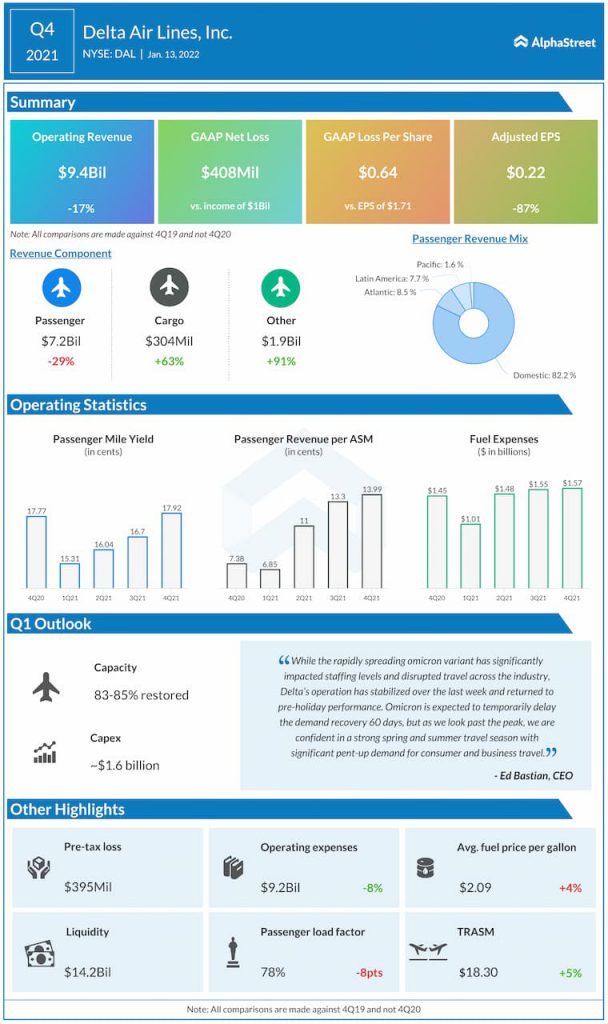

While adjusted revenue was 70% recovered in January and 80% recovered in February versus 2019, for March, it is estimated to be around 83% recovered. For the first quarter of 2022, revenue is expected to be approx. 78% recovered versus 2019. This compares to the previously provided range of 72-76%. Delta expects TRASM to be flat in March compared to March 2019. Moving into the second quarter of 2022, the company expects every month to be positive versus 2019.

Outlook

Delta expects capacity for the first quarter to be around 83% recovered versus 2019. The company has trimmed regional capacity due to some constraints with regional carriers. Delta had earlier guided that capacity would be 83-85% recovered versus 2019.

Adjusted fuel price is estimated to be around $2.80 per gallon compared to the previous range of $2.35-2.50. Delta believes it will be able to pass on the higher cost of fuel to the end consumer, given its demographics. The company expects to be able to recapture somewhere under 10% of fuel costs during the second quarter. CASM ex-fuel is estimated to be up approx. 15% compared to 2019.

Click here to read the full transcript of Delta Air Lines’ Q4 2021 earnings conference call