Several leading companies took part in this boycott and most of them announced that they were pausing advertising on not just Facebook but on other social media platforms like Twitter (NYSE: TWTR) as well.

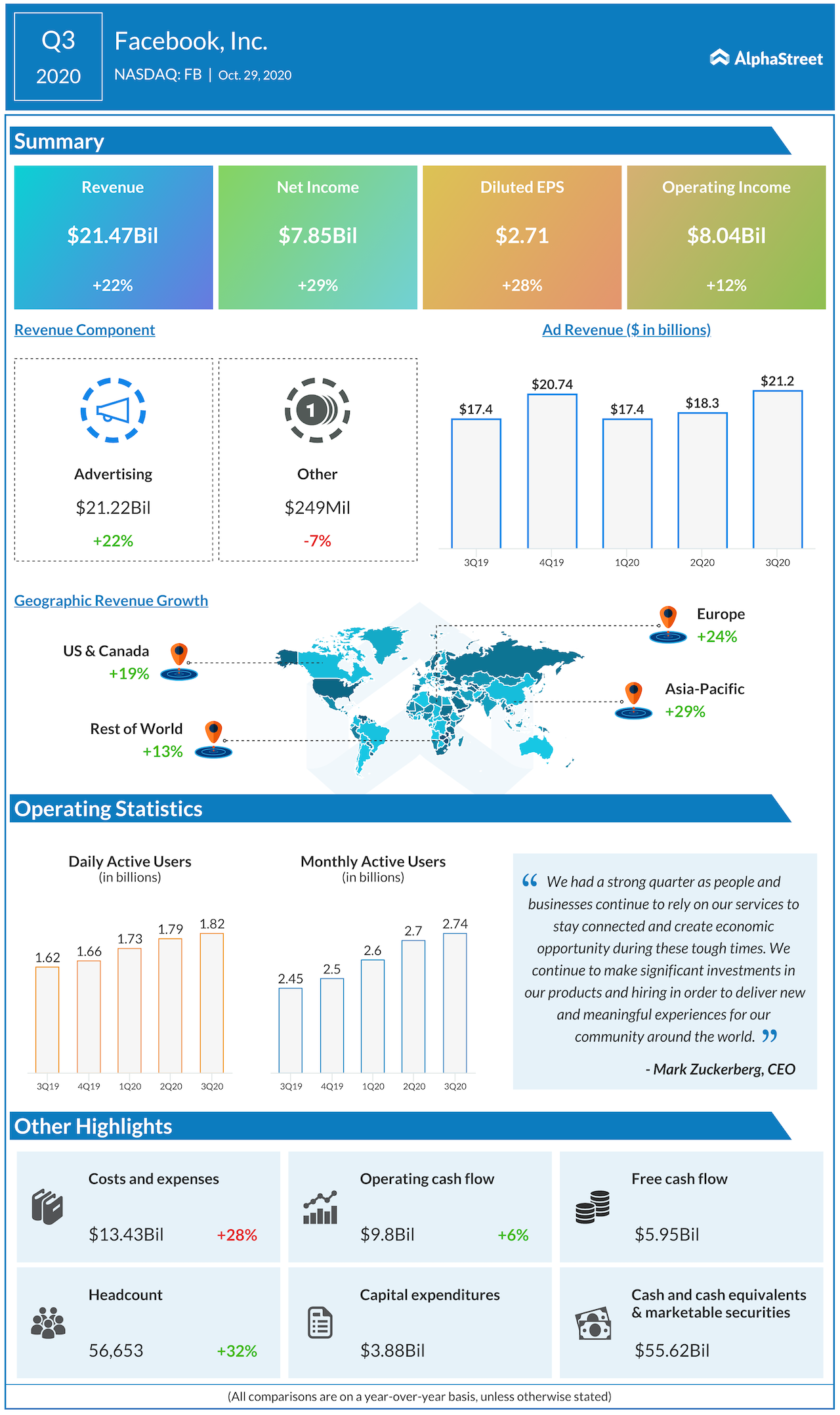

But going by the numbers announced on its most recent earnings call, Facebook doesn’t even look like it has been scratched by the ad boycott. Not only was the impact quite minimal, the numbers were pretty healthy and the outlook isn’t all that bad either.

