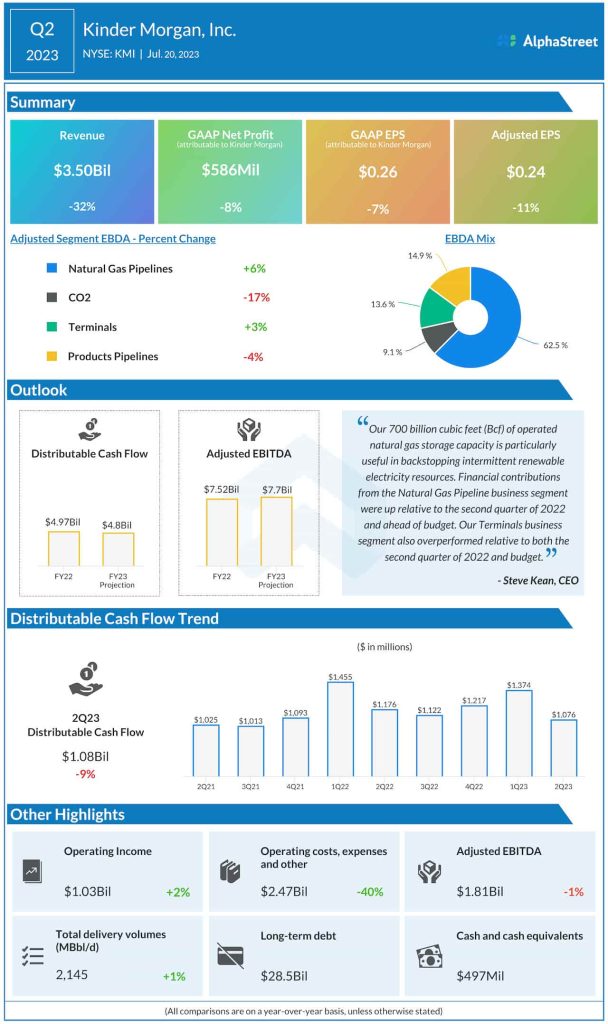

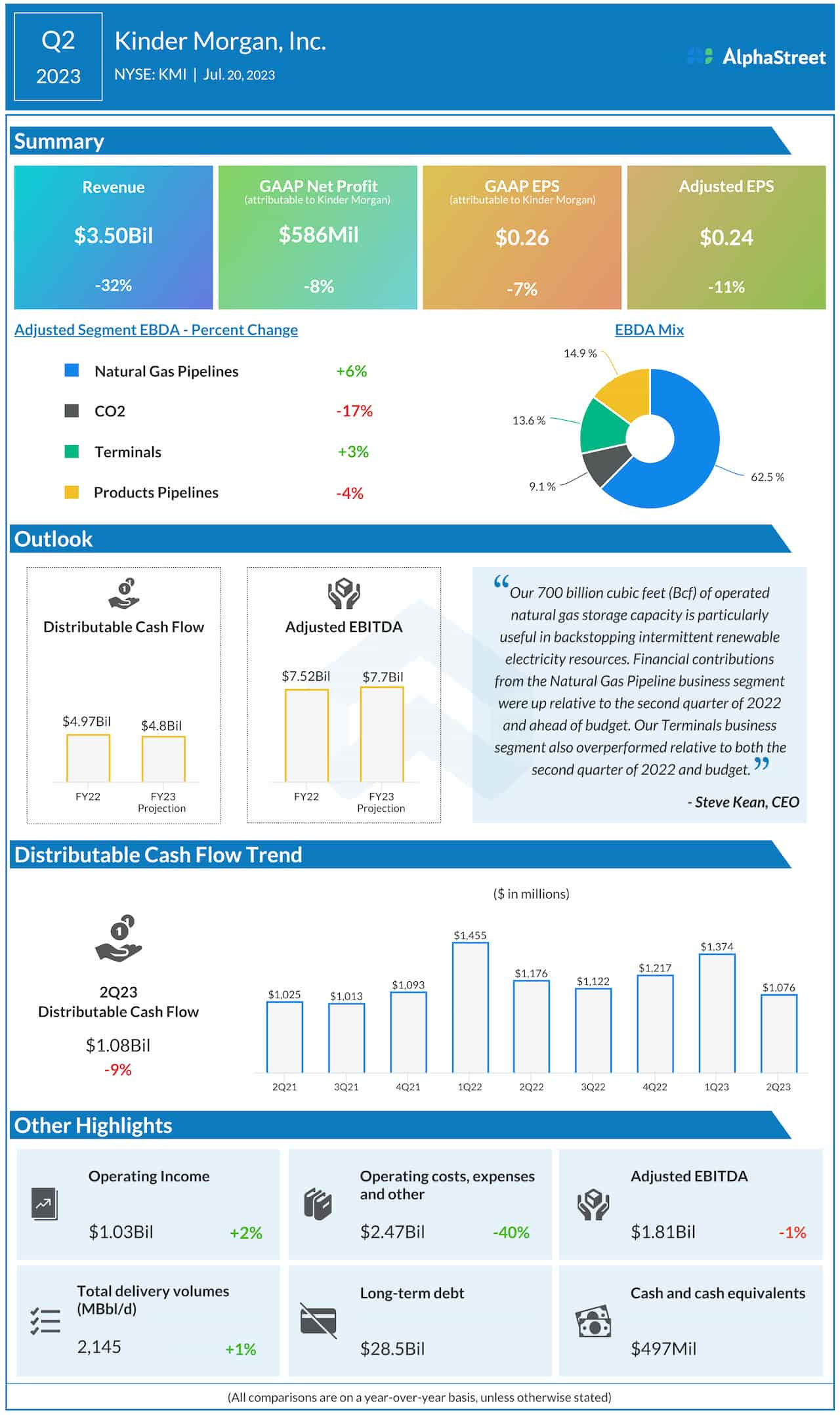

Earnings, adjusted for special items, declined to $0.24 per share in the June quarter from $0.27 per share in the corresponding period of last year. Net income attributable to shareholders was $586 million or $0.26 per share, compared to $635 million or $0.28 per share last year.

Net income was negatively impacted by a 32% fall in revenues to $3.5 billion. The company expects distributable cash flow to be $4.8 billion and adjusted EBITDA to be $7.7 billion at the end of end 2023

“We focus on maintaining a strong balance sheet while internally funding capital projects that produce returns well in excess of our cost of capital — including projects that are part of the ongoing energy evolution toward a lower carbon future. We also continue to pay a healthy and growing dividend which, based on our current stock price, results in a top 10 yield in the S&P 500 with robust coverage,” said the company’s executive chairman Richard Kinder.