For the fiscal 2020 period, the gaming giant would benefit from a one-time tax benefit of $1.7 billion or $5.61 of EPS. The company recorded $1.08 billion during the Q1 period and expects to take into the account the remaining $620 million in the second quarter.

EA CEO Andrew Wilson talking about the first quarter results said, “From great new games to live services with longevity, subscriptions on more platforms and competitive gaming for more franchises, we’re pushing to lead with innovation, quality and choice for our players.”

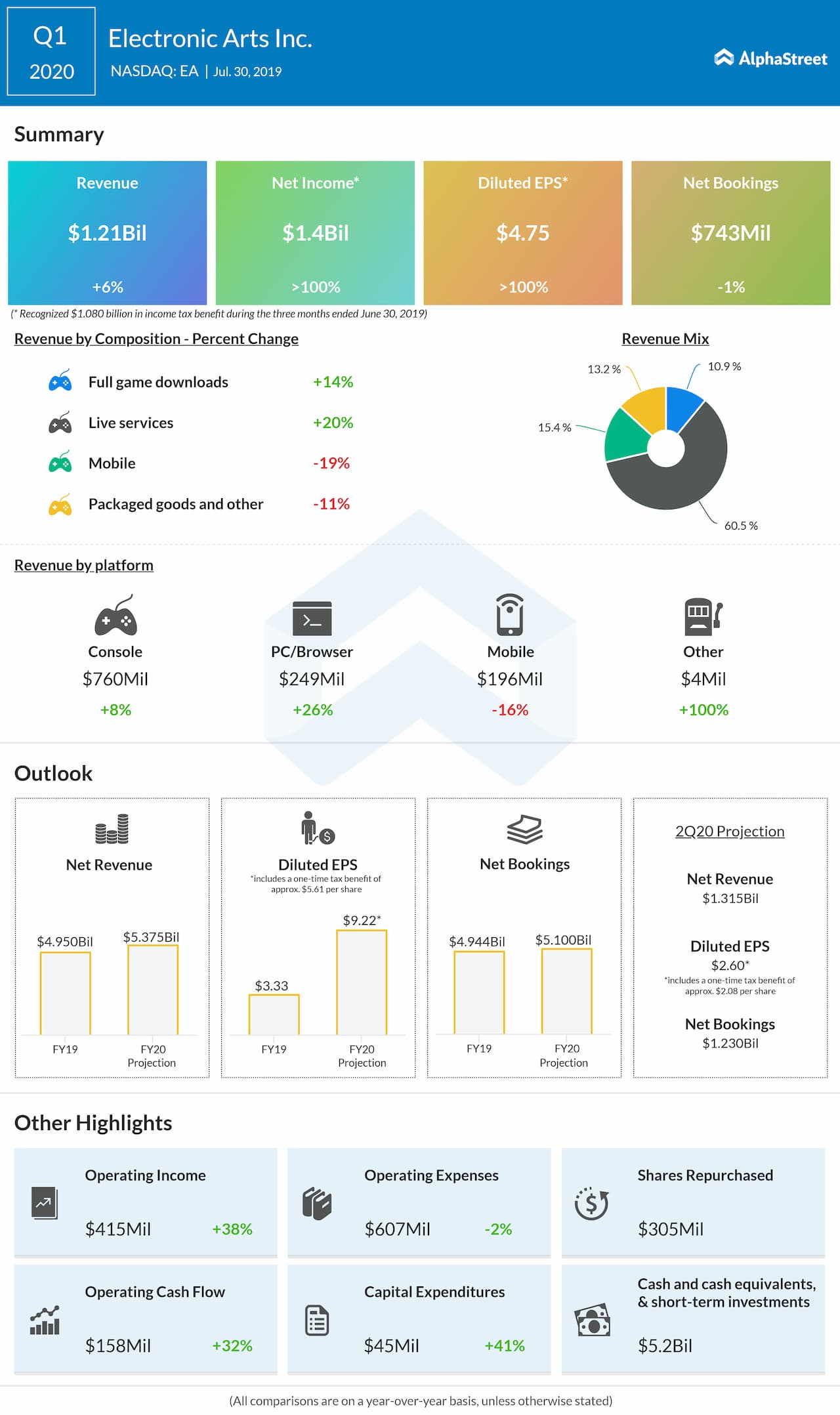

EA’s top line rose 6% to $1.2 billion and net bookings declined modestly by 1% to $743 million. Thanks to the one-time tax benefits, earnings per share surged to $4.75 compared to $0.95 reported in the prior year period. Analysts were expecting sales of $719 million and adjusted earnings of 1 cent for the Q1 period.

Digital sales brought in 87% of revenues in the first quarter continuing its momentum from the last quarter. Gaming downloads and live services grew double-digits offset by disappointing performance from the mobile and packaged services.

The company plans to launch the “Star Wars Jedi: Fallen Order” from the Star Wars franchise in November matching with the holiday season.

Outlook Update

EA expects Q2 revenue to come in at $1.315 billion and EPS of $2.60, including tax benefit of $2.08. Net bookings is forecasted to come in at $1.23 billion. For the same period, analysts are expecting sales of $1.24 billion and adjusted earnings of $0.89 per share.

For the fiscal 2020 period, Electronic Arts is expecting revenues of $5.375 billion and GAAP EPS of $9.22, which includes $5.61 as one-time tax benefit. Net bookings is projected at $5.1 billion. On the flip side, the street is anticipating sales of $5.18 billion and adjusted EPS of $4.52 compared to $4.25 reported in the prior year period.

The gaming giant’s sales guidance for both the periods is more or less in line with estimates, but adjusted EPS fell short of expectations.

Electronic Arts’ rival Activision Blizzard (ATVI) is reporting its second quarter results on August 8th while Take-Two Interactive Software (TTWO) is publishing its first quarter earnings on August 5th.