The retail sales declines which hurt the turkey business last quarter could continue in the to-be-reported quarter as well. However, the company has been taking measures to drive sales growth in its turkey division and it remains to be seen how far these steps have been effective.

Hormel is also likely to struggle with high input costs and

unstable tariffs impacting its pork business. The African swine fever in China negatively

affected the company’s pork business last quarter leading Hormel to lower its

guidance for full year 2019.

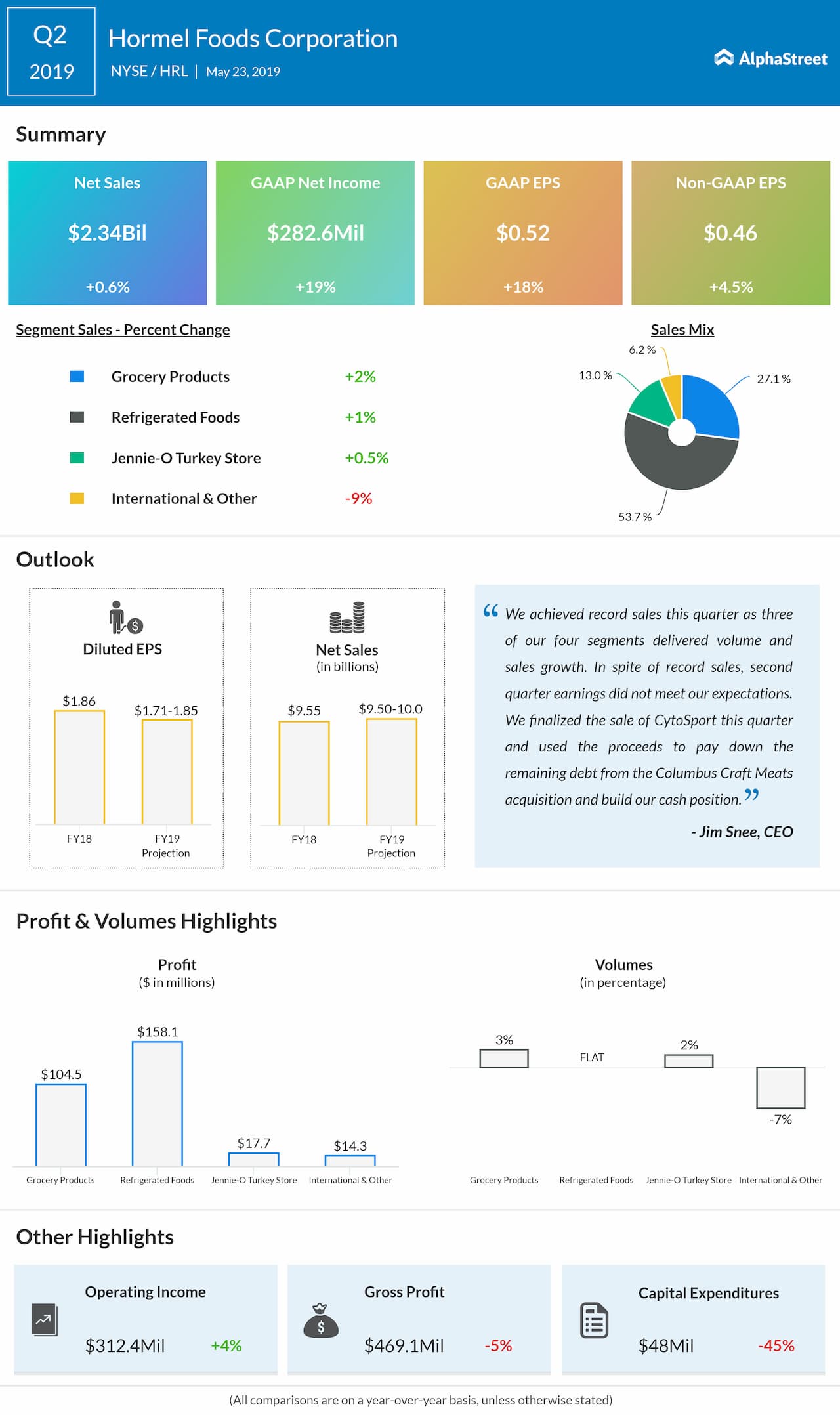

Hormel used its proceeds from the CytoSport sale to pay down debt and build its cash position. The company plans to use the cash to drive growth through strategic investments like acquisitions and capacity expansion projects.

Also see: Hormel Foods Q2 2019 Earnings Conference Call Transcript

In the second quarter of 2019, Hormel beat earnings estimates with a 4.5% increase in adjusted EPS to $0.46. Net sales inched up 0.6% to $2.34 billion.

Last quarter, Hormel lowered its fiscal 2019 net sales

outlook to a range of $9.50 billion to $10 billion from the prior range of

$9.70 billion to $10.20 billion, and its earnings guidance to a range of $1.71

to $1.85 per share from the previous range of $1.77 to $1.91 per share. The

revised earnings guidance range was based on input cost increases and a

forecast for volatile domestic pork prices in the second half of fiscal 2019.

Shares of Hormel have dropped 2.6% so far this year and 1% in the past one month. The company has an average price target of $41.50.