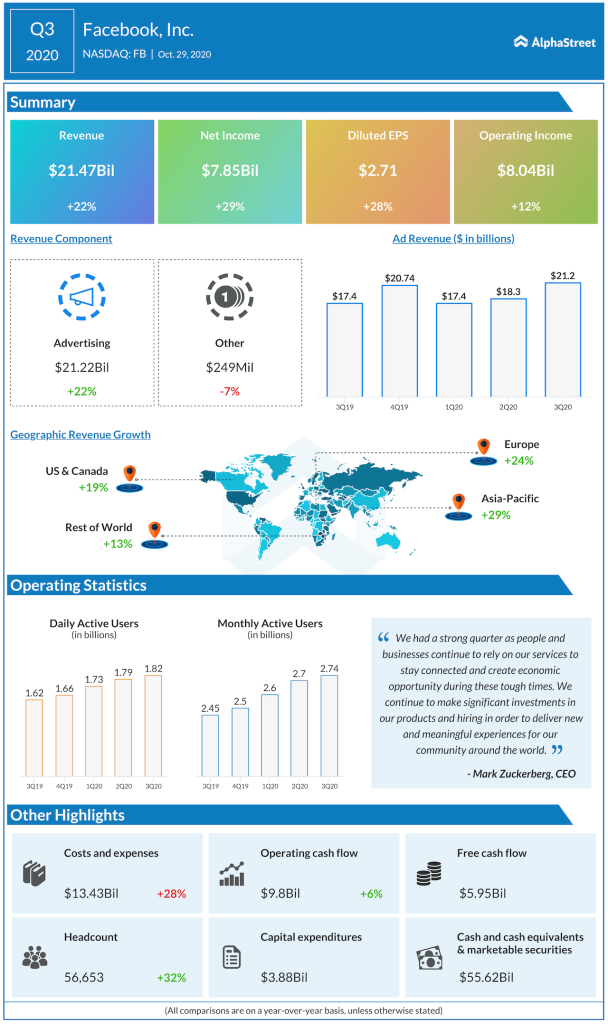

Advertising trends

Advertising revenues grew 22% year-over-year to $21.2 billion during the third quarter of 2020. On a sequential basis, ad revenues grew 15%. The growth was driven by strong advertiser demand caused by the rapid shift to ecommerce due to the pandemic. Average revenue per user from advertising increased nearly 13% in the third quarter from the second quarter.

The company saw improvements in ad revenue growth rates across all its regions from last quarter with the largest growth in Asia-Pacific at 30% followed by Europe at 25%. The US & Canada region grew 20% while Rest of World rose 12%. The total number of ad impressions increased 35% driven by Facebook and Instagram.

Last quarter on its earnings call, Facebook had mentioned that its advertising business was not heavily dependent on large advertisers but is instead driven mainly by relatively small businesses. This has pretty much proven to be the case during the third quarter as the company witnessed strength in particular from small and medium-sized businesses.

Personalized advertising

Ad revenues saw the strongest growth across the ecommerce, retail and CPG verticals during the third quarter. As the pandemic brought about store closures and restrictions to traditional shopping, many small businesses were left with no choice but to go digital. They took to Facebook, WhatsApp and Instagram to promote their goods and services in order to stay afloat and drive revenue.

Facebook currently has over 200 million businesses using its free tools to communicate with customers and over 10 million active advertisers across its services. A large chunk of these advertisers are small and medium-sized businesses. The company is seeing demand for both its free and paid tools, especially its personalized ad products.

Facebook has seen small businesses benefit from personalized advertising and the company believes that the regulatory environment needs to evolve in a way that allows for personalized advertising while protecting user data and privacy. The company opined that strict regulations could impact small businesses much more than large companies with big budgets.

Outlook

For the fourth quarter, Facebook expects strong advertiser demand during the holiday season to drive higher year-over-year ad revenue growth rates versus the third quarter. Looking into 2021, the rising demand for advertising driven by the increased shift to ecommerce could be a tailwind to ad revenue growth. However, changes in regulations could pose challenges to the company’s ad business.

All said and done, Facebook has not seen much of an impact from the ad boycott and it continues to see demand from small businesses that depend on its platforms to reach larger audiences and drive revenue growth.

Click here to read the full transcript of Facebook Q3 2020 earnings conference call