Thor Industries Inc. (THO) missed analysts’ expectations on revenue and earnings for the second quarter of 2019, sending shares plummeting over 10% during premarket hours on Wednesday.

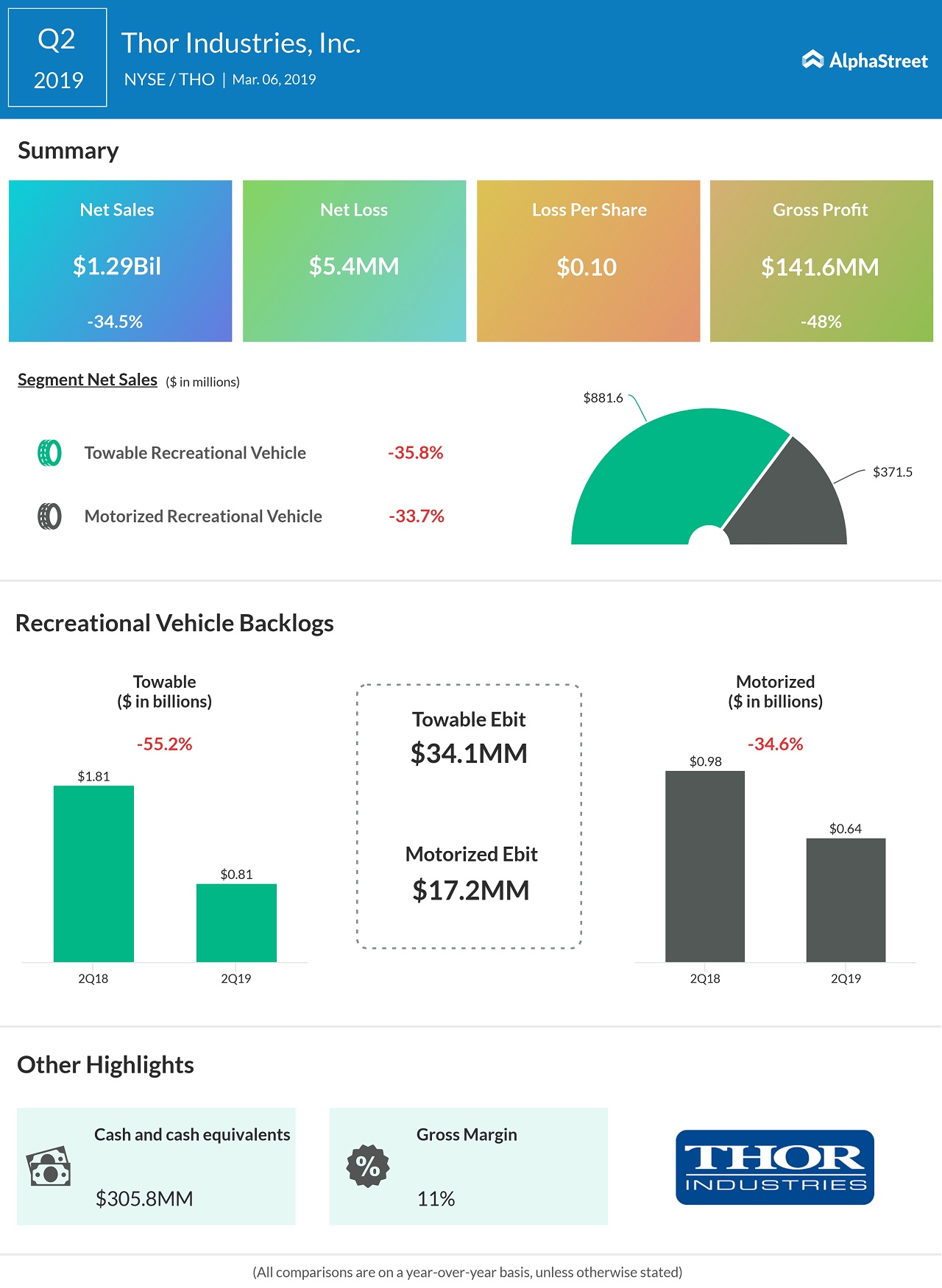

Net sales fell 34% year-over-year to $1.29 billion, lower than the street consensus of $1.48 billion. The company swung to a loss of 10 cents per share from a profit $1.51 per share a year ago. Analysts had projected earnings of 88 cents per share.

The second quarter results were hurt by acquisition-related costs totaling $42.1 million, or $0.75 per share. Thor completed its acquisition of Erwin Hymer Group on February 1, 2019.

An unusually high tax rate also played spoilsport on the second-quarter earnings. The Elkhart, Indiana-based firm’s second-quarter effective tax rate was 389.1%, versus 43.5% in the prior year as certain mark-to-market loss on the foreign currency forward contract was not deductible for income tax purposes.

The company expects to return to a more normalized effective tax rate of 23% to 25% by the end of its fiscal second half of 2019.

CEO Bob Martin said, “While we are optimistic for the long term, we also expect to face challenging conditions in the near term, as dealers continue to reduce inventory levels and we experience difficult comparisons to the record third-quarter results posted in fiscal 2018.”

READ: Thor’s stock tanks 7% on disappointing Q1 results

Thor shares have shed 47% of its value in the past 12 months. However, it has rebounded 23% since the beginning of this year.