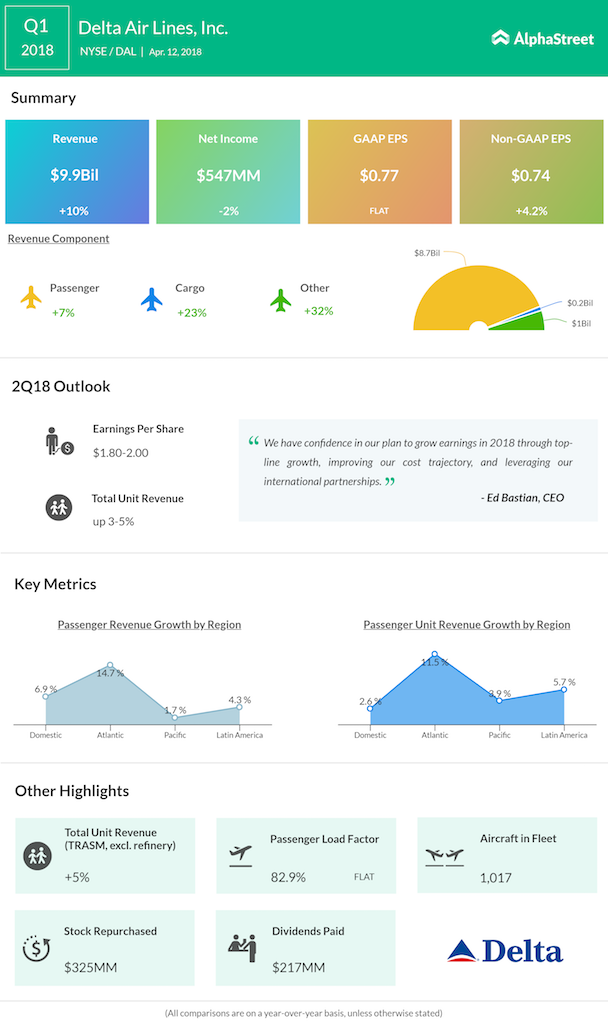

Amidst concerns over rising oil prices and overcapacity, Delta Air Lines (DAL), the biggest US carrier by market value, reported first quarter 2018 results, with reported net income declining 2.5% to $547 million and diluted EPS remaining flat year-over-year at $0.77 per share. Adjusted EPS jumped 4.2% year-over-year to $0.74.

Reported operating revenue, meanwhile, surged 9.5% to $9.96 billion, driven by a 3% increase in cargo revenue and a $78 million surge in total loyalty revenue. The airline’s bottomline was also impacted by rising costs related to fuel and related taxes. Expenses in ancillary businesses and refinery increased double-digits during the quarter.

Delta’s total unit revenue, excluding refinery sales, jumped 5% with foreign currency contributing about 0.5 points of benefit. Delta is also seeing its best revenue momentum since 2014, with positive domestic unit revenues, improvements in all international entities, strong demand for corporate travel and double-digit increases in loyalty revenues. The company expects to maintain this momentum going forward and deliver total revenue growth of 4% to 6% for the full year.

The stock surged 2.5% in pre-market trading, post the earnings results.

Geographic Highlights

The company saw all its geographic regions deliver positive results, with the Atlantic region reporting double-digit increase in revenue and others posting single-digit increases.

Guidance

For the second quarter of 2018, the company expects EPS in the range of $1.80 to $2.00, while total unit revenue, excluding refinery sales, is expected to be up 3% to 5% year-over-year. On a year-over-year basis, CASM, excluding fuel and profit sharing, is expected to be up 1% to 3% and system capacity is anticipated to increase 3% to 4%.

Earlier in the week United (UAL), American (AAL) and JetBlue (JBLU) raised their Q1 unit revenue targets, in line with Delta, while Southwest Airlines (LUV) cut its unit revenue outlook on the so-called United’s aggressive expansion fears.