EverCommerce

Read management/analysts’ comments on quartrly reports

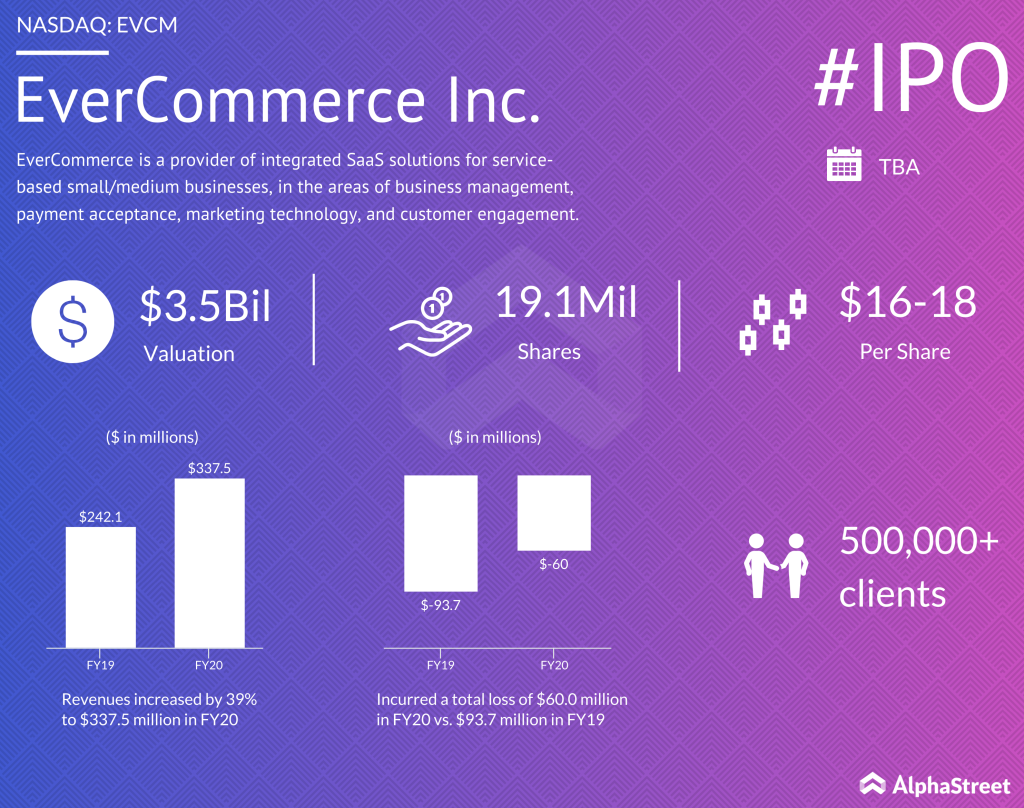

The offering is expected to generate proceeds of about $296 million — at the midpoint of the price range — and value the company at $3.5 billion. The management intends to use the amount, together with cash-on-hand, mainly to repay debt and support business growth through various initiatives including strategic acquisitions.

Focus on SMBs

The Denver-headquartered tech firm is a leading provider of integrated SaaS solutions for service-based small/medium businesses, primarily in the areas of business management, payment acceptance, marketing technology, and customer engagement. It was founded in 2016 by Eric Remer who has also served as the chief executive officer since then. Post-IPO, Remer will assume the additional role of chairman of the board.

According to Remer, EverCommerce was born out of the need to offer better tools to service-based small businesses to operate effectively. Encouraged by the successful journey so far, the company is currently targeting the huge $1-trillion global market. It is estimated that SMBs represent the single largest employer and employee category accounting for about 40% of GDP, with service businesses representing most of it.

COVID Tailwinds

The company witnessed strong adoption of its offerings during the pandemic as customers embraced digital technologies to align their businesses with the changed market conditions and customer preferences. The other factors that add to the tailwind are the shift of commerce to mobile devices, the prevalence of electronic payment, and the emergence of digital marketing as the preferred mode of business promotion.

Reflecting the high demand, revenues grew at a compound annual rate of 61% in the past two years. At, $337.5 million, the top-line remained mostly unaffected by the pandemic in fiscal 2020, growing 39% year-over-year. As a result, net loss narrowed sharply to $60 million from $94 million in fiscal 2019.

Latest Updates

A few months ago, EverCommerce acquired New Zealand-based business-management software provider Timely LTD for about $95 million. More recently, the company clinched a deal with Silver Lake to sell around $75 million of common stock in a private placement. So far, its key milestones include growing the customer base to over 500,000 — across the core verticals of Home Services, Health Services, and Fitness & Wellness Services — and tie-ups with funding partners Providence Strategic Growth and Silver Lake.

What to look for when Elevation Oncology makes its Wall Street debut

Going forward, the main challenge facing the management would be to take the company to profitability in the highly competitive and volatile market, with investments in the business adding to the pressure on the bottom line.