Q4 Report Due

AutoZone’s market value has surged by nearly one-third since the start of the year, and hit an all-time high last week. Despite the steady growth, market watchers remain bullish: a majority continue to recommend buying the stock, citing the company’s resilience amid macroeconomic headwinds and its sustained investments in innovation. At current levels, AZO ranks among the most expensive stocks on Wall Street.

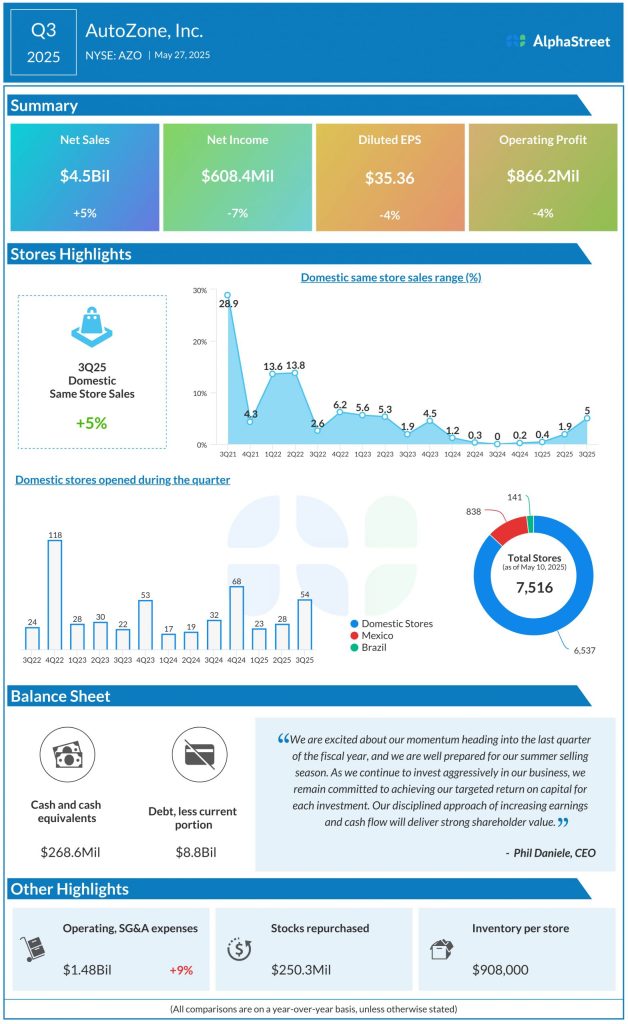

Mixed Q3

In the third quarter, domestic same-store sales grew 5% YoY, continuing the recovery that started last year and more than offsetting a 9% drop in international same-store sales. At $4.5 billion, Q3 net sales were up 5.4% from the same period a year ago and slightly above analysts’ expectations. Third-quarter net income decreased 6.6% annually to $608.4 million, while earnings per share dropped 3.6% to $35.36. The bottom line fell short of expectations, marking the third miss in a row.

AutoZone’s CEO Philip Daniele said during his post-earnings interaction with analysts, “We believe we have a best-in-class product and service offering, and this gives us confidence we will continue to win in the marketplace. Next, I will speak to our regional DIY performance. We saw weaker performance in the South Central &Western United States. While still showing positive trends, these markets were not quite as strong as the other markets. It was a nice sign for us to see the Northeast and the Rust Belt outperforming for the first time in a while — in fact, outperforming by 250 basis points from the rest of the country.”

AutoZone’s aggressive share repurchase program underscores the strength of its free cash flow, sustained sales momentum, and solid balance sheet. In the third quarter, it repurchased around 250 million shares. Meanwhile, the business is facing margin pressure due to higher freight costs and increasing price competition from rivals like Advance Auto Parts and Genuine Parts Company. Potential new tariffs could further strain profitability, particularly given the company’s reliance on imported components sourced from third-party suppliers.

Expansion

AutoZone opened 54 new stores in the US, 25 in Mexico, and five in Brazil in the most recent quarter. Encouraged by the success of its Mega-Hub program — initiated to improve the availability of inventory and increase delivery speed –and the significant improvement in store coverage, the company is opening more satellite stores, hub stores, and mega hubs.

After retreating from the recent peak, AutoZone shares have maintained a downtrend, and the weakness continued this week. On Tuesday, the stock traded slightly lower in the early hours.