For Bank of America, the street consensus for revenue is $23.25 billion, a modest 2% growth from the same period a year ago.

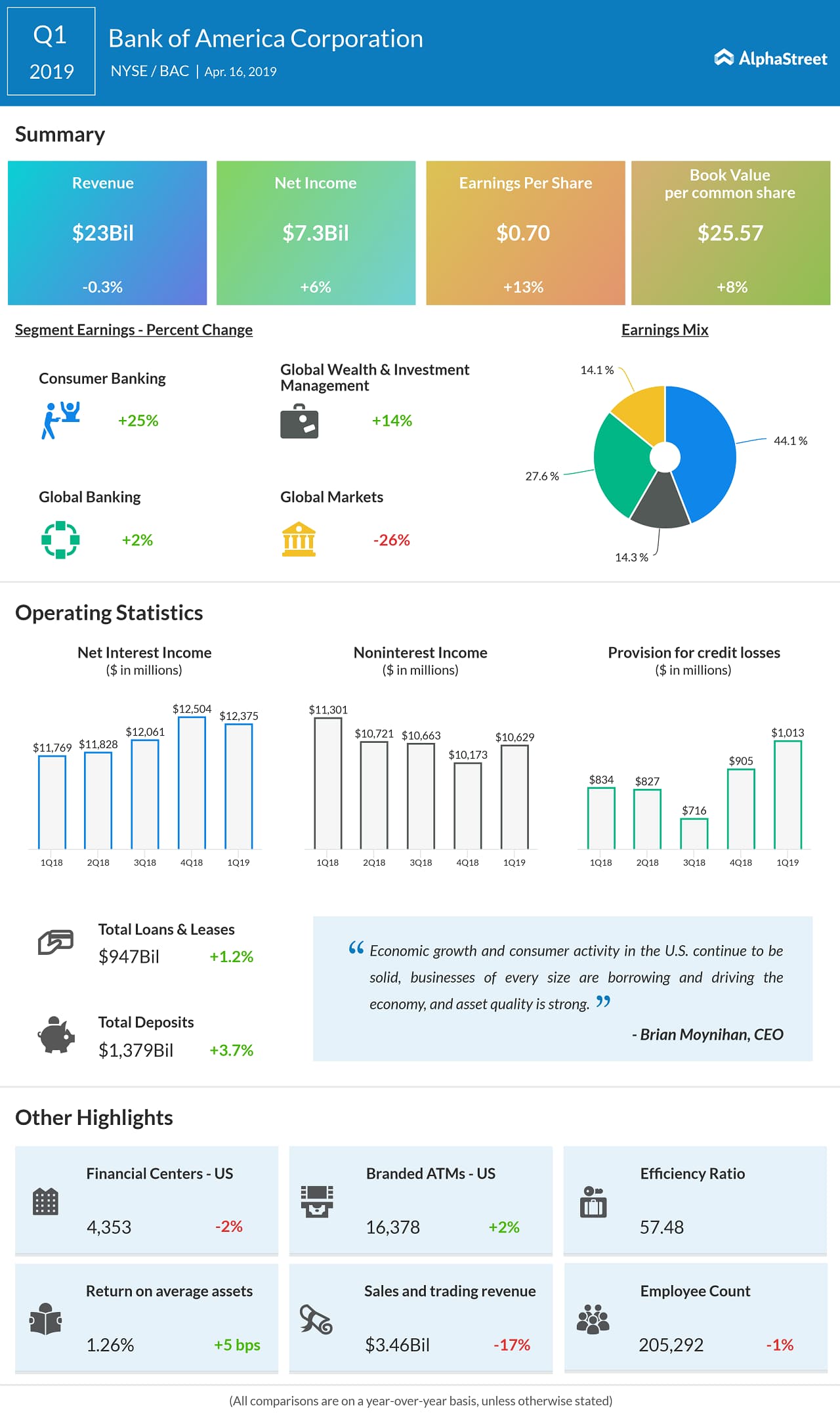

Performance at its Global Wealth and Investment Management division, which accounted for over 14% of its overall revenue, was likely hurt by a slowing economy and trade tensions. Though some major deals were sealed during the quarter, a spike in borrowing costs weighed on deal value.

Investment banking revenues primarily comprise underwriting and advisory fees associated with acquisitions and public offerings. Equity issuance was quite strong in the second quarter, helped by a dovish stance by the Federal Reserve, but most of this could be offset by weak debt issuance, which was hurt by higher interest rates.

Trading revenues are likely to decline year-over-year on dismal client activity and low volatility. Net interest income also may not please investors due to unenthusiastic industrial and commercial lending during this period.

Meanwhile, the bottom-line is expected to grow to 71 cents per share from 63 cents per share a year ago, helped by the company’s cost-cutting initiatives. Keep your ears open for any management comments relating to its cost optimization initiatives as well as its contingency plan in the event of continued decline in trading volatility.

READ: Bank of America Q1 2019 earnings conference call transcript

It may be noted that

Bank of America has a remarkable history of beating earnings consensus.

BAC stock is currently 28% above its 52-week low to which, it had plunged last December. The stock has an average 12-month average price target of $32.83, suggesting a 13% upside from the last close.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.