JB Hunt Transport Services Inc (NASDAQ: JBHT), a provider of transportation and logistics services, is coming out of a rough patch after being hit by economic uncertainties and high-interest rates. Last year was a challenging period for the company due to the unfavorable market environment and falling freight prices. JH Hunt is scheduled to report fourth-quarter earnings next week.

In 2023, the performance of JB Hunt’s stock was marked by a series of ups and downs, but it mostly stayed above the long-term average. While the volatility extended into the new year, the stock is likely to stabilize and cross the $200 mark in the coming months. It is down 3.6% since the beginning of the year.

Volume Woes

The business experienced weakness in recent times due to higher operating costs and a decline in e-commerce volumes, even as the pandemic-induced spike in online purchases subsided and people started returning to stores and dining out. However, there has been an improvement in volumes and pricing lately, especially in the Intermodal (JBI) segment. The company’s other business divisions are also showing signs of a rebound.

Going forward, revenues and margins should benefit from the ongoing volume recovery in the transportation sector and favorable shifts in customers’ inventory positions. Margins came under pressure from higher costs related to wages and fleet maintenance, with the tight labor market adding to the problem. Meanwhile, the volume recovery has yet to create any meaningful operating leverage.

Q4 Report Due

The Lowell-headquartered trucking firm is preparing to publish results for the final three months of fiscal 2023. When the fourth-quarter report comes on January 18, after the closing bell, the market will be looking for earnings of $1.76 per share, vs. $1.92 per share a year earlier. The weak sentiment over the bottom-line performance reflects an estimated 10% fall in revenues to $3.28 billion.

JB Hunt’s CEO John Roberts said at the last earnings call, “Our focus is on deploying capital in areas of the transportation industry where we see a long-term opportunity to compound returns. We participate in an industry with a large, addressable market that is cyclical. Remaining disciplined around our investments with a long-term focus on our people, technology that enables and capacity to deliver for and on behalf of our customers will support and drive long-term growth for the company and our shareholders.”

Weak Results

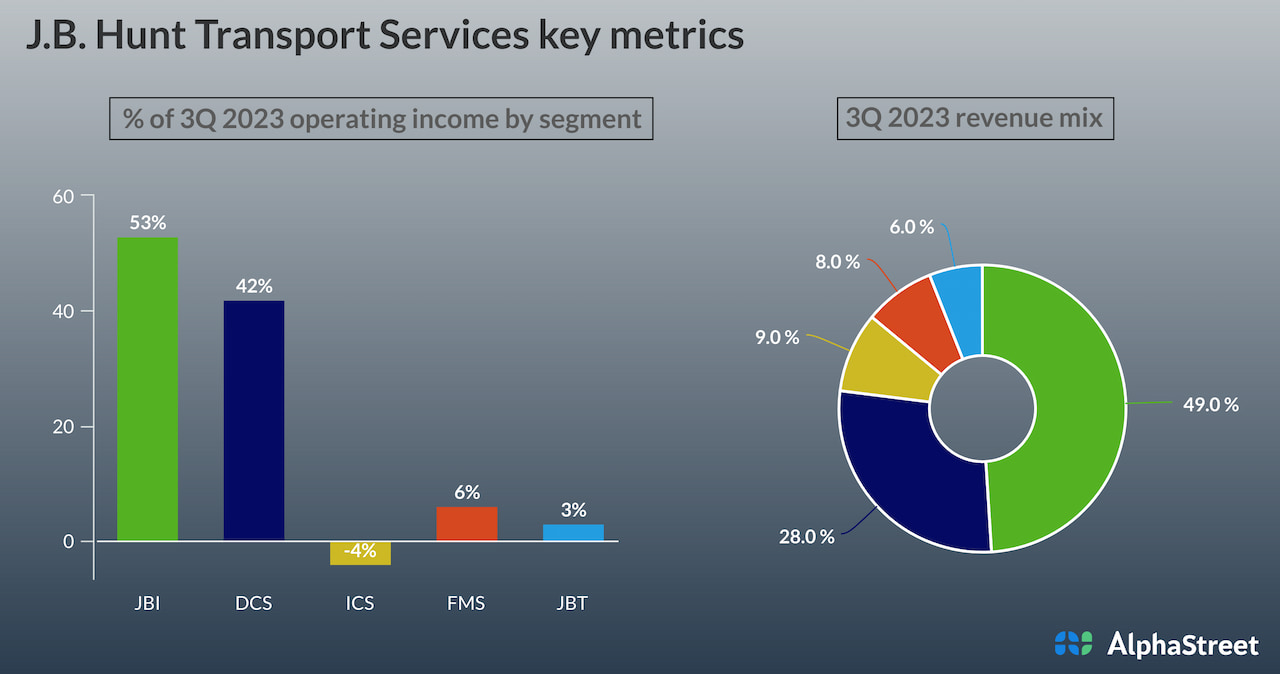

It is worth noting that both earnings and revenues missed estimates in each of the trailing four quarters. In the third quarter, earnings declined a dismal 30% year-over-year to $1.80 per share from $2.57 per share in the year-ago period. At $3.16 billion, total operating revenue was down 18% in Q3, mainly reflecting weakness in the Intermodal and Truckload (JBT) divisions. Revenue declined across the board, including the other operating segments of Dedicated Contract Services (DCS), Integrated Capacity Solutions (ICS), and Final Mile Services (FMS).

JBHT experienced big fluctuations in early trading on Thursday and hovered around $190 in the afternoon, after opening the session lower.