Over the years, BlackRock, Inc (NYSE: BLK) has emerged as a key player in the asset management space, leveraging the long-term growth of capital markets and increasing confidence among institutional and retail investors. The company follows a capital management strategy that is focused on investing in the business and then returning excess cash to shareholders.

The asset manager’s stock experienced weakness in the first half of the year, but regained momentum ahead of the upcoming earnings and is currently trading above its 52-week average. After the latest hike, BLK currently pays a dividend of $5.00 per share with a yield of 2.9%, which is well above the market average. The company has long been an investors’ favorite due to its potential to deliver long-term shareholder value.

Bullish View

The good news is that the stock looks poised to gain in the second half, making shareholders richer than they are now. It is worth noting that the value more than tripled in the past decade, outpacing the broad market quite often, thanks to the company’s loyal clients. Total assets under management should keep growing in the coming years since financial markets typically maintain an uptrend over the long term — recovering from temporary declines — and reach new highs.

Aladdin, BlackRock’s advanced electronic system that combines sophisticated risk analytics with comprehensive portfolio management and operations tools on a single unified platform, delivered record net sales last year. The uptrend is expected to gather steam going forward, considering the widespread technology adoption.

Mixed Q2 in Cards

The company is preparing to announce data for the May quarter on July 14, at 6:15 am ET. Market watchers, on average, predict adjusted net income of $8.38 per share, compared to $7.36 per share reported in the second quarter of 2022. Meanwhile, total revenue is expected to decline by about 3% to $4.4 billion.

“BlackRock’s industry-leading organic growth is a direct result of the disciplined investments we’ve consistently made through market cycles. Our business is well-positioned to take advantage of the opportunities before us and we remain committed to optimizing organic growth in the most efficient way possible. In line with our guidance in January, at present, we’d expect our headcount to be broadly flat in 2023 and we’d also expect a mid-to-high single-digit percentage increase in 2023 core G&A expense,” said the company’s CFO Martin Small at the last earnings call.

Key Numbers

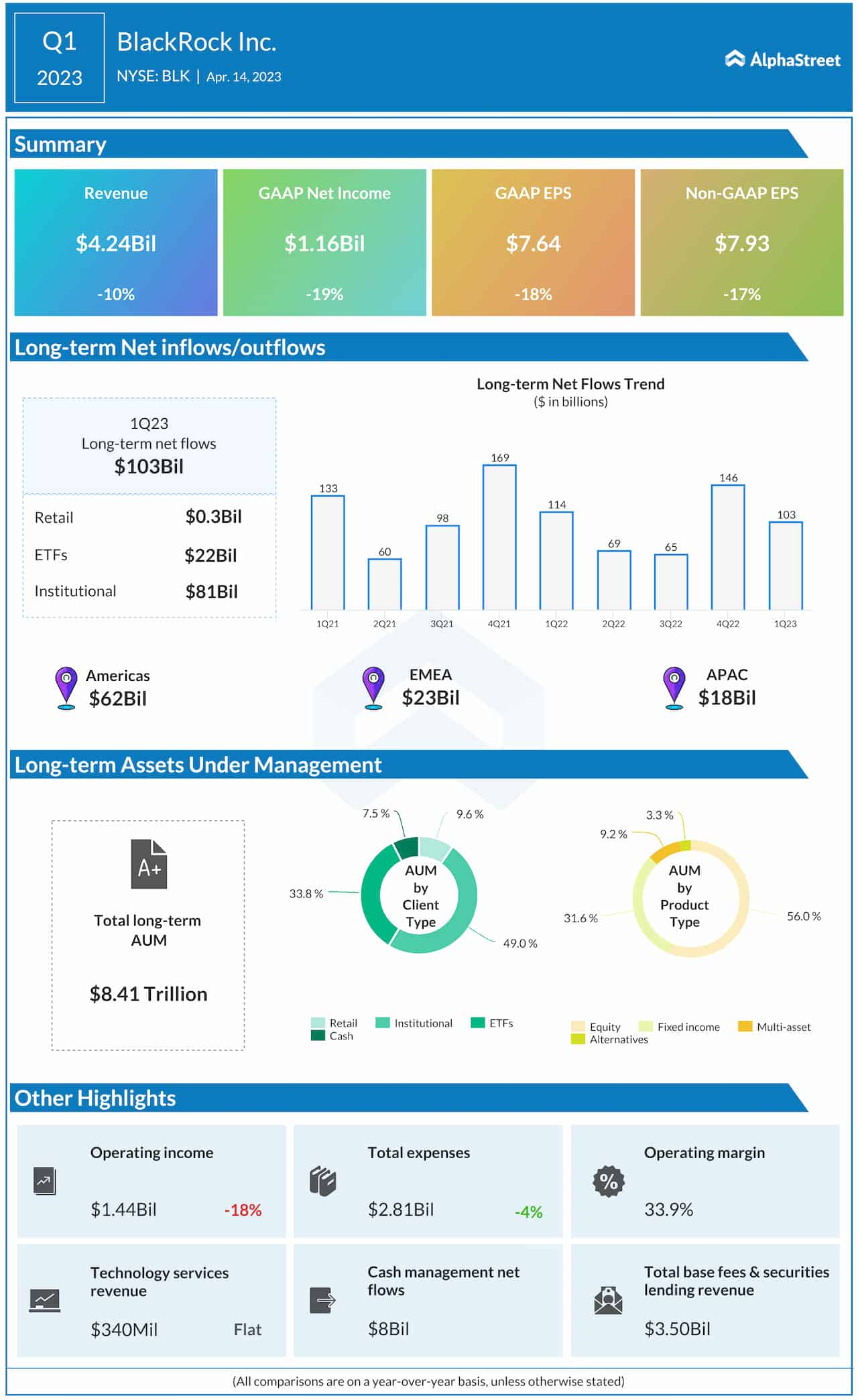

The actual earnings number is likely to beat estimates if the past performance is any indication – earnings topped expectations in every quarter, except once, since 2019. Though in the most recent quarter, the bottom line contracted 17% year-over-year to $7.93 per share. That is mainly due to a 10% fall in revenues to $4.24 billion, which also fell short of expectations.

Net inflows, an important measure of the health of fund flow, declined from the prior-year period to $103 billion, with institutional clients accounting for nearly 80% of it. At the end of the quarter, total long-term assets under management stood at $8.41 trillion.

Shares of BlackRock started Monday’s session higher, after closing the previous day’s trading lower, and maintained the uptrend in the early hours. It is down 4% since the beginning of 2023.