Lilly has been looking at multiple ways to treat COVID-19, including studying its existing drugs and partnering with two biotech companies to discover novel antibody treatments. The company is looking at both single antibody therapy as well as antibody cocktails for the treatment of COVID-19.

There is significant opportunity in the COVID-19 treatment space

and any positive development in this area could provide a huge boost to the

company’s growth and stock. Rivals like Gilead (NASDAQ: GILD) and Moderna

(NASDAQ: MRNA) have also

recently published data and moved on to the next phase of their coronavirus

vaccine studies.

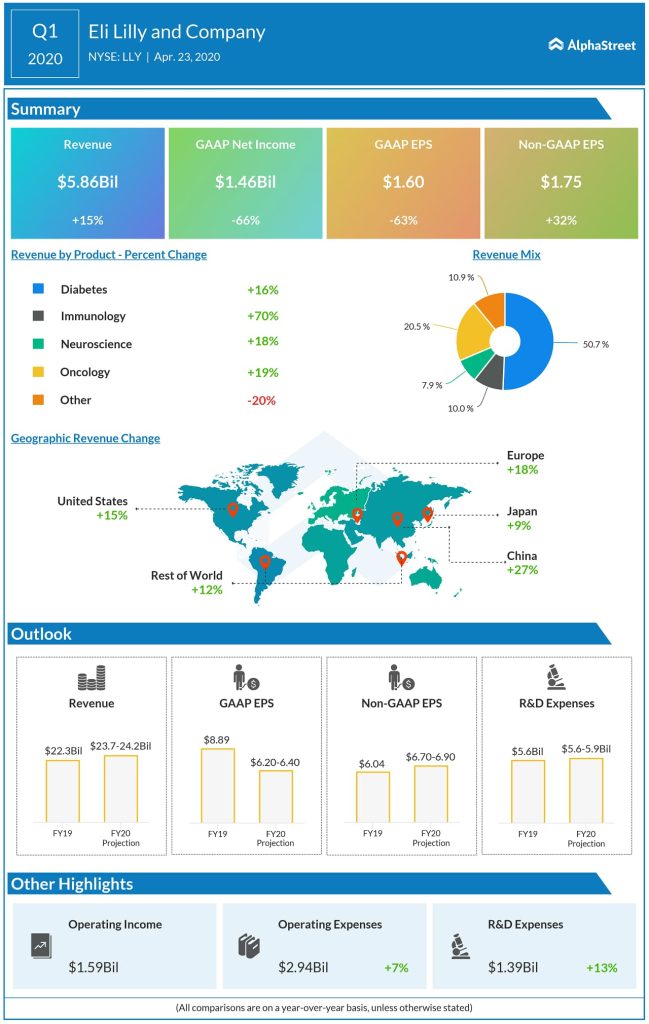

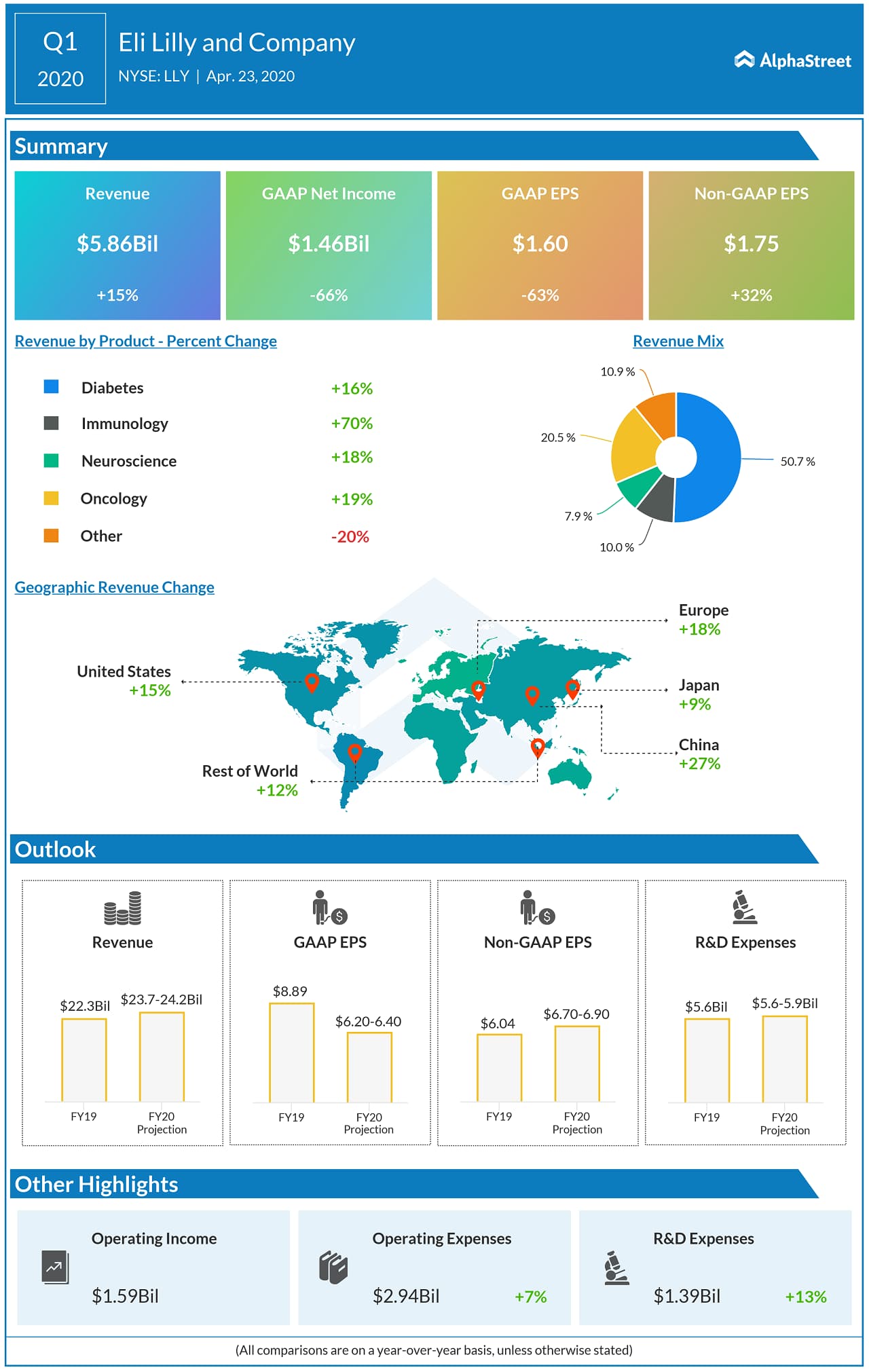

In its most recent quarter, Lilly saw 15% revenue growth

along with 22% volume growth. The company generated around $250 million in

additional revenue due to increased customer buying patterns and patient

prescription trends due to the pandemic.

“Lilly exited 2019 with strong revenue growth and margin expansion, driven by the uptake of our newer medicines. That momentum continued in Q1 2020 and was augmented by higher patient and supply chain purchasing due to the COVID-19 pandemic.” – Josh Smiley, CFO

Lilly’s strong product portfolio of successful drugs that scale

across several medical conditions provide the company with a strong advantage. Key

growth products including Trulicity, Taltz and Jardiance contributed 19% of

revenue growth in the first quarter of 2020.

In terms of its COVID-19 treatment efforts, the company is

studying the potential use of baricitinib, which is its JAK inhibitor in

collaboration with Incyte, to treat the virus and expects to see the results in

a month or two.

Lilly is also undertaking a Phase 2 trial with a monoclonal

antibody against Angiopoietin 2 in pneumonia patients with COVID-19 who are at

risk of progressing to acute respiratory distress syndrome and expects the

results over the coming months.

Despite the near-term benefits and long-term opportunities from

COVID-19, the company faces challenges as well from the pandemic. Further into

the year, Lilly expects headwinds from destocking due to a normalization in

supply chain after the recent demand surge, a drop in new prescriptions and

pricing pressures.

Keeping these challenges in mind, Lilly has guided for reported EPS of $6.20-6.40 and adjusted EPS of $6.70-6.90 for the full year of 2020. Revenues are expected to be $23.7-24.2 billion.

Click here to read the full transcript of Eli Lilly Q1 2020 earnings call