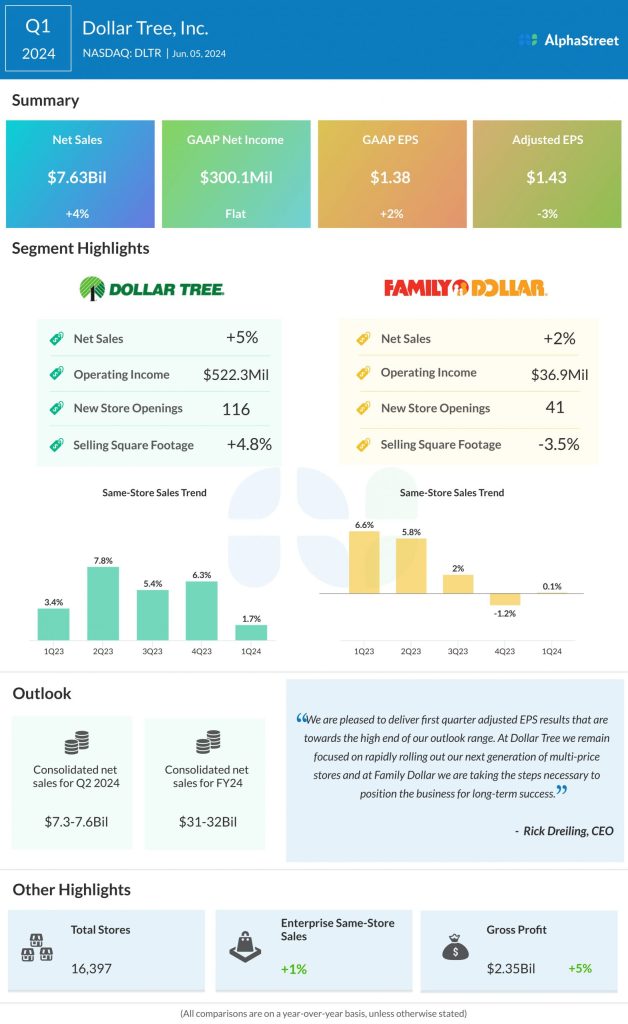

Net income was $300.1 million, or $1.38 per share, compared to $299 million, or $1.35 per share, last year. Adjusted EPS was $1.43.

Earnings surpassed estimates while revenue came in line.

For the second quarter of 2024, the company expects consolidated net sales to range from $7.3-7.6 billion, based on comparable net sales growth in the low-single-digits for the enterprise. Adjusted EPS for the quarter is estimated to range between $1.00-1.10.

In its earnings report, Dollar Tree said it has initiated a formal review of strategic alternatives for its Family Dollar business segment, which could include among others, a potential sale, spin-off or other disposition of the business. The company has not set a deadline for the completion of this process, and there is no assurance that it will result in any transaction or particular outcome.

The stock dropped over 1% in premarket hours on Wednesday over news of the review of the Family Dollar business.

Prior performance