Estimates

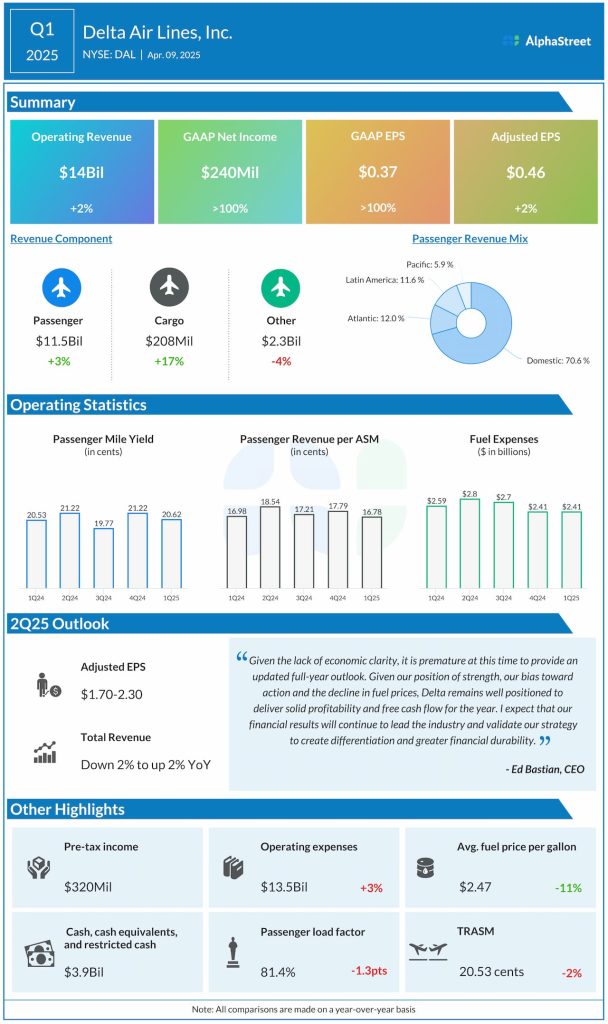

The company is all set to publish its second-quarter 2025 financial results on Thursday, July 10, at 6:30 am ET. Analysts’ consensus earnings estimate for the June quarter is $2.03 per share, excluding one-off items, which represents a 14% decline from the prior-year quarter. Wall Street predicts a 2.85% year-over-year decline in Q2 revenues to $16.18 billion. A few weeks ago, the Delta leadership said it expects second-quarter revenue to be down 2% to up 2% YoY. It is looking for adjusted earnings per share in the range of $1.70 to 2.30 for Q2.

“During periods of heightened uncertainty, our differentiators and structural advantages become even more apparent, helping to insulate our business and create durability in our financial performance. No matter the environment, we manage our business for margins, cash flow, and returns. And with our bias to action and our position of strength, I expect our financial results will continue to lead the industry, and this year, prove to be another validation of our strategy as we create differentiation and demonstrate financial durability,” Delta’s CEO Edward Bastian said during his post-earnings interaction with analysts.

Positive Outcome

In the first three months of FY25, Delta’s net income increased multifold to $240 million or $0.37 per share from $37 million or $0.06 per share in the same period of the previous year. On an adjusted basis, earnings per share rose 2% annually to $0.46. At $14 billion, first-quarter revenue was up 2% from Q1 FY24. Revenue and earnings topped expectations, marking the second beat in a row.

The airline industry has been under pressure from geopolitical uncertainties, including ongoing armed conflicts and new import tariffs introduced by the Trump administration. Delta’s premium services and SkyMiles loyalty program have helped it remain resilient, to a great extent. The ability to deliver stable financials, despite the cyclical nature of its revenue and earnings performance, reflects the company’s disciplined execution and operational strength. Meanwhile, the general outlook for business and leisure travel remains subdued due to continued customer concerns about recession risk.

DAL has been trading below its 52-week average price for over a month, often underperforming the broader market. The stock traded lower on Tuesday afternoon.