Long Road to Recovery

While it is almost certain that demand conditions would return to the pre-crisis levels in the long term, the question is how long it would take. A long-drawn-out slump would not bode well for airline companies as they are highly sensitive to fluctuations in cash flow. Some experts believe this is the right time to enter airline stocks so that investors can make handsome gains in the years to come. When it comes to United, the company has a history of successfully rising from setbacks.

Focus on Cash

In their post-earnings comments, United executives exuded confidence in the company’s ability to bounce back and become cash-flow positive once normalcy returns to the market. According to the management, demand would grow10% sequentially in the fourth quarter, but capacity would be about 55% below the prior-year levels during the remainder of the year. Going forward, the top priorities would be cost-cutting and reduction of cash burn.

Also read: JetBlue Airways Q2 2020 Earnings Call Transcript

As part of achieving those goals, United recently purchased a fleet of 16 new aircraft directly, which allowed it to finance the transaction more efficiently. The company will ensure that all the upcoming aircraft purchases are fully financed. It had about $19.4 billion available cash at the end of the September-quarter and enhanced liquidity further through existing credit facilities and support programs like the federal stimulus.

Tough Measures

The management recently clinched an agreement with pilots to reduce flying hours, thereby averting lay-offs. The deal will help the company continue operations without disruption. Earlier, the airline had furloughed about 13,000 workers after operations came to a standstill. In the near term, United is poised to incur more than $1 billion in pre-tax costs, mainly related to employee severance.

Even though the negative impact of COVID-19 will persist in the near term, we are now focused on positioning the airline for a strong recovery that will allow United to bring our furloughed employees back to work and emerge as the global leader in aviation.

Scott Kirby, chief executive officer of United Airlines

ADVERTISEMENT

According to chief executive officer Scott Kirby, the next 15-20 months are going to be a difficult period as recovery would not be in a straight line. To those who are concerned about safety, the company’s answer is a series of safety measures including rigorous aircraft checking after every trip and re-engineering of the airflow mechanism.

