The Ann Arbor Charter Township, Michigan-based restaurant chain is hoping to beat this by opening stores in as many locations as possible, which, in turn, would cut down delivery times. At the end of the first quarter of 2019, the company had 1,148 more stores than it did a year ago.

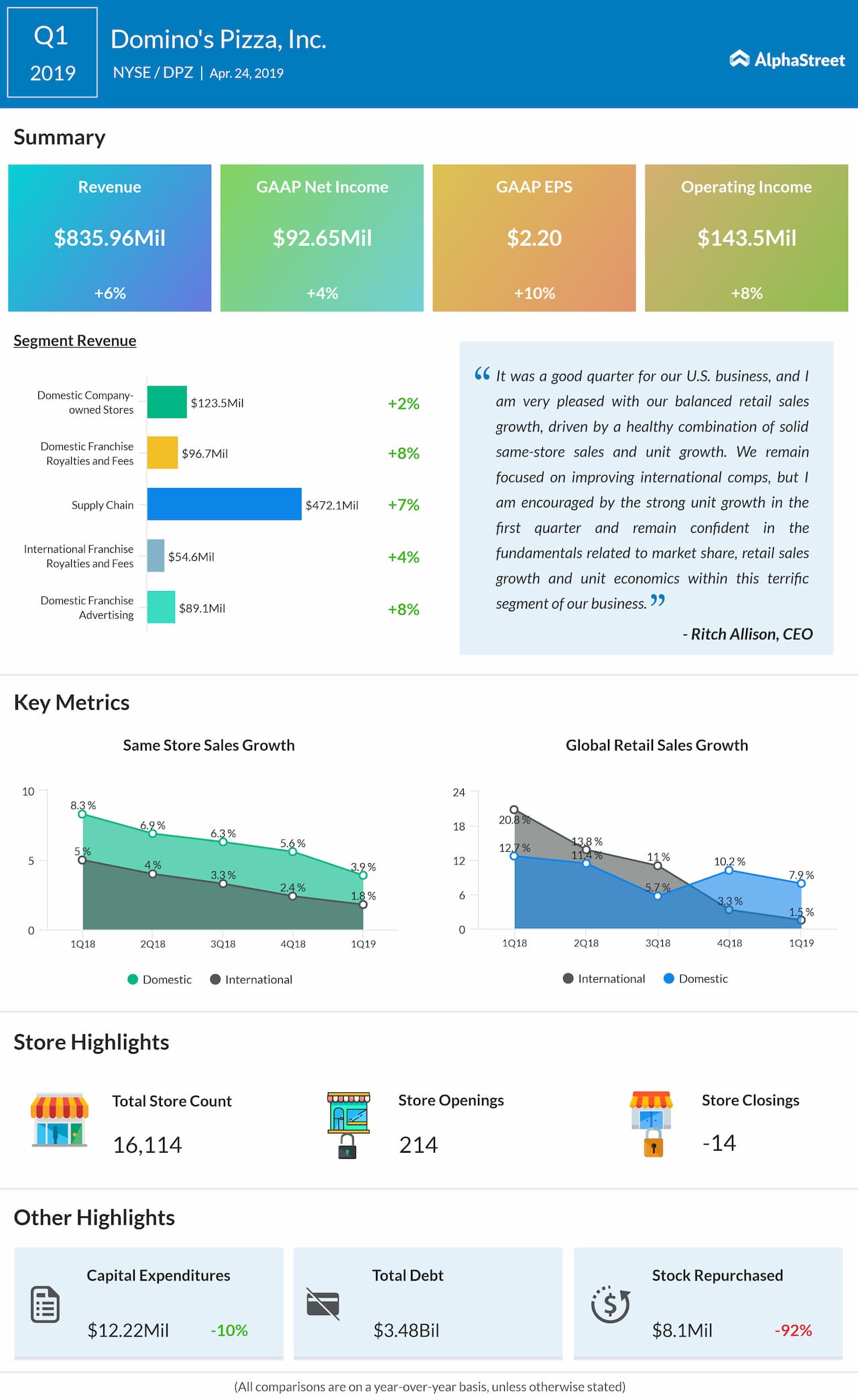

During the first quarter, domestic same-store sales grew 3.9%, vs. 8.3% growth it reported in the prior-year quarter. The management is likely to talk in detail about its contingency plan to lift its same-store sales, in the face of severe competition from food delivery firms.

READ: Beyond Meat continues to leave analysts flabbergasted

ADVERTISEMENT

Revenues from supply chain and franchise are expected to see continued strength, with year-over-year growth projected at around 10% for both. Meanwhile, market observers are anticipating a modest decline in domestic company-owned stores.

Wall Street anticipates Q2 earnings of $2.02 per share, compared to $1.84 it reported during the year-over period, helped by its aggressive cost optimization measures.

DPZ shares have

gained 14% in the year-to-date period. According to TipRanks, the stock has a

12-month average price target of $312.58, suggesting a 12.5% upside from the

last close.

Pizza Hut-parent Yum Brands (NYSE: YUM) and Papa John’s are both slated to announce financial results early next month (NASDAQ: PZZA).

Listen to on-demand earnings calls and hear how management responds to analysts’ questions