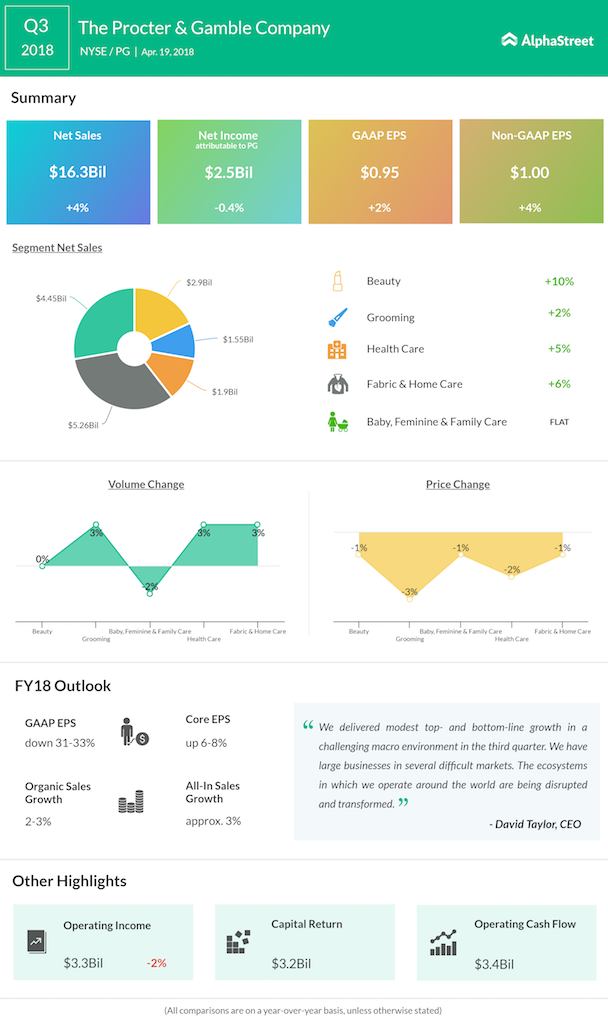

Foreign exchange contributed positively by 4% to net sales, which rose 4% to $16.3 billion. Organic volume growth drove organic sales higher by 1%. The disproportionate growth of premium-priced products, specifically in the Beauty segment, drove product mix, which in turn contributed to the organic sales growth.

US Shave Care pricing reductions and higher merchandising investments hurt pricing in the quarter. Pricing trends are expected to improve in the upcoming fiscal year after several of the negative pricing impacts, including the US Shave Care reductions made last year, will begin to annualize in the next few quarters.

Outlook

Looking ahead into fiscal 2018, P&G expects all-in sales growth of about 3%, which includes a benefit from the combination of acquisitions and divestitures and foreign exchange. Organic sales growth is now expected to be at the lower end of the 2-3% range. The company narrowed its core EPS growth guidance to 6-8% from the previous estimate of 5-8%. GAAP EPS is predicted to decline 31-33% from 2017 GAAP EPS of $5.59.

Segment-wise, strong growth in the super-premium SK-II brand and Olay Skin Care, as well as premium innovation in the personal care category, drove Beauty segment organic sales by 5%. Higher merchandising activities and favorable mix from the disproportionate growth of premium products drove Fabric and Home Care segment organic sales higher.

Pricing reductions in the US last April, as well as product and geographic mix, hurt grooming segment organic sales. Trade inventory reductions, increased trade merchandising spending and competitive activity hurt organic sales in the Baby, Feminine and Family Care segment. Sales in this segment were down 3%.

Organic sales in the Healthcare segment rose 1% as strong cough/cold season and growth in international shipments from PGT partnership offset trade inventory reductions.

The company returned $3.2 billion in cash to shareholders during the quarter, through $1.8 billion of dividend payments and $1.4 billion in common stock repurchase. Earlier this month, P&G had announced a 4% increase in its quarterly dividend. The payout ratio stands at 72.83% and the 5-year average dividend yield is at $3.12.