What to Look for

The market will be keeping track of the stock to see where it is headed post-earnings. After the recent gains, the current valuation looks high, while the broad outlook is positive. Defying the recent tech slowdown, Oracle has thrived on the rapid expansion of the cloud-computing profile, as a testament to the strength of its new business model.

Oracle Database is considered to be both high-performing and cost-effective, which has helped the company add big names like Nvidia and many government-level customers to its clientele. When it comes to the overall performance, however, weakness in other areas like the Hardware business will continue to be a drag on the top line.

Oracle reported better-than-expected earnings consistently in the past three quarters, a trend the company is likely to maintain when it reports first-quarter 2024 results on September 11 at 4:05 pm ET. Market watchers predict adjusted earnings of $1.14 per share for the August quarter, compared to $1.03 per share reported in the first three months of fiscal 2023. The consensus estimate for first-quarter sales is $12.46 billion, which represents an 8.8% year-over-year growth.

Strong Q4

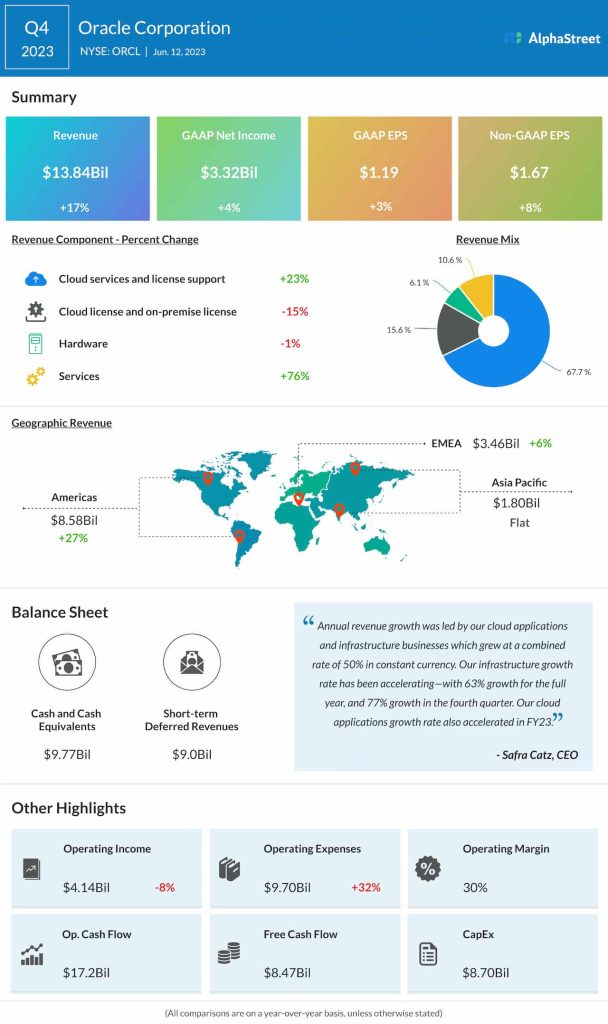

In the fourth quarter, revenues increased 17% year-over-year to $13.84 billion and topped expectations. The top line benefitted from a 23% growth in the core Cloud Services & License Support revenues. The infrastructure and cloud applications businesses expanded at an accelerated pace during the three-month period. Earnings, adjusted for special items, moved up 8% annually to $1.67 per share. Margin growth was restricted by a sharp increase in operating expenses.

From Oracle’s Q4 2023 earnings conference call:

“Our momentum has been driven by two fundamental differences from our competition. One, highly differentiated technology, and two a much better customer experience. Firstly, our cloud applications are very popular with a growing base of customers in part because we are the most modern, comprehensive, and innovative set of apps across back-office CX and industry applications. We implemented AI machine-learning capabilities years before anyone was talking about it and it helps our customers run their businesses every day.”

Continuing the strong momentum seen last week, ORCL traded higher in the early hours of Tuesday’s session. The value has increased by around 45% in the past eight months.