The Illinois-headquartered packaged foods firm, which owns popular brands like Healthy Choice and Birds Eye, restored its market value to the pre-crisis levels in a few weeks after the pullback. Buoyed by the uptrend, the management this week raised the dividend by 29% after holding it steady for about three years.

Conagra’s stock seems to have peaked, going by the current valuation, and the moderate target price indicates muted growth going forward. That calls for a cautious approach as far as investing is concerned. Experts recommend holding the stock. For prospective buyers, the best strategy would be to wait and watch until a clearer picture emerges.

Shopping Spree

Ready-to-eat meals and frozen vegetables found a place in people’s shopping lists when they rushed to stock on essential items soon after the pandemic broke out. Conagra was one of the beneficiaries of the buying spree that boosted organic sales and volumes, thereby helping the company shrug off the COVID blues.

“While we hope and expect that the most acute and severe impact of COVID-19 is behind us, we believe that recent shifts in consumer behavior coupled with macroeconomic trends suggest that at home eating will remain elevated for some time. We also believe that we are very well-positioned to capitalize on this opportunity,” Conagra’s CEO Sean Connolly told analysts after publishing the first-quarter report.

Cash Power

When the company entered fiscal 2021 its main strength was the impressive cash flow, a part of which was used for reducing debt. To some extent, Conagra owes its stable sales performance to the revamped e-commerce platform that witnessed solid traffic during the crisis when people mostly relied on digital shopping.

But there is uncertainty about the course of the pandemic, though the relaxation of shelter-in-place orders has encouraged people to venture out. Like in the case of all other businesses, the odds of Conagra retaining its resilience would depend a lot on the recovery of the larger economy. The management is looking for a second-quarter profit that is slightly above the first-quarter levels but sees organic sales growth slowing down sequentially.

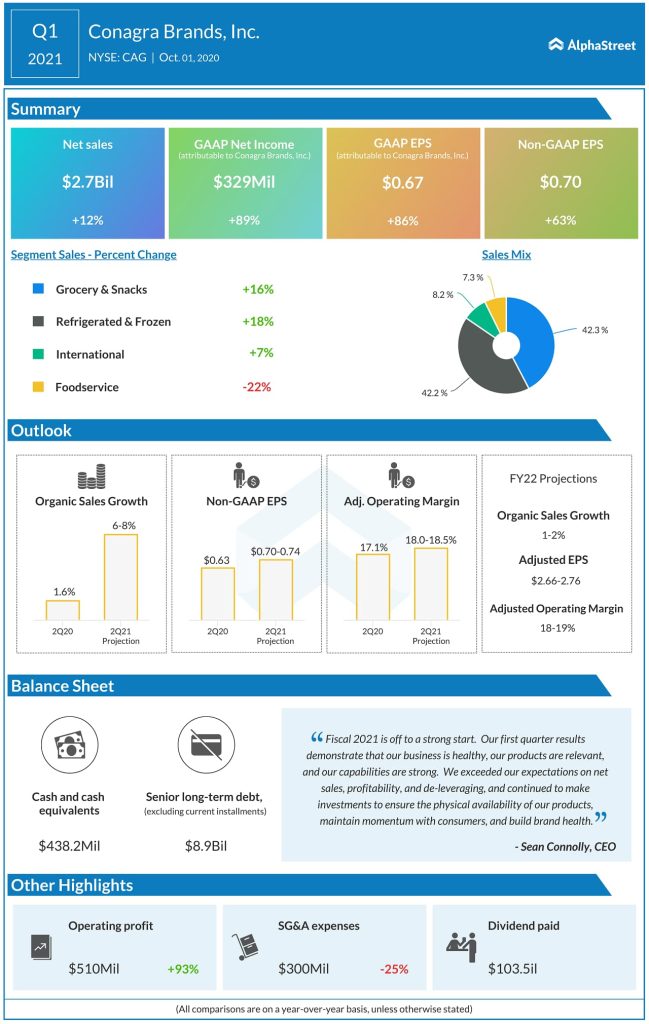

Q1 Numbers Beat

In a sign that the demand for Conagra’s popular brands was not affected by the shutdown, sales grew in double digits to $2.7 billion in the August-quarter, with ready-to-eat meals and frozen vegetables contributing significantly to the top-line. As a result, adjusted earnings rose a whopping 63% year-over-year to $0.70 per share. Margin growth was catalyzed by a 25% dip in selling, general and administrative expenses.

Conagra’s executives attributed the stronger-than-expected outcome to Conagra Way, a game-changing concept coined a few years ago to take the brand to the high-growth mode through organizational restructuring. The focus of the strategy is to revamp the portfolio and manage cost effectively.

The transformation we’ve undertaken over the past five years by following our Conagra Way playbook to perpetually reshape our portfolio and capabilities for growth and better margins have proven critical in enabling us to respond to the changing dynamics in the current environment. Our modernized portfolio, commitment to innovate, and agile culture have allowed us to respond to the increased consumer demand and changing preferences today and position us to deliver meaningful growth into the future.

Sean Connolly, and chief executive officer of Conagra Brands

Read management/analysts’ comments on quarterly reports

Stock Steadies

The company’s shares traded higher throughout Friday’s session, extending the post-earnings momentum. Since the beginning of 2020, the stock moved up 23%. It has maintained a steady uptrend in recent years and the current value is close to the record highs seen four years ago.