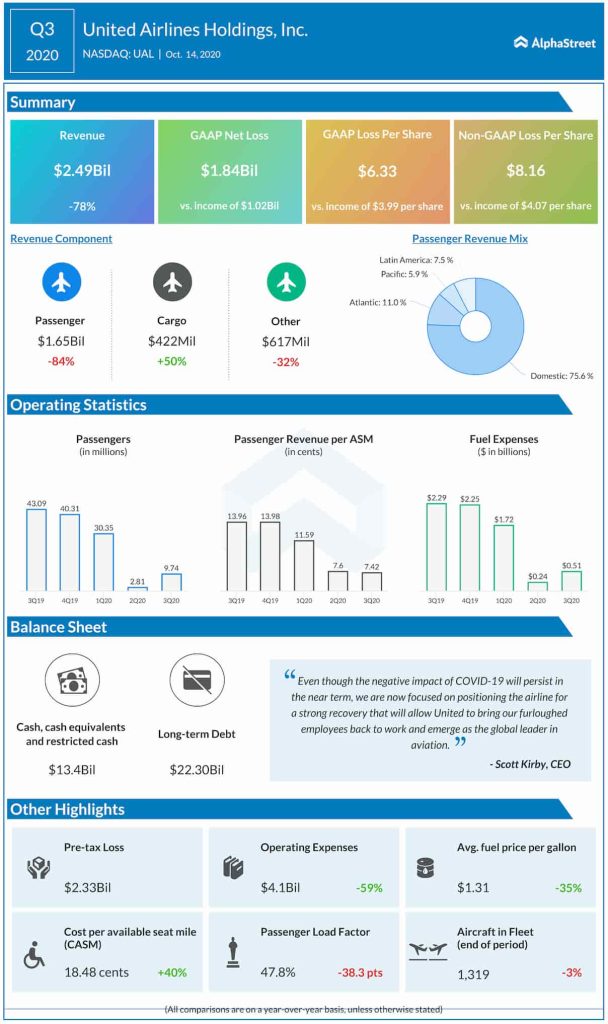

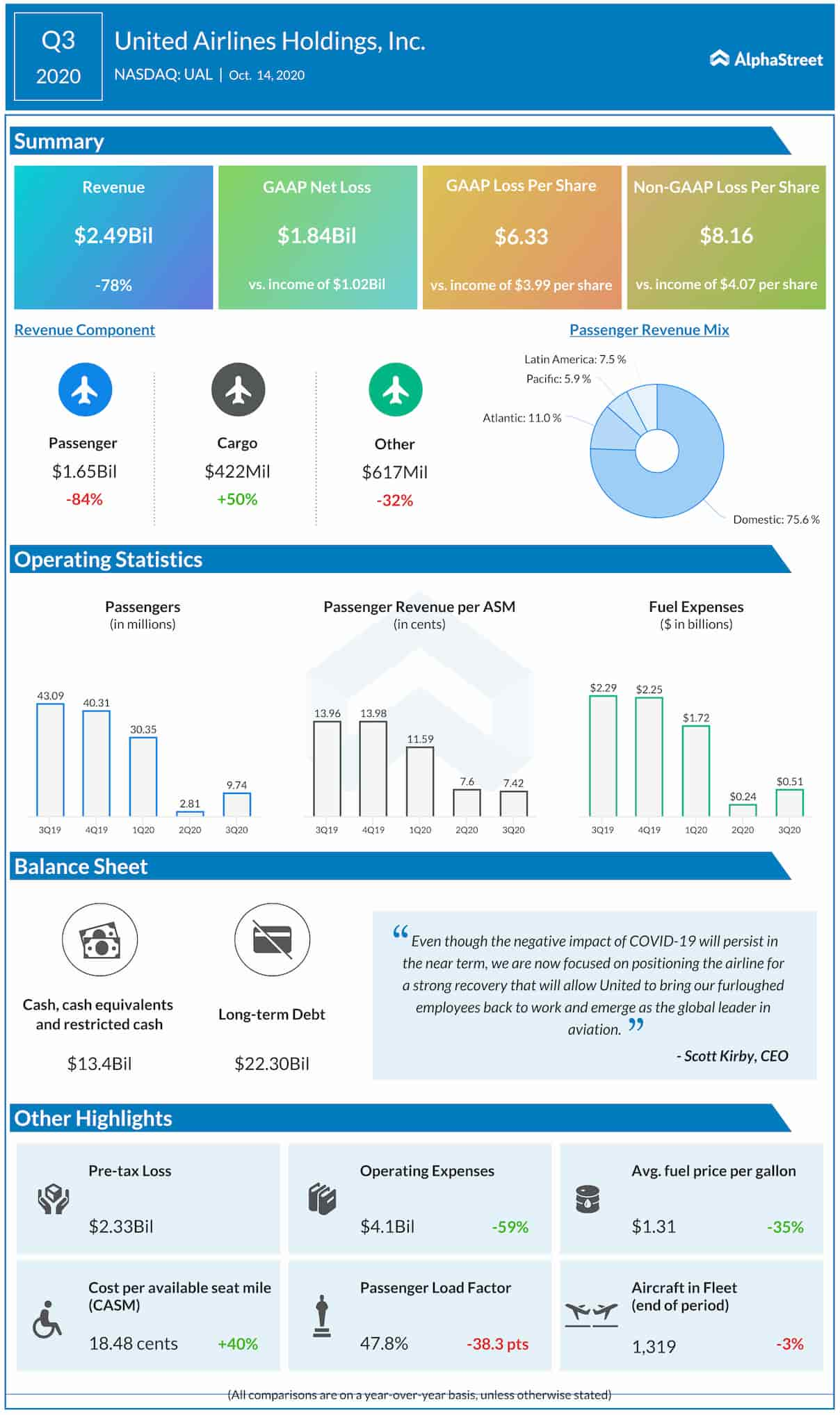

Q3 Debacle

When the company unveiled its September-quarter numbers this week, the only relief for the stakeholders was the modest improvement in performance from the previous quarter. At $2.5 billion, revenues were down 78% from last year and far below expectations. With the sole bright spot being cargo, the company incurred a whopping $8.16-per share loss. It was wider than the estimated loss and represented a sharp deterioration from the year-ago quarter when it recorded a profit.

Earlier this week, Delta Air Lines (DAL) published its third-quarter report that is not much different from that of United. Both passenger traffic and cargo movement contracted to all-time lows, dragging the company into a loss of more than $5 billion. As expected, investors turned cautious and the stock got crushed.

Read management/analysts’ comments on quarterly earnings results

The post-earnings sell-off erased several millions of dollars from United’ market capitalization. The downturn continued on Thursday, after opening the session at $36.26. The value of the shares more than halved since the beginning of the year, and they underperforming the market during that period.