Liquidity position

Southwest’s balance sheet strength provides it with additional financial flexibility as compared to DAL in a time of unprecedented crisis. In the earnings conference call, Southwest’s CEO Gary C. Kelly mentioned that the firm “began this year with the smallest amount of debt to total capital in our history,” which gives it the benefit of raising capital through debts without significantly increasing its leverage.

See Southwest Airlines Q1 2020 Earnings INFOGRAPHIC

ADVERTISEMENT

In a low revenue environment,

cost containment measures go in full swing. The management of DAL stated that

all the discretionary spending has been postponed for later, and about 37,000

employees have taken unpaid voluntary leaves. Falling fuel prices and reduced

flying have reduced operating expenses by $2 billion in Q1 2020. Southwest also shares closer figures in

terms of cost savings. It has made efforts to reduce about $2.5 billion in fuel and non-fuel

expenses for the quarter.

While both the companies have taken actions to shore up liquidity in their own ways, on an absolute basis, Southwest is faring better. Cash burn of Southwest stood at $65 million per day, and has set targets to half of this by the end of Q2. DAL burnt approximately $100 million by the end of Q1 and expected it to lower to $50 million at the end of Q2.

Preparing for the future

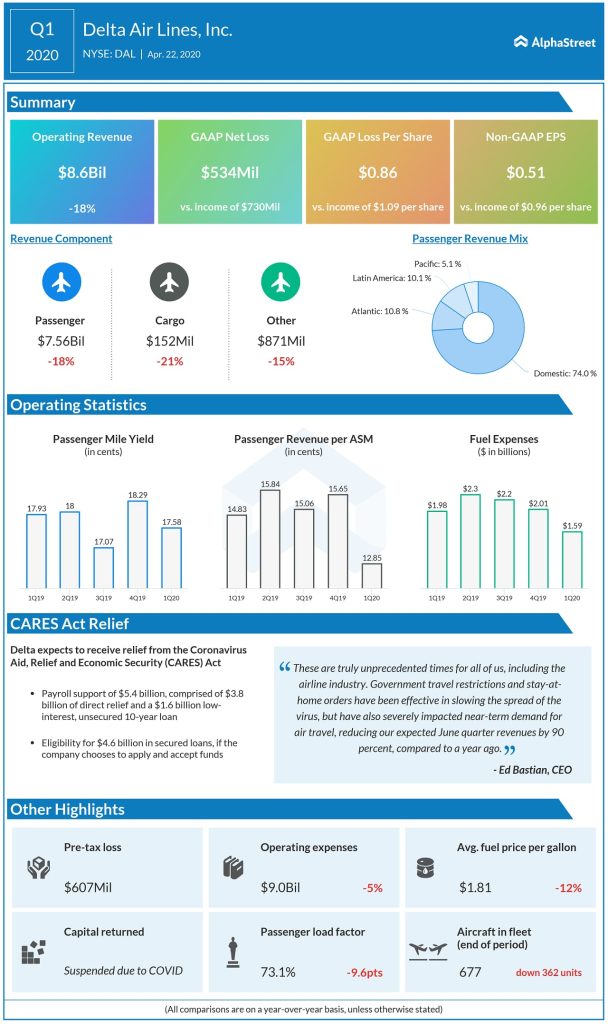

DAL has taken a higher amount of relief funds from the CARES Relief Act Payroll Support Program (PSP), $5.4 billion in total, $3.8 billion as direct aid, and rest as a low-interest unsecured loan. It is deliberating an additional debt on remaining unencumbered assets. Meanwhile, Southwest has availed $3.3 billion from the CARES PSP funds. For additional liquidity, it has announced public stock offering of $1.6 billion, and $1 billion in convertible debt with the hope of sending a positive signal that fundamentals of the company are strong.

[irp posts=”58283″]

Southwest does not have a history

of furloughs, layoffs, pay cuts. The CEO

Gary Kelly said in a video released on the website, “Southwest’s cash balance is strong, but I

want to underscore this doesn’t solve our problem.” What he assured to his

employees is that they would look for every other option possible before going

for layoffs, starting with voluntary retirement programs, temporary pay cuts,

etc.

DAL

was rather

explicit in stating that, “We don’t

know when it will happen, but we do know that Delta will be a smaller airline

for some time, and we should be prepared for a choppy, sluggish recovery even

after the virus is contained.” The statement would hit employees hard.

In terms of maintaining social distancing in future flights, Delta has made a statement that it would block middle seats. While Southwest is yet to make a certain statement in this regard, it seems to have an approach that can help them balance between taking a greater hit on revenues, and social distancing. What is assured from the management is that they would not book a full flight, and keep load factors low. Individual customers could perceive either decision differently and dictate demand for the carriers accordingly.

[irp posts=”57743″]

DAL remains conservative and forecasts

that it would cut capacity by 85% in Q2. Southwest looks at this from a

point of view of revival. It has gone aggressive, lowered capacity only by 50% by the end of Q2, and chooses to

retain 80%of itineraries. Speaking on this, the COO Michael G. Van de Ven said, “It’s just very hard to put it [capacity] back in. So I’d rather have it

on hand and pulled out as necessary”. This is an indication that Southwest

will be more prepared in terms of capacity post the pandemic.

Fear of paradigm shift

Both the players maintain a

pessimistic view on the demand front. Southwest and Delta stated that they are

operating in a virtually zero demand environment. Business travel accounts for

at least one-third of traffic for the industry. Past recessions are providing

evidence to the fact that business travel takes longer to revive to normal

levels.

What analysts and the industry fear is business travel might lower significantly owing to the fact that people are getting comfortable working from home, might hold meetings over Zoom or Microsoft Teams and avoid travel unless a mandate.

(Written by Manjula S)