The retail sector experienced a slowdown in 2022 as the economic downturn and inflationary pressure weighed on consumer spending, and the trend is likely to continue this year. The market will be closely following the upcoming earnings of consumer electronics retailer Best Buy Co., Inc. (NYSE: BBY), looking for updates on how things are shaping up for the industry.

For the company’s stock, 2023 has been a mixed year so far, marked by several ups and downs. The performance ahead of the earnings is not very encouraging, though the shares traded slightly higher on Tuesday. It would be a good idea to wait until BBY comes out of the current slowdown before buying or selling. But it is still a safe bet from the long-term perspective. The annual dividend hikes and strong yield adds to the stock’s prospects as a dependable investment for the long term.

Key Numbers

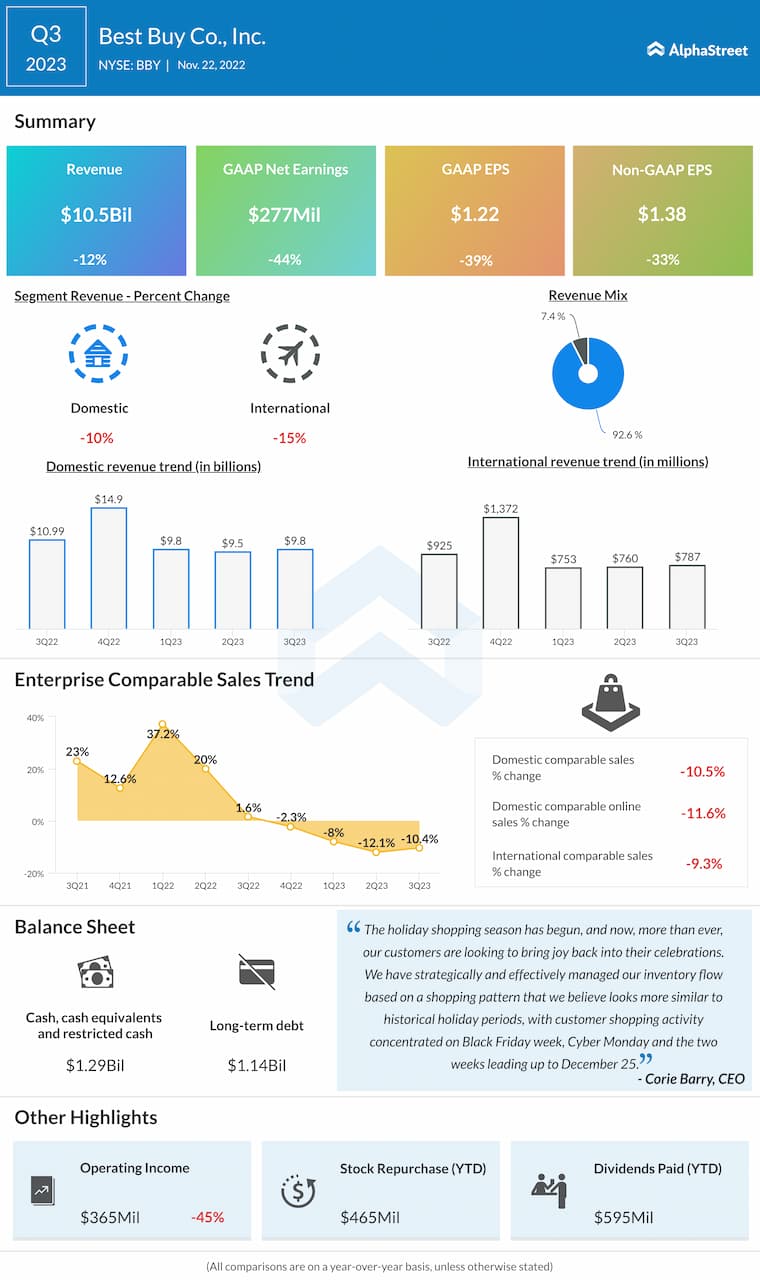

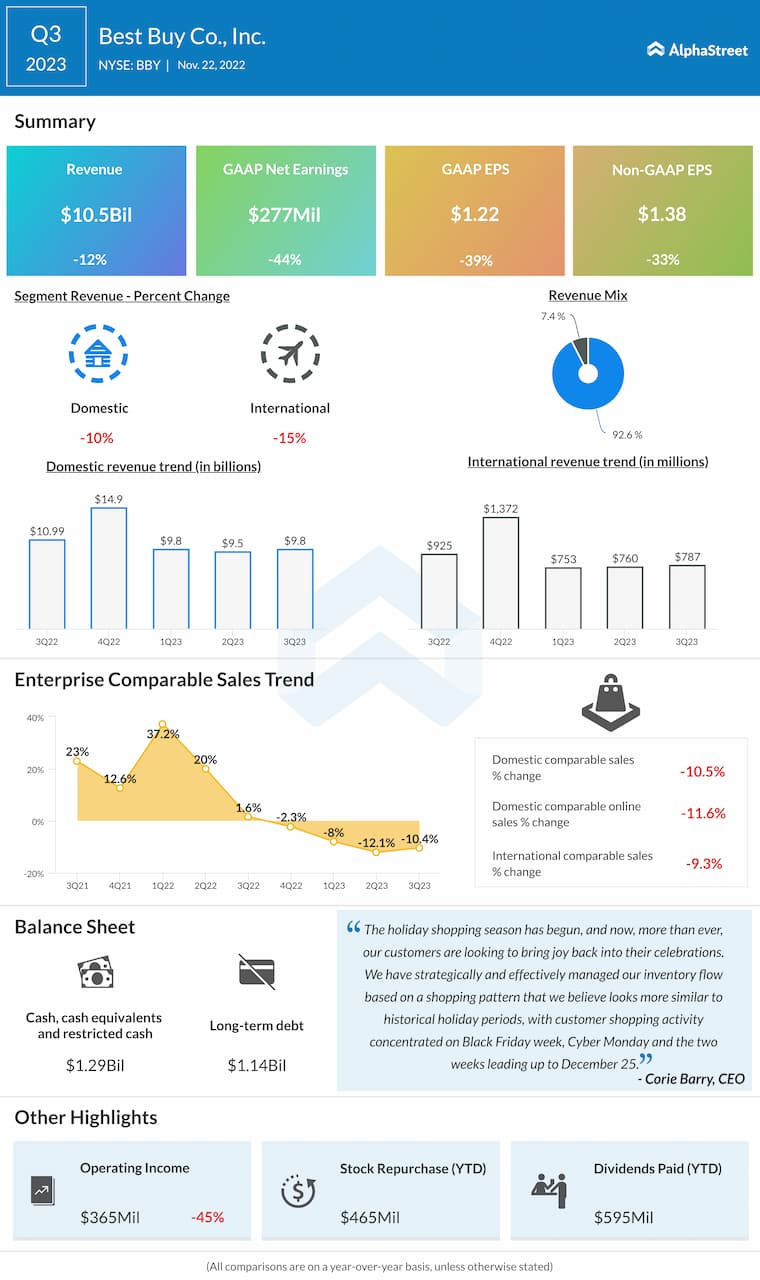

Underscoring the drag on consumer sentiment, revenues, and adjusted earnings declined in the third quarter amid faltering sales in both the domestic and overseas markets. The top line contracted by 12% to $10.5 billion, while adjusted earnings dropped by more than a third to $1.38 per share. Continuing the downtrend that started a year ago, comparable store sales declined 10.4%, but there was a modest improvement from the previous quarter. However, the latest numbers came in above the estimates. In the last decade, earnings topped expectations almost every quarter.

From Best Buy’s Q3 2022 earnings conference call:

“While sales are down in our signature categories as we lap the strong growth of the pandemic years, our initiative to expand our presence in adjacent categories is driving sales growth. While still small overall, we are driving sales growth in e-bikes and outdoor living categories as we expand to more stores in addition to our online assortment. Outdoor furniture, in particular, is demonstrating strong growth driven by new showrooms for our Yardbird assortment, including in our Best Buy stores and new stand-alone showrooms.”

Q4 Report on Tap

It is expected that the company would report a 23% decrease in earnings to $2.11 per share when it publishes fourth-quarter results on Thursday before the opening bell. The weak outlook reflects an estimated 10% drop in revenues to $14.72 billion.

Earnings: Walmart Q4 results beat estimates; US comps up 8.3%

After peaking more than a year ago, Best Buy’s market value slipped and hovered around $18 billion this week. The stock has lost about 22% in the past twelve months.