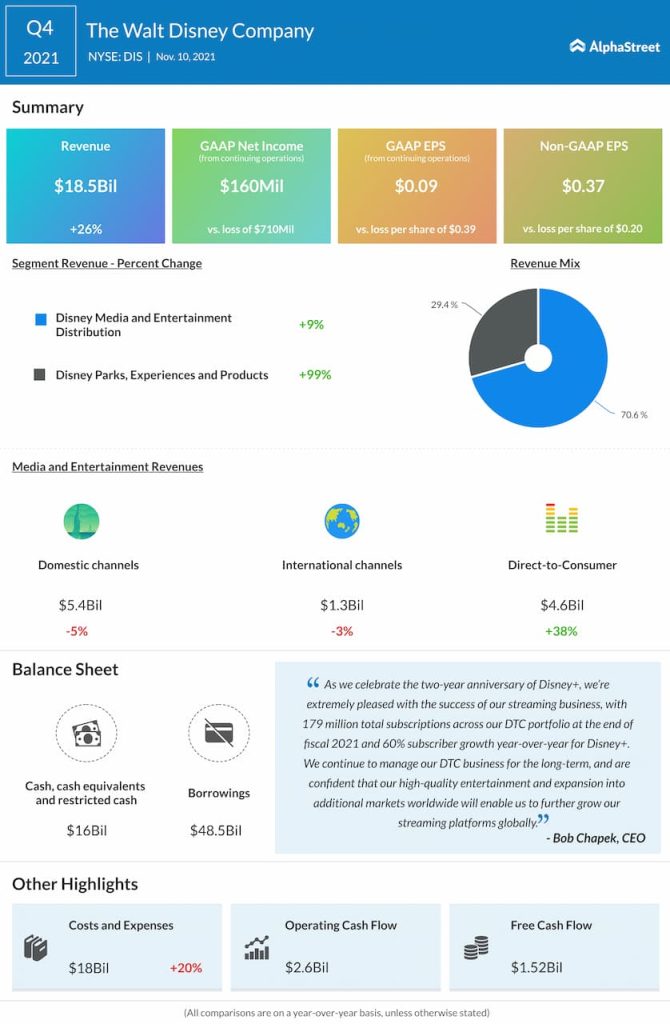

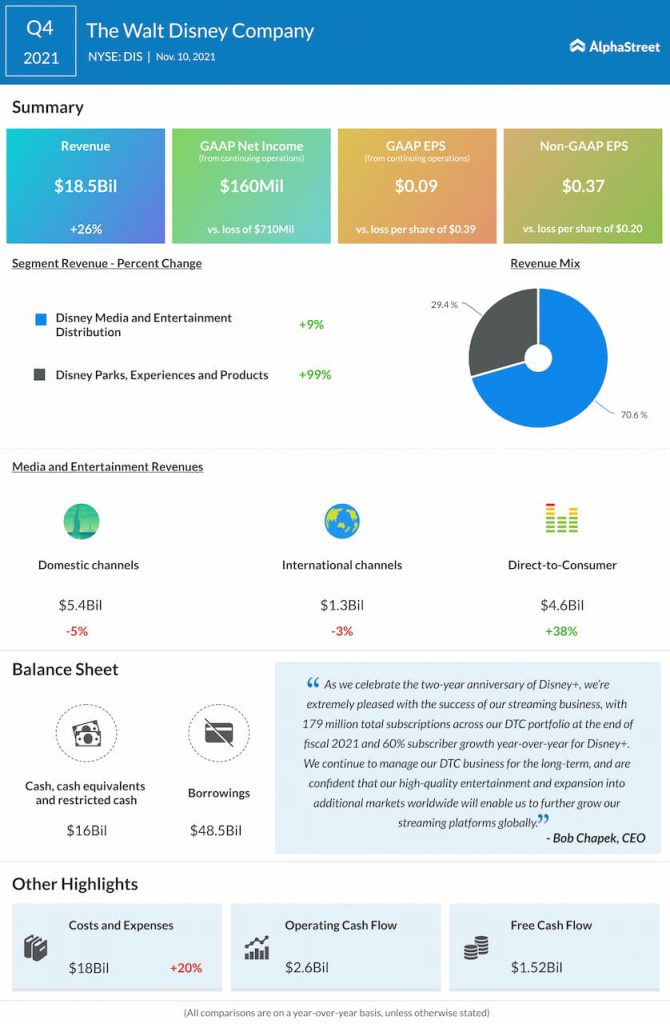

Subscriber growth

Back in September at an analyst event, Disney’s CEO Bob Chapek had said that net additions for Disney+ in Q4 were expected to come in the “low single digit millions of subscribers.” The slowdown in subscriber growth was mainly caused by people starting to go out more often as well as pandemic-related disruptions affecting content production.

Subscribers across the company’s domestic and core international markets, excluding Disney+ Hotstar, grew by almost 4 million on a sequential basis. Disney+ Hotstar subscribers declined sequentially, accounting for about 37% of the total Disney+ paid subscriber base at quarter-end.

International expansion

Disney continues to expand its flagship streaming service to more regions across the world. Within two years of its launch, Disney+ has reached over 60 countries and is available in more than 20 languages. The service is now available throughout Japan and will launch shortly in South Korea, Taiwan, and Hong Kong.

In 2022, the company plans to roll out Disney+ to viewers in more than 50 countries, including in Central Eastern Europe, the Middle East and South Africa. Disney aims to double the number of countries it is in at present to over 160 by FY2023. This paves the way for more growth for the streaming service in the near term.

Content slate

Disney’s subscriber growth in Q4 was hindered by virus-related disruptions in content production. The company has a strong content pipeline which can attract new subscribers to the platform. Disney has a number of titles such as Shang-Chi and the Legend of the Ten Rings and Home Sweet Home Alone slated for release on its special Disney+ Day.

During the September event, CEO Bob Chapek had mentioned that while adding subscribers was important, it was equally important to reduce churn and that constantly adding new content within its marquee brands would help attract as well as retain subscribers.

Disney is investing significantly in original content and it is also focused on rolling out more local and regional content suited for each of its markets. The company is doubling the amount of original content that will come from its marquee brands – Disney, Marvel, Pixar, Star Wars, and National Geographic – to Disney+ in FY2022. The majority of its highly anticipated titles will arrive July through September.

To worry or not to worry?

Disney remains confident that it will be able to achieve its target of 230-260 million paid Disney+ subscribers globally by the end of FY2024 and that Disney+ will become profitable the same year. Looking into FY2022, while the company is excited about the content coming in the first three quarters of the year, it stated that it will not be at its anticipated steady-state cadence of content releases.

Disney expects to see a stronger flow of content from the fourth quarter of 2022 and therefore expects Disney+ subscriber net adds in the second half of 2022 to be meaningfully higher than the first half. The company also does not anticipate subscriber growth to be necessarily linear from quarter to quarter.

While the current slowdown in subs and the forecast that content will not reach a steady state till the end of next year has triggered concerns for some experts, there are those that believe that this is a short-term setback and that Disney still has enough room for growth in the coming years.

Click here to read the full transcript of Walt Disney’s Q4 2021 earnings conference call