Glu Mobile (GLUU) is set to report its fourth quarter and full-year 2018 results on February 4, Monday after the bell. Analysts expect the mobile game publisher to report first time quarterly profit in the three years on revenue of $95 million. Shares of Glu Mobile hit a new 52-week high ($9.93) on Friday’s trading session.

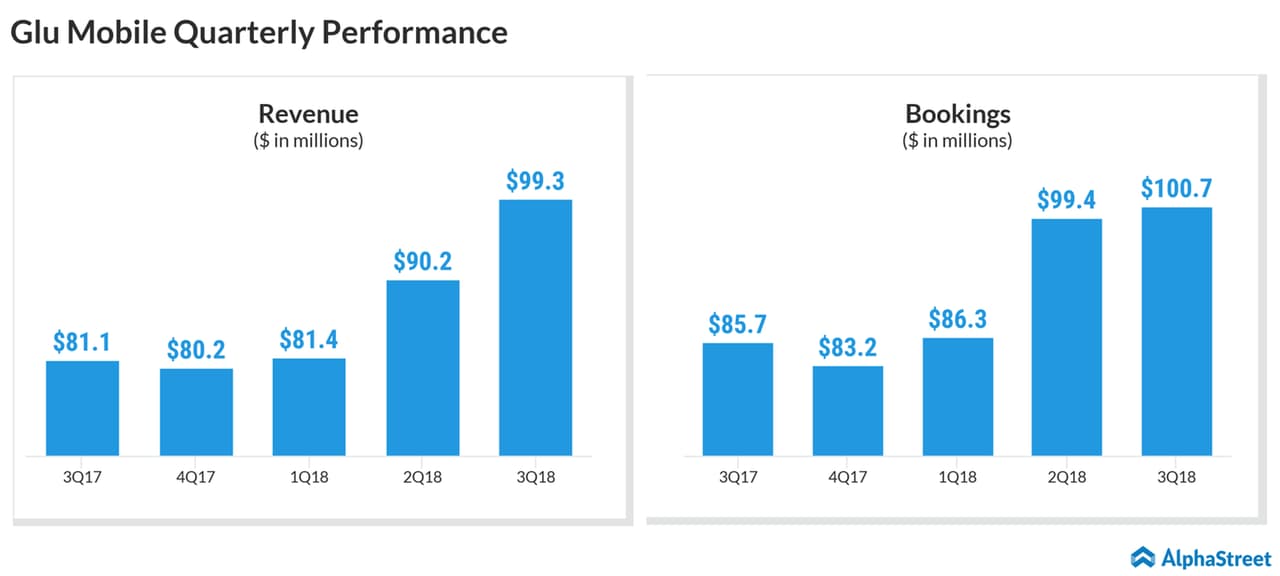

For the third quarter ended September 30, 2018, Glu Mobile reported breakeven earnings on revenue of $99.3 billion. Bookings grew 17.5% year-over-year to $100.7 million. Daily active users count decreased to 3.4 million from 3.9 million in the prior-year quarter and monthly active users declined to 19.4 million from 27.6 million a year ago.

For the fourth quarter of 2018, the company had projected bookings to be in the range of $94.3 million to $96.3 million. For full-year 2018, Glu Mobile lifted its bookings outlook and set the range as $380.7 million to $382.7 million.

The San Francisco, California-based company is expected to continue its strong performance for the fourth quarter, which will be driven by the strength in Growth titles. The first nine months of 2018 benefitted from the strong performance of the games, namely Design Home, Covet Fashion and Tap Sports Baseball.

In 2019, Glu Mobile is expected to release new games like WWE: Universe and Diner Dash Town.

As smartphone users are growing rapidly, mobile gaming is also expected to grow in the coming years. According to Goldstein Research, the global mobile gaming market is forecast to grow at a CAGR of 5.4% during 2016-2024. The market is likely to reach $56.2 billion by the end of forecast period.

Tencent and Netease pops up as China reinstates gaming approvals

In 2018, Glu Mobile stock soared 122% and the stock closed the Friday’s trading session at $9.92, up 1.85%.

We’re on Apple News! Follow us to receive the latest stock market, earnings, and financial news at your fingertips