Analysts are bullish on Roku’s huge expansion opportunities

outside the US market as well as the growth in its advertising segment, known

as the platform unit. Roku launched analytical tools for advertisers during the

quarter and updates on this area will be worth watching. Roku is holding its

ground amid competition from the likes of Netflix (NYSE: NFLX), Amazon (NYSE:

AMZN) and Walt Disney (NYSE: DIS).

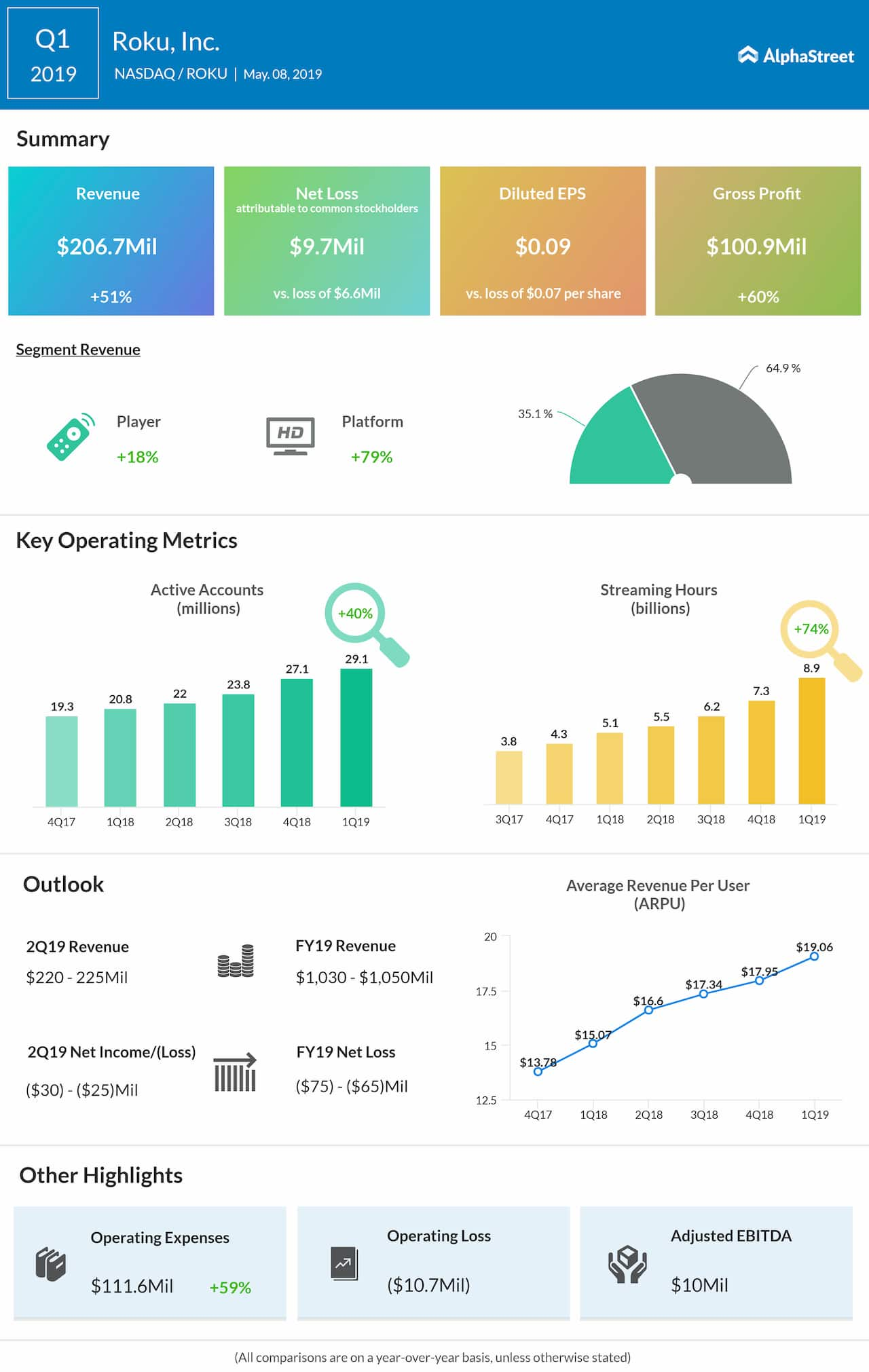

In the first quarter of 2019, Roku reported better-than-expected results with a 51% growth in revenue to $207 million and a narrower loss of $0.09 per share. Active accounts grew 40% while streaming hours grew 74%. Per-user revenue increased 27% to $19.06.

For the second

quarter, Roku has guided for a net loss of $30 million to $25 million on

revenues of $220-225 million. The forecast for the whole of 2019 is a net loss

of $75-65 million on revenues between $1.03 billion and $1.05 billion.

Roku’s shares have climbed 230% so far this year and 53% in the past three months. In the short term, the stock may experience a correction, following the long bull run. It has a 12-month price target of $89, which is a 10% downside from the current stock price of $99.