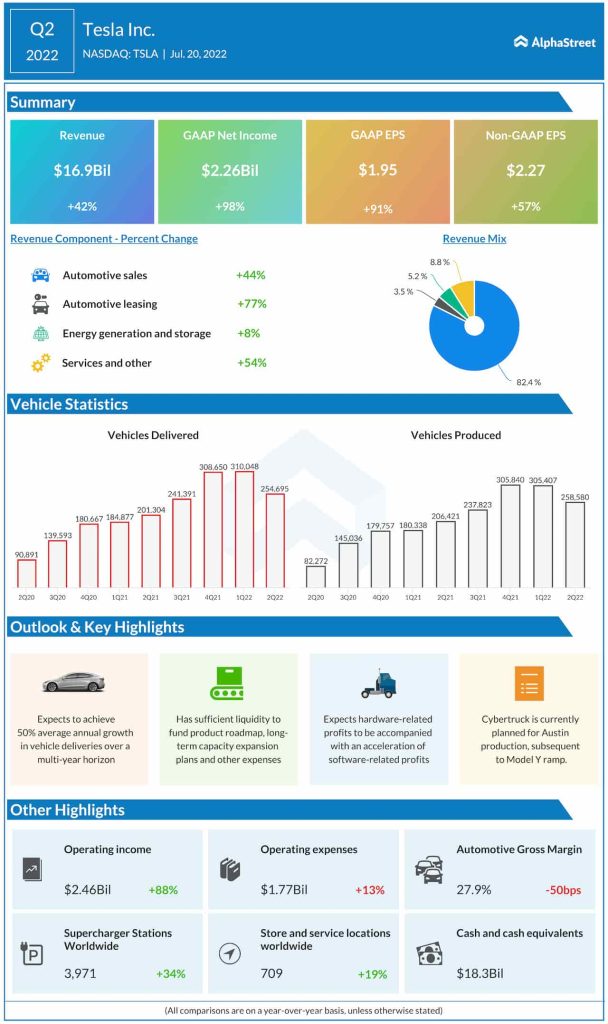

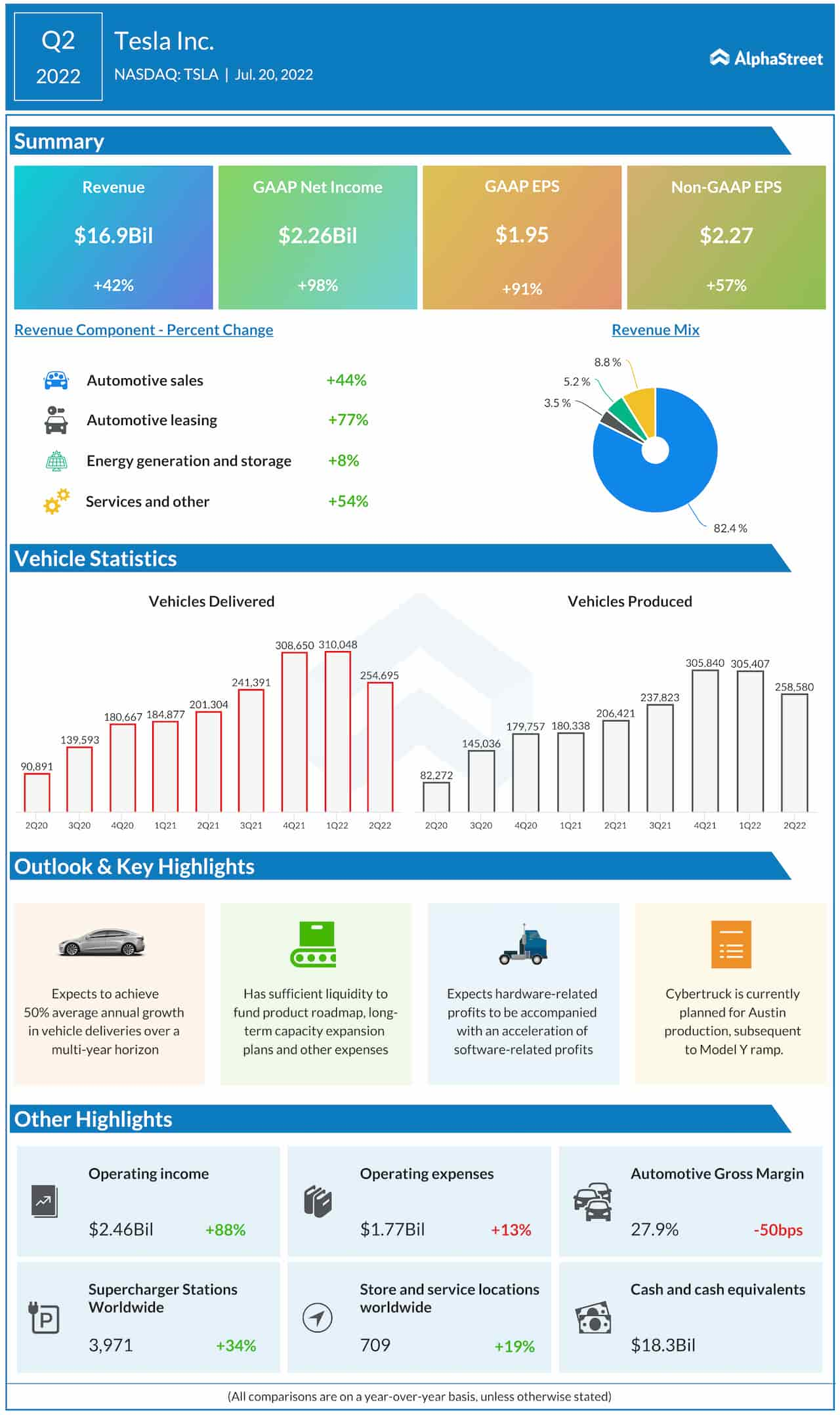

Revenues of the Austin-based electric car maker advanced 42% year-over-year to $16.9 billion during the three-month period but fell short of estimates. The company produced a total of 258,580 vehicles and delivered 254,695 units, mainly comprising the Model-3 and Model-Y variants.

Earnings, excluding one-off items, climbed to $2.27 per share in the second quarter from $1.45 per share a year earlier. Experts were looking for slower growth. Second-quarter unadjusted net income moved up to $2.26 billion or $1.95 per share from $1.14 billion or $1.02 per share in the same period of 2021.

Check this space to read management/analysts’ comments on Tesla’s Q2 report

TSLA’s market value increased in the past twelve months. The stock closed Wednesday’s regular trading higher and gained further in the extended session soon after the announcement.