Mixed Q2 in Cards

The Winona-headquartered supplier of industrial and construction supplies is expected to report second-quarter 2024 results on Friday, July 12, at 6:50 am ET. Market watchers forecast a mixed outcome – net income is expected to drop by a penny to $0.51 per share on revenues of $1.92 billion, which represents a 1.5% year-over-year increase.

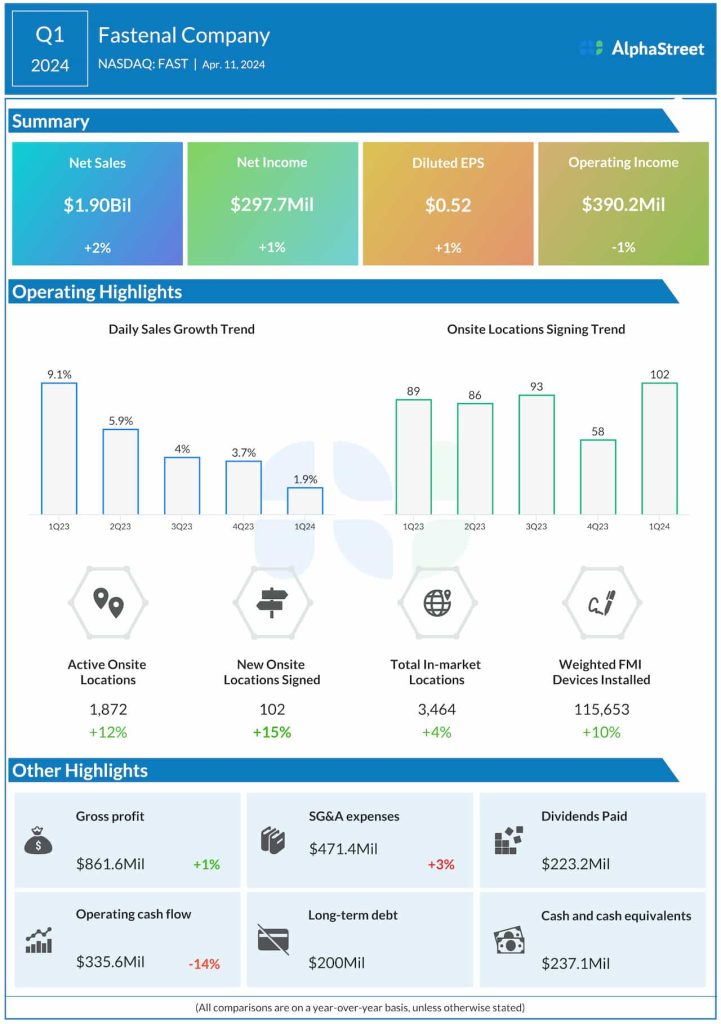

In recent quarters, daily sales growth decelerated and the company delivered near-flat quarterly sales that often fell short of expectations. Reflecting the management’s cost-cutting efforts, SG&A expense growth moderated in the past five quarters, resulting in improved margin performance. Meanwhile, margins might come under pressure in the second quarter due to continued investments in hardware, personnel, customer service, and promotional activities.

Road Ahead

Last year, several of Fastenal’s customers experienced a slump as the economic slowdown affected industrial production and construction activities, which in turn hurt the company’s sales. Improving economic conditions and recovery in industrial activity, as indicated by recent economic data, bode well for the company in terms of returning to the high-growth path.

“One thing we have been doing, and this has been going on for the last four or five years is we have made a conscious effort to continue to diversify our supply base, not just by the number of suppliers, but by the geographies from which we obtain product. That’s part of our covenant with our customers. We balance that with cost-effectiveness. And because, if you — it’s sitting on the customer and saying, what’s the trade-off of what we’re willing to spend for supply-chain to have that diversity of supply because there is a trade-off there,” Fastenal’s CEO Daniel Florness said at the Q1 earnings call.

Key Numbers

The company entered the fiscal year on a positive note, reporting a modest increase in first-quarter sales to $1.90 billion. Net income edged up 1% from last year to $297.7 million or $0.52 per share in the March quarter. The bottom line fell short of expectations, reversing the recent trend of either beating or matching the Street view. Onsite locations increased by 102 signings during the quarter, which represents an increase both sequentially and year-over-year.

Fastenal’s stock has lost about 20% since its March peak. On Wednesday, FAST opened at $62.76 and traded slightly higher in the early hours.