The need to practice social distancing made people take up tasks like home fitness, golfing, and other outdoor activities that require minimal personal interaction. As a result, sporting goods and accessories once again witnessed strong demand. Facilities like curbside pickup and digital fulfillment allowed Dick’s to offer an improved customer experience.

Stock Recovers

The positive investor sentiment helped the company’s shares recover quickly from last year’s lows. The stock, which hovers near the record highs seen a few weeks ago, looks overvalued at the current price. Justifying the sentiment, market watchers have assigned it moderate buy rating, while projecting an 8% growth for the twelve-month period.

From Dick’s Sporting’s Q4 2020 earnings conference call:

“It’s clear that our strategies over the past several years are working and have helped us not only withstand the pandemic but thrive, setting us up for long-term success. As we enter 2021, our business has so much momentum, and we are pleased with the start of our year. Our focus this year will center around enhancing our existing strategies to accelerate our core and enable long-term growth.”

Cost Pressure

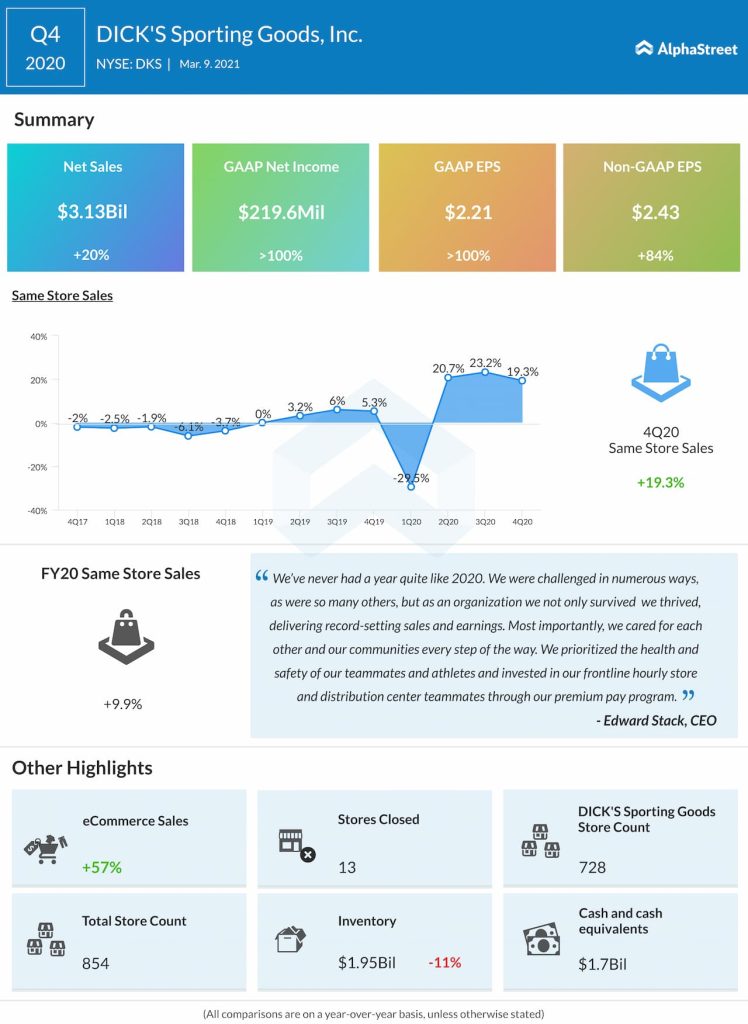

Having ended 2020 with a $1.7-billion cash balance, Dick’s is well-positioned to take forward its growth initiatives. On the flip side, it will continue to incur incremental expenses related to employee compensation and COVID safety in the coming months, as it did in the last few quarters. Also, with the high volumes adding to shipping costs, margins could come under pressure.

When Dick’s published its fourth-quarter numbers earlier this week, what caught everyone’s attention was the 57% spike in e-commerce sales that accounted for about one-third of total sales. After recovering from the sharp fall witnessed early last year, same-store sales rose at a steady pace. As a result, sales grew 20% annually to $3.13 billion and earnings jumped 84% to $2.43 per share, continuing the recent trend.

Road Ahead

Interestingly, the bottom-line beat estimates in every quarter of last year. Going forward, capital spending will be focused on strengthening the vertical brands and venturing into additional product categories. The aim is to build momentum in fast-moving categories like golf and athletic apparel and retain it beyond the pandemic. With team activities gaining steam after the shutdown, the team sports business is also expected to do well this year.

Shares of Dick’s closed the last trading session at $71.53, which was slightly lower. The stock has gained 28% since the beginning of the year.