Fiat Chrysler Automobiles (FCAU) Thursday reported higher earnings and revenues for the fourth quarter, reflecting the stable demand for its premium models. Meanwhile, shares of the Italian-American automaker fell sharply after the management issued weaker-than-expected guidance for fiscal 2019, amidst concerns over the softening sales in key markets and trade war.

On an adjusted basis, net profit surged 49% year-over-year to EUR 1.6 billion or EUR 1.04 per share in the fourth quarter. Reported earnings jumped to EUR 0.82 per share from EUR 0.51 per share in the fourth quarter of 2017.

During the three-month period, net revenues advanced 6% to EUR 30.62 billion. However, combined shipments declined 6% annually to about 1,177,000 units. The results include the Magneti Marelli division which the company has agreed to divest, tentatively in the second quarter.

The results include the Magneti Marelli division which the company has agreed to divest, tentatively in the second quarter

In the whole of 2018, adjusted earnings climbed 33% to EUR 3.20 per share, on revenues of EUR 115.41 billion, up 4%. Full-year reported earnings moved up 3% to EUR 2.30 per share.

For fiscal 2019, the management expects adjusted earnings to be above EUR 2.70 per share, excluding Magneti Marelli. The outlook represents a decline from last year, reflecting the uptick in effective tax rate.

Industrial free cash flow is expected to fall sharply to around EUR 1.5 billion, hurt by higher capital expenditure and other costs. Full-year adjusted earnings before interest and taxes (EBIT) is forecast to be above EUR 6.7 billion, broadly in line with the 2018 levels.

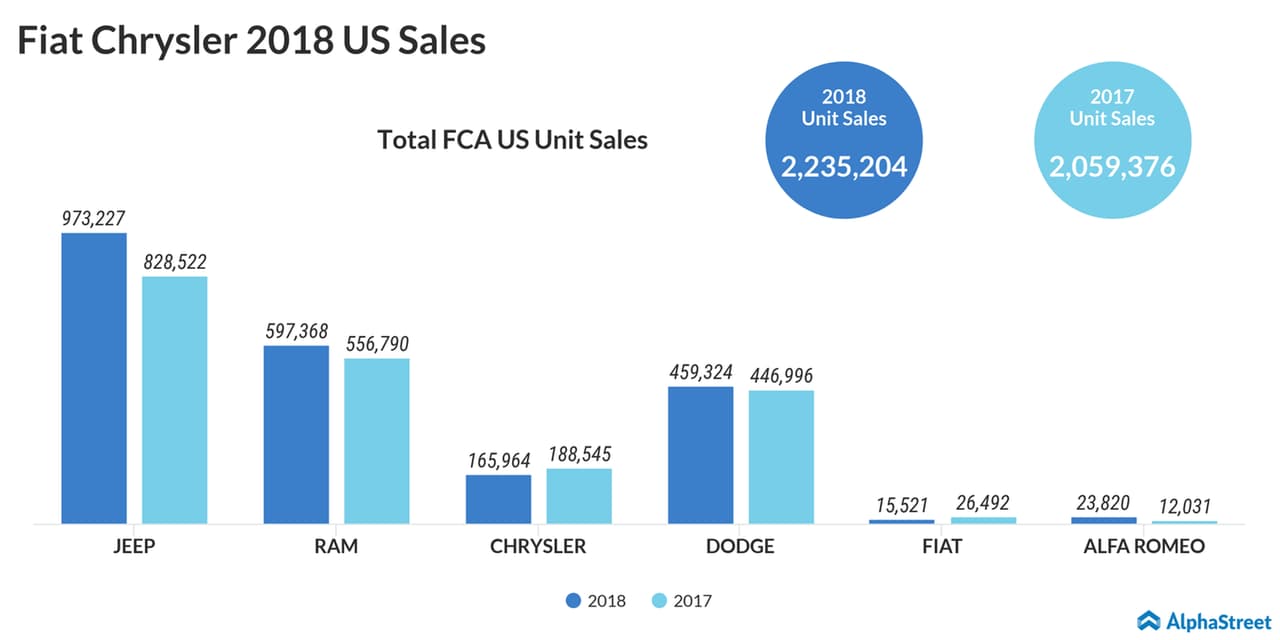

Also see: Fiat Chrysler sees best US retail sales in 17 years

The outlook fell short of market expectations as Fiat Chrysler continues to face challenges in some of its key markets, including the US and China. In the most recent quarter, earnings from the North American operations came in below the Wall Street forecast.

Shares of the company dropped about 12% in the New York Stock Exchange Thursday, after closing the previous session higher. The stock has lost about 29% in the past twelve months.