Weibo Corporation (NASDAQ: WB) has reported a decline in revenues and adjusted earnings for the fourth quarter of 2022, amid muted user growth.

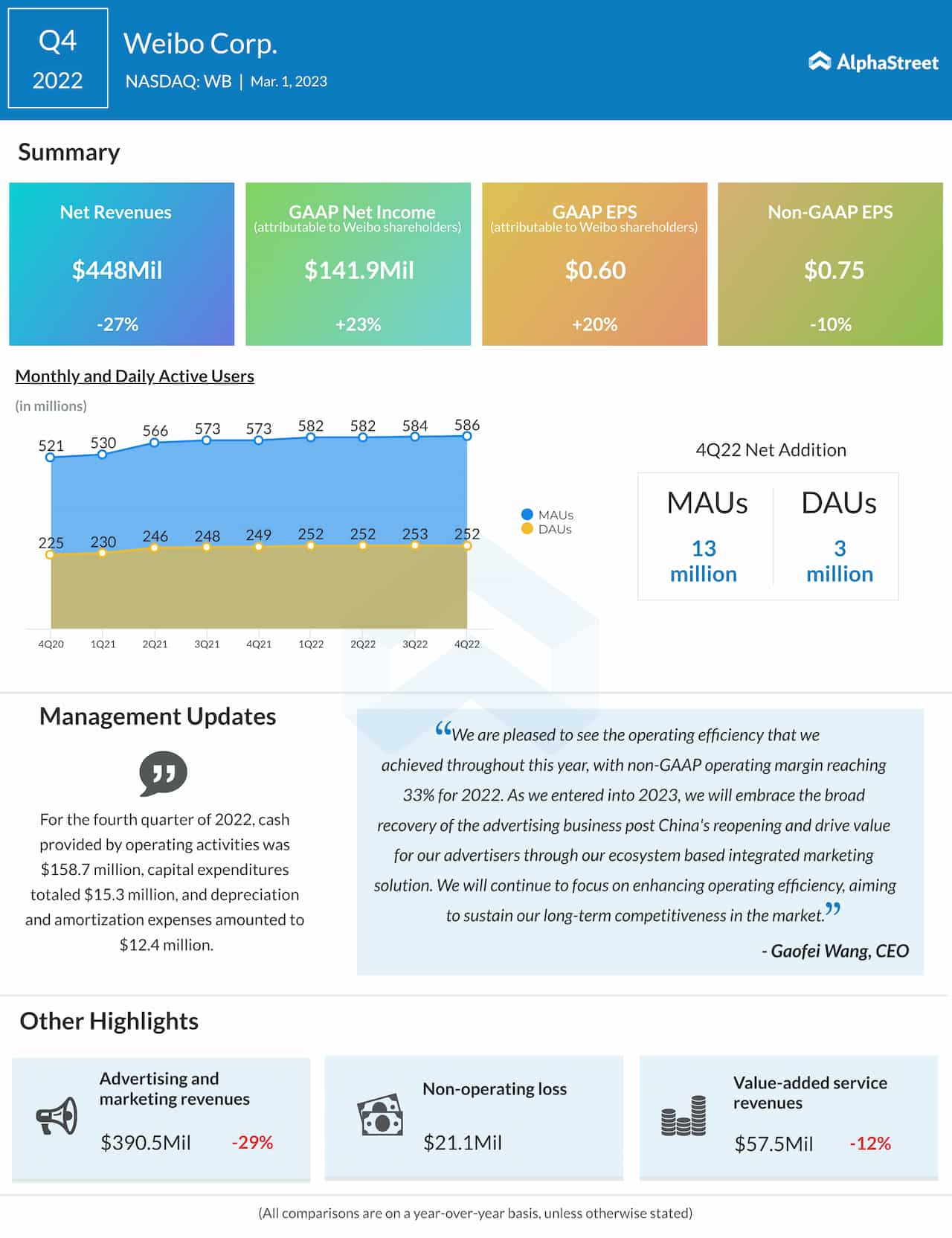

The China-based social networking company reported an adjusted profit of $0.75 per share for the most recent quarter, down 10% from the year-ago period. On an unadjusted basis, net income was $141.9 million or $0.60 per share, compared to $115.7 million or $0.50 per share last year.

Adjusted profit was hurt by a 27% decrease in revenues to $448 million. At the end of the quarter, Weibo had around 586 million monthly active users and 252 million daily active users.

Check this space to read management/analysts’ comments on quarterly reports

“Our community remained healthy and engaged, mainly attributable to the optimization of social product and effective channel investment. On monetization, our advertising business has exhibited recovery trend in the second half of 2022, although macro challenges continuously weighed on the overall advertising demand,” said Weibo’s CEO Gaofei Wang.