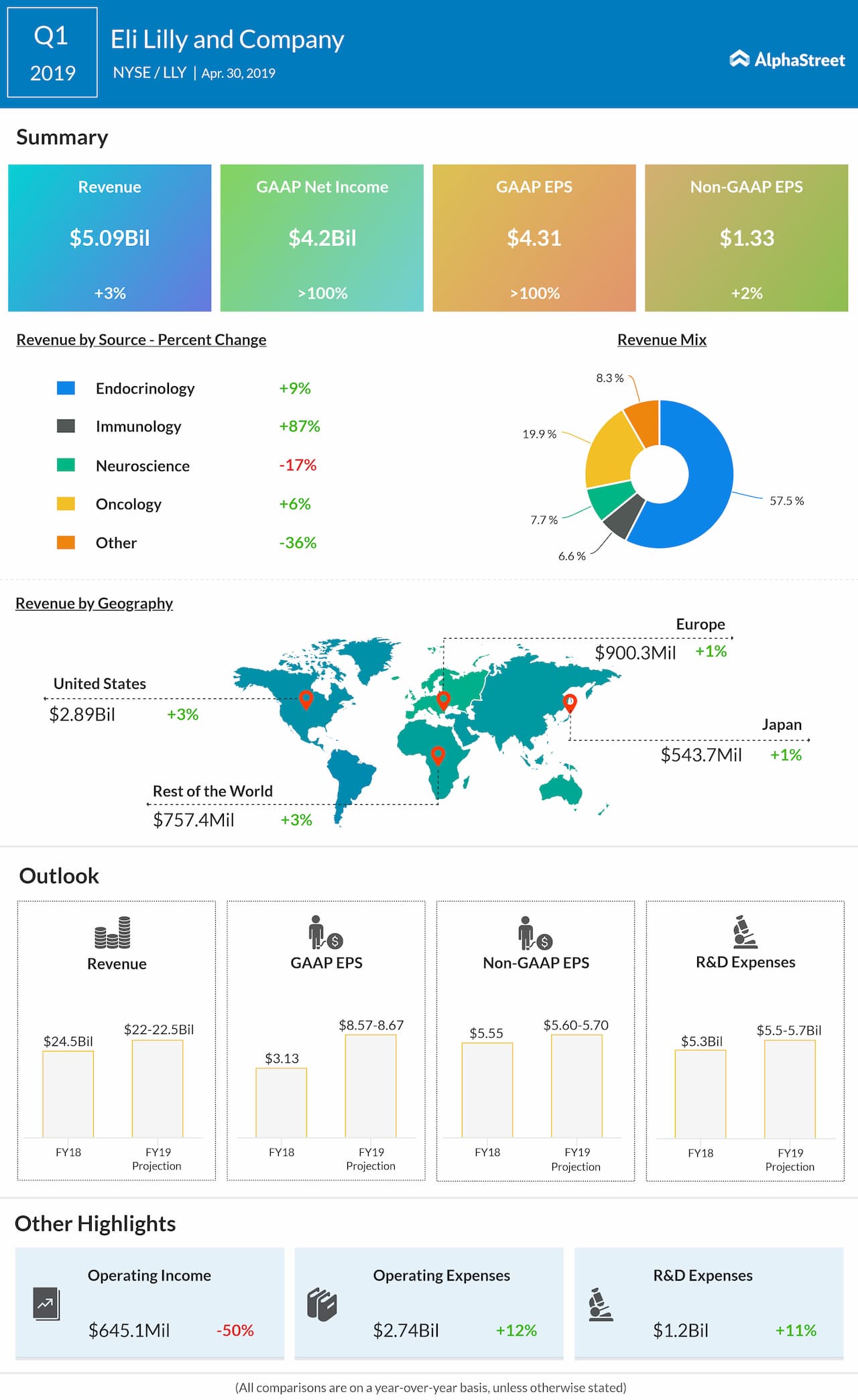

Net income improved to $4.2 billion, or $4.31 per share, compared to $1.2 billion, or $1.16 per share in the year-ago quarter, helped by a gain recognized on the disposition of Elanco Animal Health. Adjusted net income fell 4% to $1.2 billion while adjusted EPS rose 2% to $1.33.

Revenue in the US grew 3% year-over-year to $2.8 billion, driven by a volume increase of 6%. Revenue outside the US rose 2% to $2.2 billion, helped by a volume growth of 9%. Volume growth, both in the US and internationally, were driven by key products like Trulicity and Taltz.

Products such as Trulicity, Taltz, Basaglar and Jardiance posted double-digit revenue growth during the quarter helped by higher demand and volume growth. Products like Cialis, Humalog and Humulin posted sales declines hurt by factors like generic competition and foreign exchange rate fluctuations.

Eli Lilly updated its guidance to reflect the disposition of the Elanco Animal Health business. For the full year of 2019, the company lowered its revenue outlook to a range of between $22 billion and $22.5 billion. The company increased its earnings guidance and now expects GAAP EPS to be $8.57-8.67 and adjusted EPS to be $5.60-5.70.