China

Starbucks is broadening its store footprint by opening stores in both new and existing cities. The company opened 225 net new stores in Q4 and 654 net new stores for the full year. Starbucks ended FY2021 with 5,360 stores in 208 cities throughout China. The company also saw its 90-day Starbucks Rewards active members grow 5% sequentially and 33% year-over-year to reach 17.9 million in Q4.

Starbucks does not expect its recovery in China to be linear but its business and operating margins remained strong in Q4 and the company is confident in its long-term growth strategy for the region.

Quarterly performance

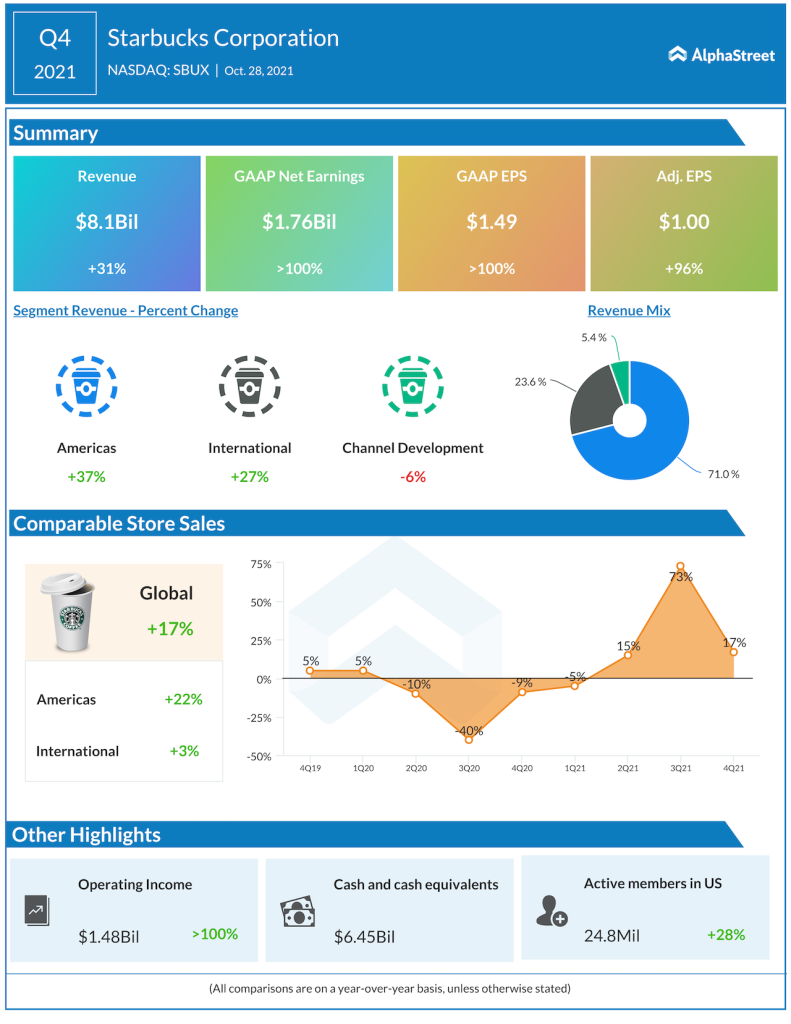

Consolidated revenues grew 31% YoY to $8.1 billion driven by a double-digit increase in comparable store sales. Revenues in the North America segment grew 27% YoY to $5.8 billion and in the International segment, it grew 18% YoY to $1.9 billion.

Global comparable store sales increased 17%, driven by increases in comparable transactions and average ticket. North America comp store sales increased 22% while International comp store sales rose 3%. Comp store sales rose 22% in the US but fell 7% in China. GAAP EPS more than doubled YoY to $1.49 while adjusted EPS jumped 96% to $1.00.

Starbucks opened 538 new stores in Q4, ending the period with 33,833 stores. The company had 15,450 stores in the US and 5,360 stores in China.

Outlook

For FY2022, Starbucks expects consolidated revenue to range between $32.5-33 billion, which is beyond its long-term guidance for growth of 8-10%. Global comp sales are anticipated to see high single-digit growth during the year. GAAP EPS is expected to decline by 4% or less while adjusted EPS is expected to grow at least 10% from the base of $3.10 in fiscal year 2021.

The company expects to add around 2,000 net new stores globally in FY2022 and it expects 75% of these new stores to be outside the US as it diversifies its portfolio across highly profitable markets.

Click here to read the full transcript of Starbucks’ Q4 2021 earnings conference call