During FY2020, the company continued these efforts and rolled out a transformation plan while also increasing its planned investments for EVs and AVs. The company anticipates these efforts to drive growth in 2021.

Turnaround efforts

As part of its transformation efforts, Ford is allocating more resources and capital to its strong areas such as pickups, commercial vehicles and utilities. The company invested $7.1 billion in EBIT and $1.6 billion in cash through 2020 to revamp its portfolio as well as its geographic and industry footprints.

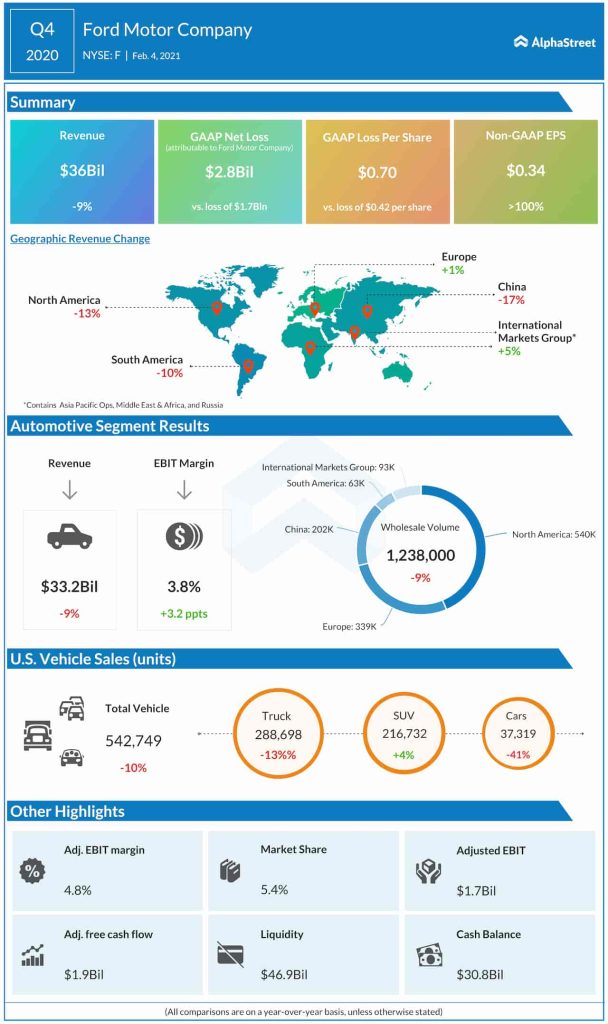

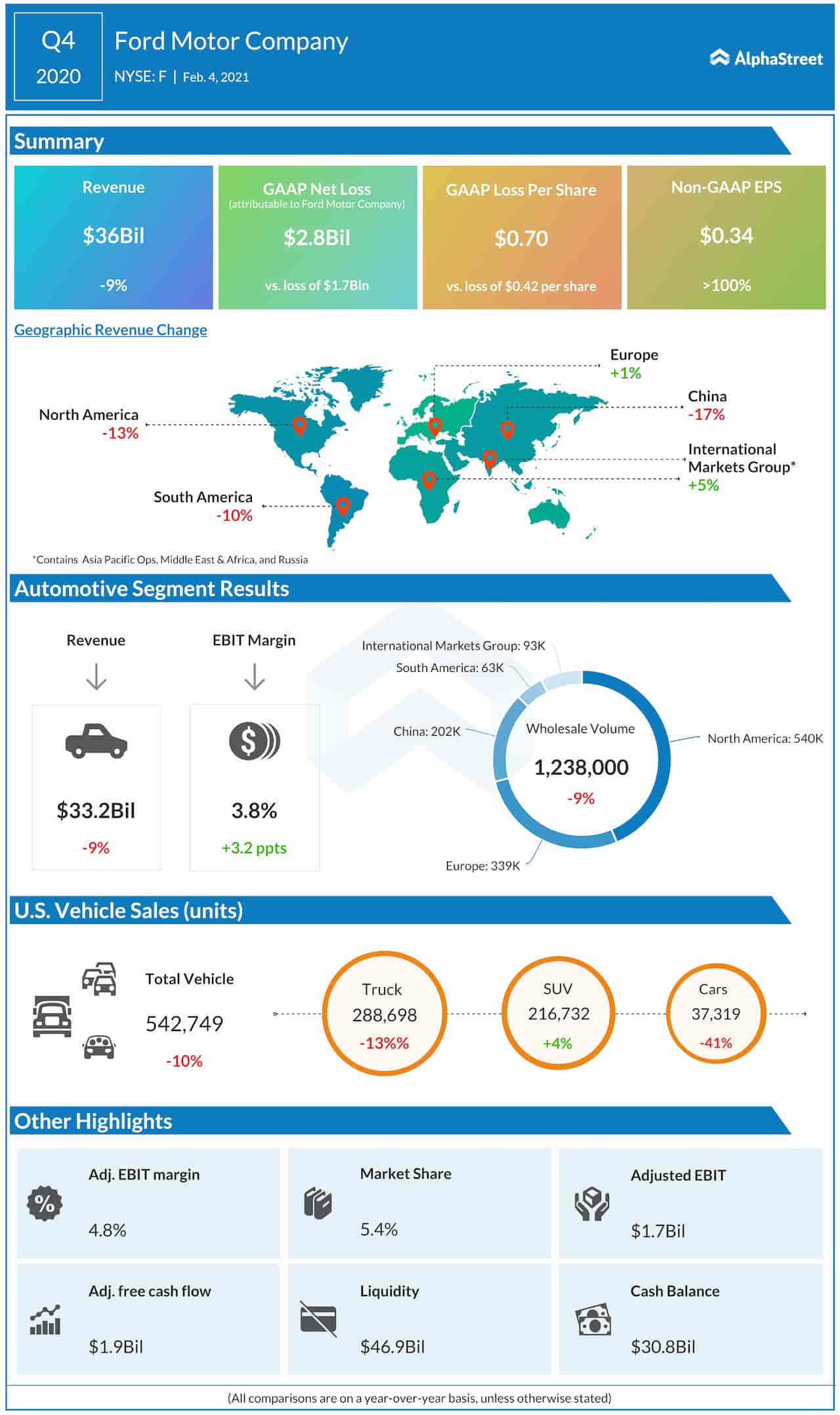

In Europe, Ford is focusing on its more profitable commercial vehicles as well as a small portfolio of passenger cars within its stronger segments in order to maximize returns. In 2020, the company reduced its manufacturing footprint in the region and slashed its headcount by 20% while also lowering its annual structural cost by $1.1 billion thereby achieving an EBIT margin of 5.8% in the fourth quarter.

Another region that underwent significant restructuring is South America. Ford has lost over $4.5 billion in South America over the past ten years. During the fourth quarter, revenues in the region fell 10%. In 2020, Ford exited its non-core heavy truck business and discontinued its Focus and Fiesta models in the region. It also reduced headcount by more than 40%. These actions helped bring down losses in the region to its lowest levels since 2013.

Last month, Ford decided to end its production in Brazil and close down three facilities. This will help the company focus more on its profitable models such as its Ranger pickup trucks and Transit commercial vehicles. Ford will source vehicles from Argentina and Uruguay to serve its customers in the Brazil and South America markets.

Electric and autonomous vehicles

Ford is investing significantly in electric and connected vehicles. Electric vehicles are gaining ground across many regions with China seeing increased sales of electric vehicles. During the fourth quarter, Ford rolled out its first all-electric Mustang Mach-E which is performing well. The company will also roll out its all-electric van, E-Transit, later this year and its all-electric pickup truck F-150 in mid-2022.

As part of its connectivity plans, Ford entered into a six-year partnership with Google to create connected vehicles. Beginning in 2023, a large part of Ford and Lincoln vehicles will be powered by Android with built-in apps and services from Google. Ford plans to invest at least $22 billion in electrification and $7 billion in autonomous vehicles through 2025, bringing its overall commitment to $29 billion.

Click here to read the full transcript of Ford Motor Company Q4 2020 earnings conference call