Delta has an advantage in terms of not being affected by the

trade war or the Boeing crisis as the company does not have any Boeing Max 737

jets in its fleet. For the month of June, Delta reported a 6.2% increase in

revenue passenger miles compared to the same period last year. Capacity was up

by 4% with a load factor of 90.4%.

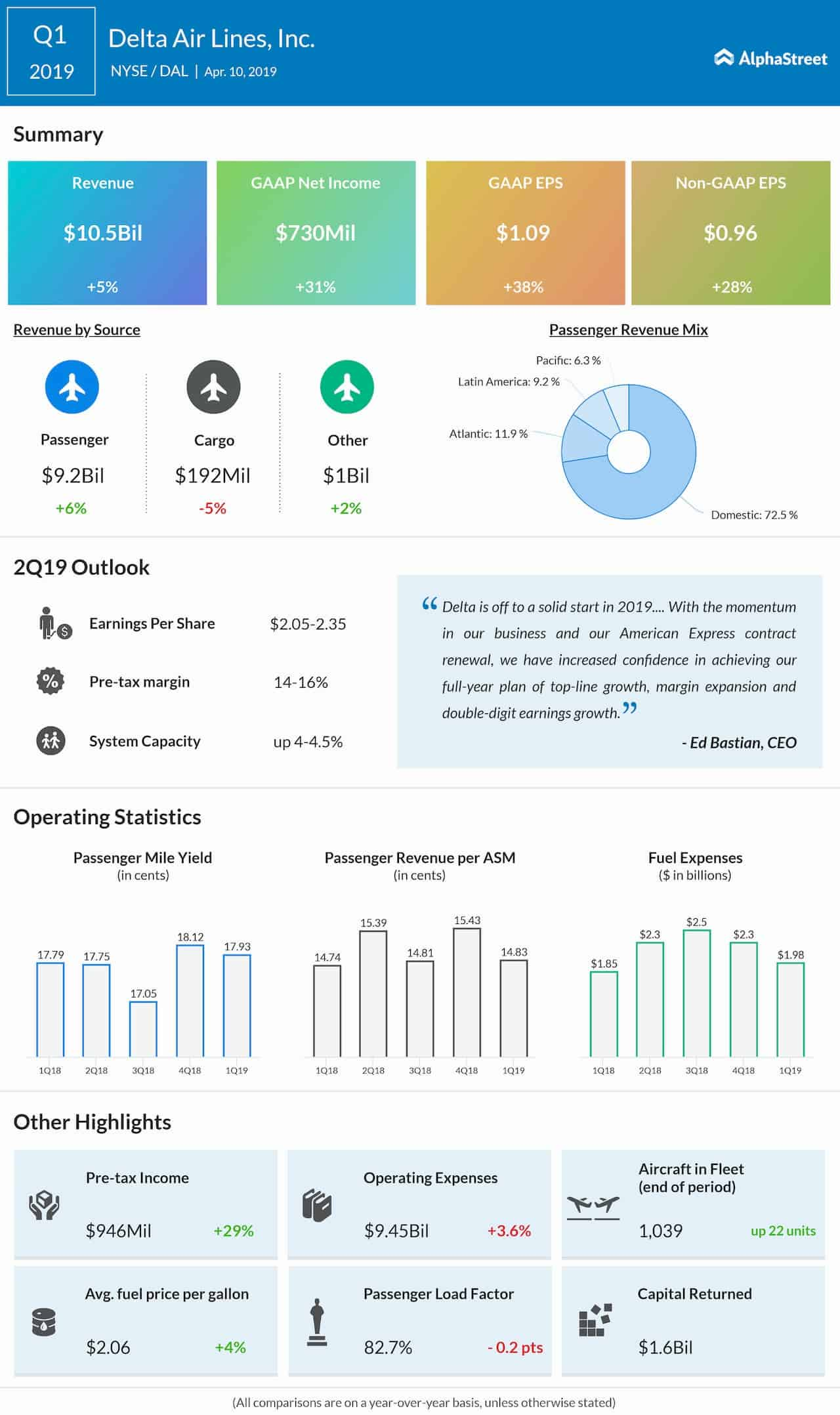

In the first quarter of 2019, Delta beat revenue and earnings estimates with revenues growing 5% year-over-year to $10.5 billion and adjusted EPS climbing 28% to $0.96.

Last week, Delta raised its guidance for the June quarter

and the company now expects adjusted EPS to be $2.25-2.35 along with adjusted

pretax margin of 15-16%. Total adjusted revenue is expected to grow 8-8.5%

while TRASM is expected to grow around 3.5%.

Delta’s shares have climbed 18% thus far this year and over 2% in the past three months. The majority of analysts are bullish on Delta and have rated the stock as Buy with an average price target of $69.56.

Delta’s competitor American Airlines (NYSE: AAL) will report earnings on July 26.