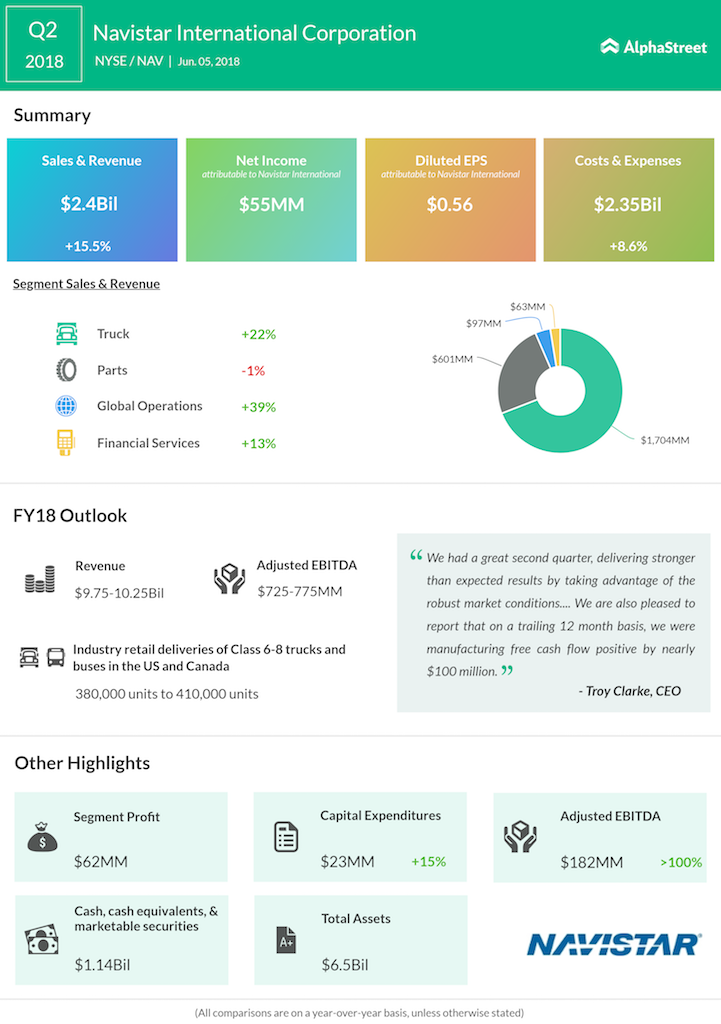

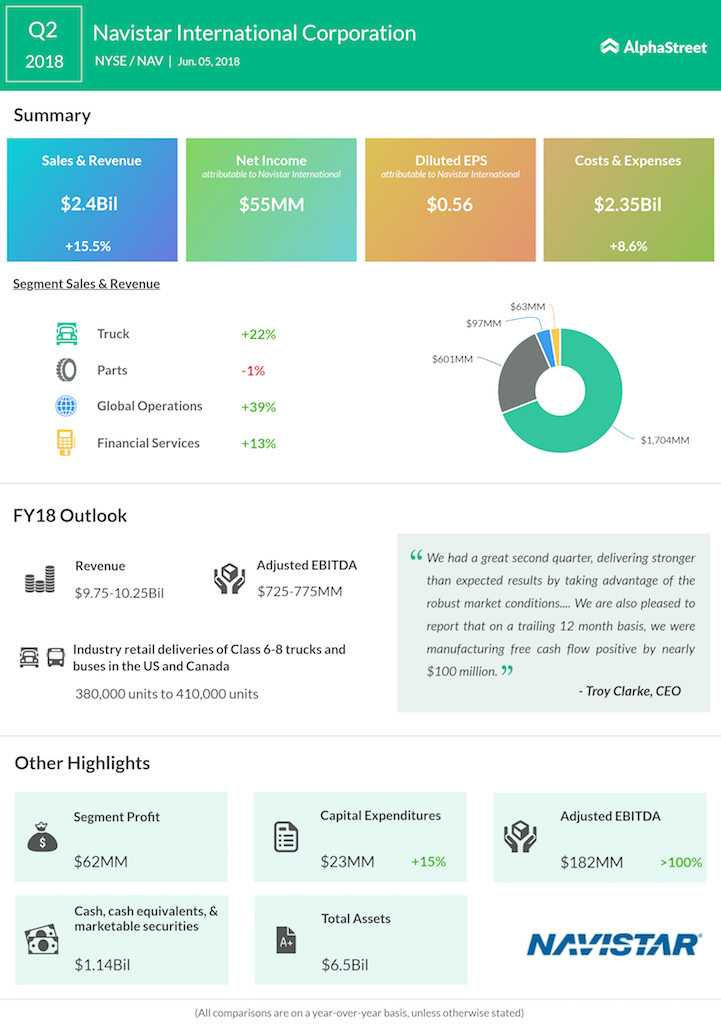

Navistar International Corporation (NAV) reported a 16% increase in revenues to $2.4 billion for the second quarter of 2018 compared to last year, driven by higher volumes in the Core market where charge-outs were up 17%.

The company reported a net income of $55 million or $0.55 per diluted share for the quarter compared to a net loss of $80 million or $0.86 per diluted share in the prior-year period. Navistar stock rose more than 2% premarket.

Net sales in the Truck segment increased 22% to $1.7 billion during the quarter, driven by higher volumes in the Core markets, higher export truck volumes, an increase in military sales and a shift in model mix. In the Parts segment, net sales fell 1% to $601 million, hurt by lower U.S. volumes and Blue Diamond Parts sales.

Global Operations segment sales rose 39% to $97 million, primarily driven by higher engine volumes in the South American engine operations. Financial Services segment sales rose 13% to $63 million, mainly due to higher overall finance receivable balances in the U.S. and Mexico.

The company raised its guidance for full-year 2018. Navistar expects revenues to be between $9.75 billion and $10.25 billion. Adjusted EBITDA is expected to be between $725 million and $775 million while manufacturing cash at year-end is touted to be about $1.2 billion.

Industry retail deliveries of Class 6-8 trucks and buses in the US and Canada are forecast to be 380,000 units to 410,000 units, with Class 8 retail deliveries of 250,000 to 280,000 units.