Ford Motor Company (NYSE: F) reported a 86% dip in earnings for the second quarter of 2019 as a result of ongoing global redesign and restructuring activities, primarily in Europe and South America. The results missed analysts’ expectations. The company guided full-year 2019 adjusted earnings below consensus estimates. Following this, the stock fell over 7% in the after-market session.

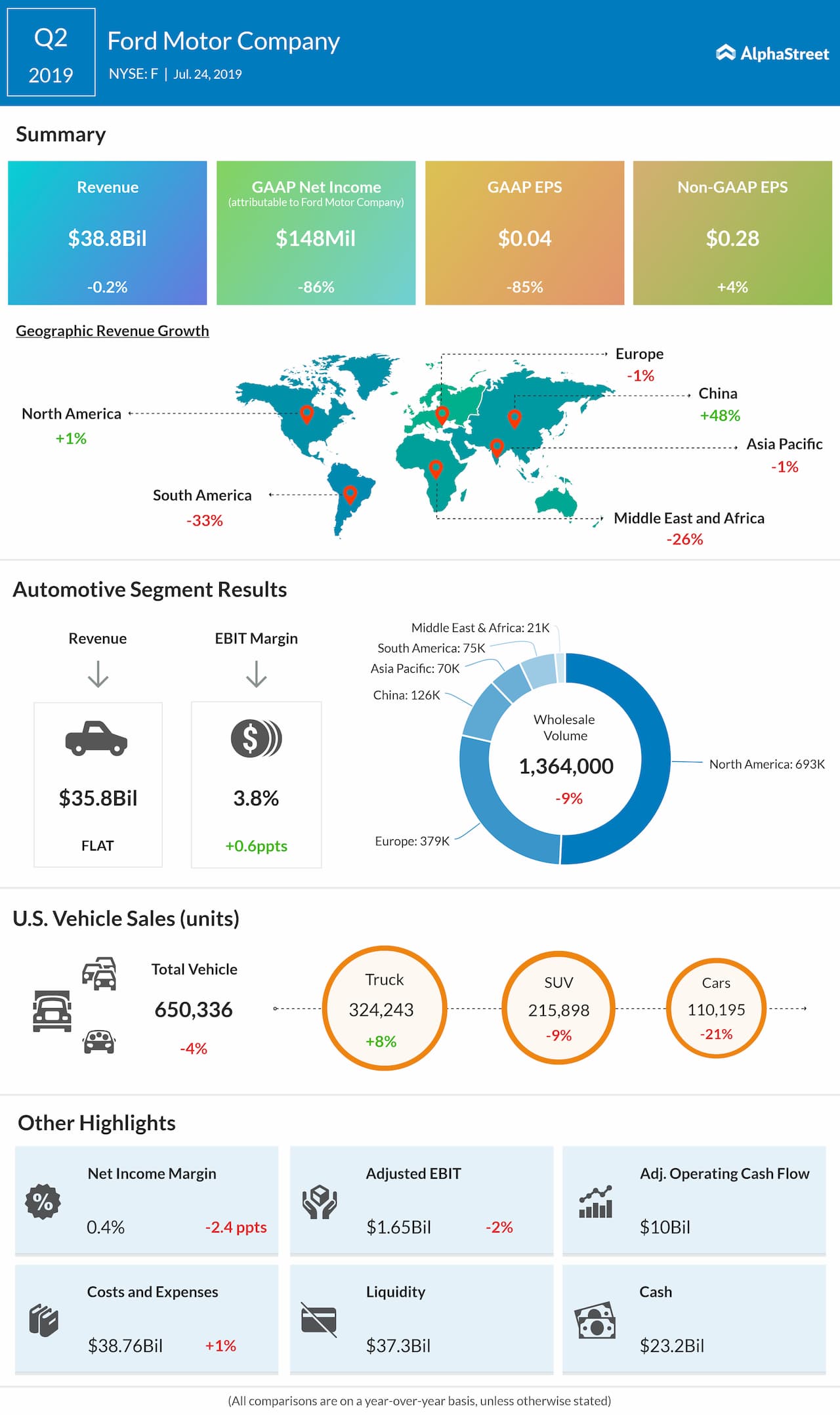

Net income plunged by 86% to $148 million or $0.04 per share. Adjusted earnings rose by 4% to $0.28 per share. The results were hurt by mark-to-market valuation adjustment loss on Ford’s shares in Pivotal Software, a cloud-based software company. Excluding the Pivotal Software revaluation, adjusted EPS would have been $0.32.

Revenue declined by 0.2% year-over-year to $38.85 billion. This was due to lower wholesale units and a decline in market share.

Looking ahead into the full year, the company expects adjusted earnings in the range of $1.20 to $1.35 per share. The range assumes a full-year adjusted effective tax rate between 18% and 20%, which would be up from 10% last year, creating a headwind of 12 to 16 cents per share in 2019. Ford still expects capital expenditures to be about $7.7 billion.

Ford continues to target improvement in its 2019 adjusted free cash flow, led by the automotive business. Adjusted EBIT is expected to be between $7 billion and $7.5 billion in 2019, compared with $7 billion in 2018. Given the cadence of product launches and normal seasonality, the company expects fourth-quarter adjusted EBIT to be higher than in the third quarter.

For the second quarter, Automotive earnings before interest and taxes (EBIT) grew by 19% year-over-year, driven by improvement in mix and net pricing, especially North America’s franchise strengths in trucks and sport-utility vehicles.

Also read: Harley-Davidson Q2 earnings results

The North America region again delivered strong vehicle mix and net pricing, supported by F-Series trucks and a continued shift to SUVs and away from sedans. That favorability was more than offset by launch-related lower volume, along with higher warranty costs. Revenue from consolidated China operations improved by 48% driven by higher volumes for Lincoln.

Wholesales were down 7% as the company introduced an all-new Ford Explorer and Police Interceptor. Those models accounted for 72,000 units of the decline. The company is adding capacity for hybrid versions of Ford Explorer and Lincoln Aviator, as well as the Police Interceptor.

Shares of Ford closed Wednesday’s regular session up 1.57% at $10.33 on the NYSE. The stock has fallen over 2% in the past year while it has risen over 7% in the past three months.