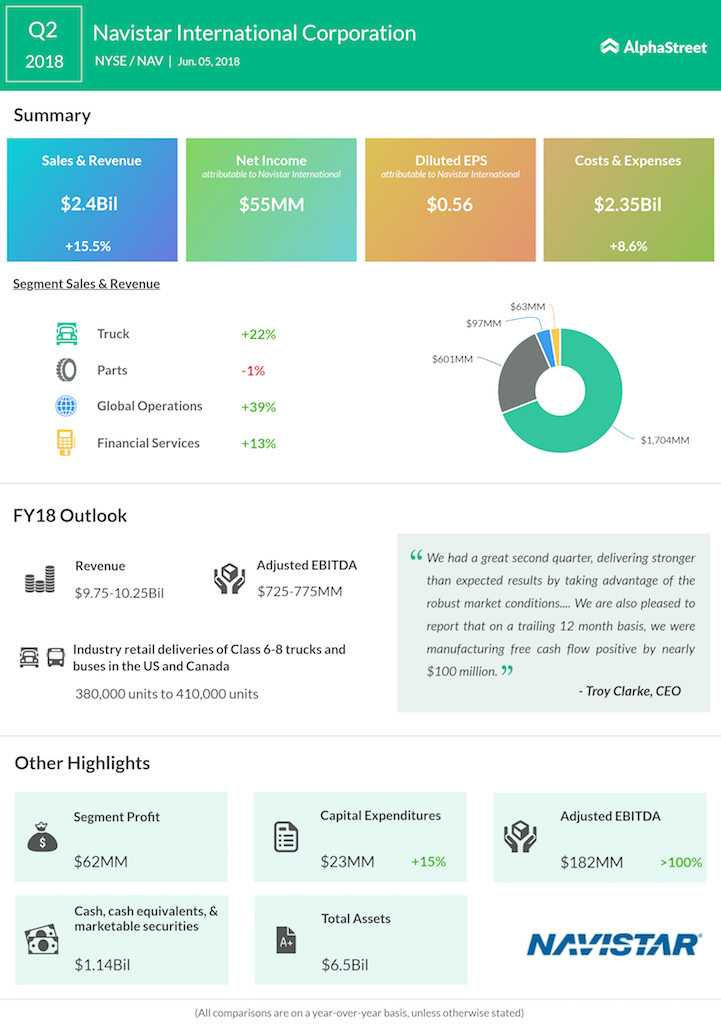

Last quarter, the company saw revenue growth across all its segments, barring Parts, fuelled mainly by higher volumes and mix shifts. The decline in Parts was caused partly by lower volumes in the US.

For the full year of 2018, Navistar guided for revenues of $9.75 billion to $10.25 billion. Analysts believe the company could post revenues of $9.9 billion along with earnings of $2.25 per share this year.

The company has a track record of beating earnings estimates and analysts believe this might continue for the third quarter too. Navistar is likely to post growth in revenue and earnings which could give the stock a lift unless some other negative factor catches the attention of investors.

Navistar’s shares were down 3.19% at $42.18 when the market closed Tuesday. The stock is down 1.6% thus far this year and has gained 22% in the past one year.

Related: Navistar Q2 2018 Earnings Infographic