Revenue and profitability

During the quarter, domestic passenger revenue was 2% higher compared to the 2019 period while international passenger revenue was 97% recovered. Adjusted unit revenues were up 23% compared to 2019.

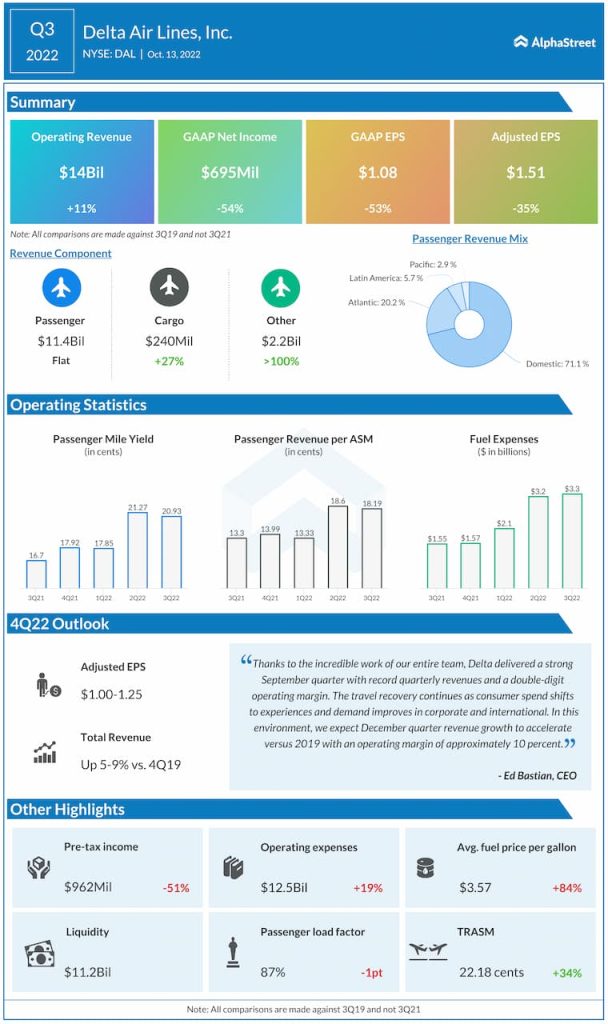

For the fourth quarter of 2022, adjusted operating revenue is expected to be up 5-9% compared to the same period in 2019. Unit revenues are expected to be up mid-teens versus 2019.

In Q3, Delta reported adjusted EPS of $1.51, which was down 35% from the same quarter in 2019. Adjusted operating margin was 11.6%. For Q4 2022, the company expects adjusted EPS to be $1.00-1.25 while operating margin is expected to be 9-11%.

Demand and capacity

Delta witnessed strong demand trends during the third quarter as consumers resumed their travel plans, businesses returned to travel and international markets reopened. It saw improvement in business travel and has forecast corporate sales recovery for the fourth quarter of 2022 in the low to mid-80s at a system level.

The airline anticipates corporate travel will fully recover and new travel patterns will emerge from the flexible work models being created. One of its corporate surveys indicated that 90% of accounts expected their travel to stay the same or increase moving into the fourth quarter.

Delta is seeing strong demand for the entire holiday season. It expects the month of December to be impacted by an elongated period between the holidays and more return travel than usual pushed into January.

Capacity in the third quarter of 2022 was 83% restored relative to 2019 and it is expected to be 91-92% restored to 2019 in the fourth quarter of 2022.

Costs

In Q3 2022, operating expense was $12.5 billion on a GAAP basis and $11.3 billion on an adjusted basis. Non-fuel CASM was 22.5% higher than Q3 2019. Non-fuel unit costs are expected to be 12-13% higher in the fourth quarter of 2022, improving 10 points sequentially.

Click here to read the full transcript of Delta’s Q3 2022 earnings conference call