DocuSign (Nasdaq: DOCU) reported an increase in adjusted earnings and revenues for the first quarter. The results also came in above expectations. However, shares of the e-signature technology company dropped about 15% during Thursday’s extended trading session as its reported loss missed the market’s estimates.

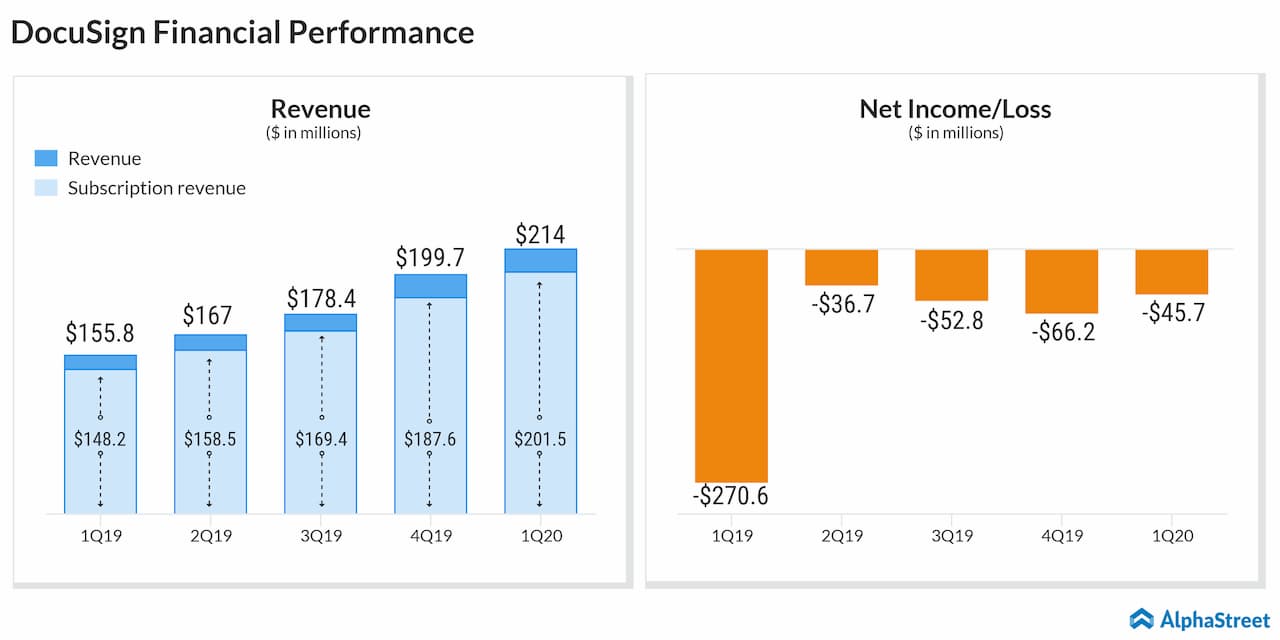

Adjusted earnings, excluding special items, were $0.07 per share in the April quarter, compared to $0.01 per share last year. On a reported basis, the company posted a net loss of $45.7 million or $0.27 per share, compared to a loss of $270.7 million or $7.46 per share in the first quarter of 2019. While the adjusted result beat the Street view, the reported number missed.

The improvement reflects a 37% annual growth in revenues to $214 million. Analysts were looking for a lower number. At $201.5 million, subscription revenue was up 36% from the year-ago period.

“With the announcement of the DocuSign Agreement Cloud this quarter—our suite of products and integrations for automating the entire agreement process—we can now deliver a much broader set of solutions to market, positioning us as the next ‘must-have’ cloud,” said Dan Springer, CEO of DocuSign.

At $201.5 million, subscription revenue was up 36% from the year-ago period

For the second

quarter, the management forecasts total revenues in the range of $218 million

to $222 million and billings between $215 million and $225 million. Adjusted

gross margin is estimated to be 78%-80%.

For the whole of 2019, the company predicts revenues in the $917 million-$922 million range. Full-year billings are expected to be between $1.01 billion and $1.03 billion. The forecast for adjusted gross margin is 78%-80%.

Of late, DocuSign has been facing stiff competition from Adobe (ADBE) and Dropbox (DBX), which last year enhanced its portfolio through the acquisition of HelloSign.

DocuSign shares stabilized in recent weeks after recovering from last year’s tech selloff, and have been trading above the $50-mark consistently. But they are still trading slightly below the levels seen a year earlier. The stock closed Thursday’s regular trading higher but fell sharply in the after-hours session.