Shares of Electronic Arts Inc. (NASDAQ: EA) were down 1.8% during afternoon hours on Thursday, a day after the company reported its earnings results for the first quarter of 2022. Revenue and earnings exceeded estimates and the company raised its guidance for the full year but the outlook fell short of expectations which hurt the stock. Despite this, EA remains optimistic about its growth prospects for this year and beyond.

Better-than-expected results

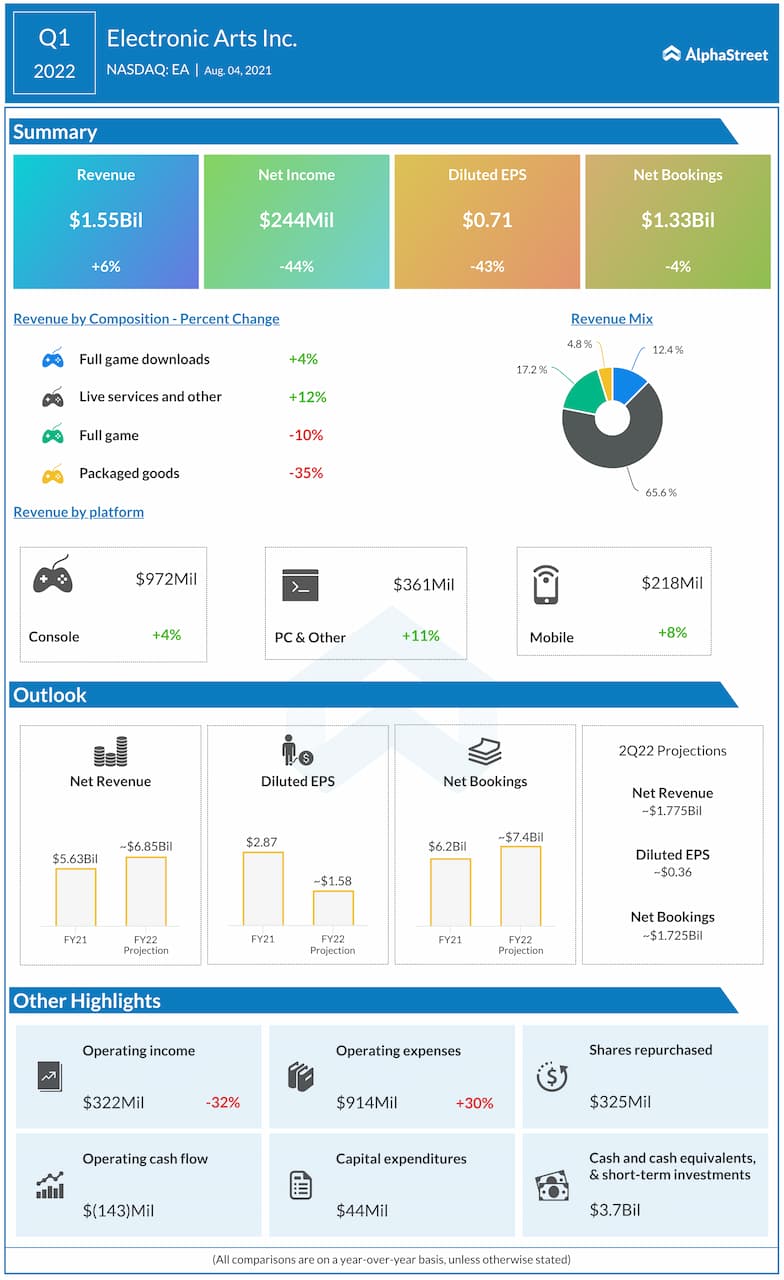

Net revenue increased 6% to $1.55 billion in Q1 compared to the same quarter a year ago and surpassed analysts’ projections. The top line growth was helped by a 10% increase in live services and other revenue. Although earnings dropped to $0.71 per share from $1.25 per share last year, it exceeded expectations. Net bookings amounted to $1.33 billion. Revenue, earnings, and net bookings all exceeded the company’s guidance for the quarter.

Strong engagement

Electronic Arts continues to see strong engagement for its games even as restrictions ease. Both its existing titles and new launches performed well during the quarter. FIFA Ultimate Team Matches were up 48% YoY in Q1 and over 31 million players have joined FIFA 21 on console and PC since launch.

More than 140 million players have engaged with EA SPORTS games over the last 12 months. The release of F1 2021 has garnered good response with sales rising significantly year-over-year and total active players increasing by nearly 10% since launch over last year’s game.

Apex Legends and Battlefield continued their strong performance with Apex Legends averaging more than 13 million weekly active players during Season 9. The company unveiled Battlefield 2042 during Q1 and since launch, Battlefield trailers and content have cumulatively generated more than 210 million views to date across all channels.

Mobile gaming opportunity

Electronic Arts has significant growth opportunity within mobile gaming and the acquisitions of Codemasters, Glu Mobile and Playdemic will help generate meaningful yields within this space. The acquisition of Glu Mobile brought over 15 mobile live services to EA’s portfolio and the addition of Playdemic will give it access to the leading sports mobile title Golf Clash.

During the first quarter of 2021, mobile revenues increased 8% YoY to $218 million. Compared to the pre-pandemic period in Q1 2020, mobile, excluding the Glu acquisition, was up 16% organically.

Outlook

EA raised its guidance for the full year based on the strong performance in the first quarter. For FY2022, the company expects net revenue to be approx. $6.85 billion and net bookings to be approx. $7.4 billion. For the second quarter of 2022, EA expects net revenues of $1.77 billion and net bookings of approx. $1.72 billion.

Click here to read the full transcript of Electronic Arts’ Q1 2022 earnings conference call