For Novavax Inc. (NASDAQ: NVAX), the new fiscal year is of great significance due to the progress it has achieved in developing Covid-19 vaccine. At a time when healthcare agencies across the world are racing to find a therapy for the deadly virus, the biotechnology firm’s plan to start mass production by year-end should bring cheer to shareholders.

Shares of the Gaithersburg, Maryland-based company posted one of the biggest intra-day gains on Monday, following the first-quarter earnings release, and maintained the uptrend since then. The value more than doubled since trading started this week and market watchers recommend buying the stock, though it looks overvalued at the current levels.

The Vaccine Race

Novavax is all set to start human trail of its candidate NVX-CoV2373 in Covid-19 patients this month, in combination with the Matrix-M adjuvant. Dozens of healthcare entities including pharma giants Pfizer (PFE) and Johnson & Johnson (JNJ) are making rapid progress in their research on formulations that can fight the pandemic. Needless to say, the future prospects of Novavax would depend a lot on proving its mettle in the race.

“Many experts think this will become a common annual seasonal issue, and it would make sense to have a combination vaccine. It’s certainly theoretically possible. We could formulate the vaccine. It’s the same platform, it’s a nanoparticle, our using Matrix-M in both those settings, that’s a good thought.”

ADVERTISEMENTGregory Glenn, head of R&D at Novavax

The market has been keeping a close watch on the vaccine project, for which the company recently received a grant of around $388 million from the Coalition for Epidemic Preparedness Innovations. The management’s plan is to produce about 1 billion doses next year. Since there is no clarity on the cost of production and selling price, it is too early to predict the effect of the whole project on the company’s finances.

Epidemic Expert

Novavax has extensive experience in dealing with infectious diseases and has a development process that is scalable – probably the main reason why it was chosen for the funding. The company is armed with sufficient clinical data to takes forward the vaccine program, but it is doubtful if it has the resources required for mass production.

[irp posts=”61037″]

“The significance of this funding cannot go understated, nor can our appreciation for CEPI’s vote of confidence in our technology platform and progress. It has been an enormous undertaking to get this program up and running since January, but we have made immense progress in a very short period of time to make this vaccine a reality,” said Stanley Erck, CEO of Novavax, during his interaction with analysts at the earnings conference call.

NanoFlu Trial

In another key development, Novavax reported encouraging results from an advanced stage clinical trial on NanoFlu, which according to the company would be a ‘game-changer’ for influenza treatment. The positive outcome, which met all the targets, is expected to pave the way for the drug’s entry into the market through an accelerated approval.

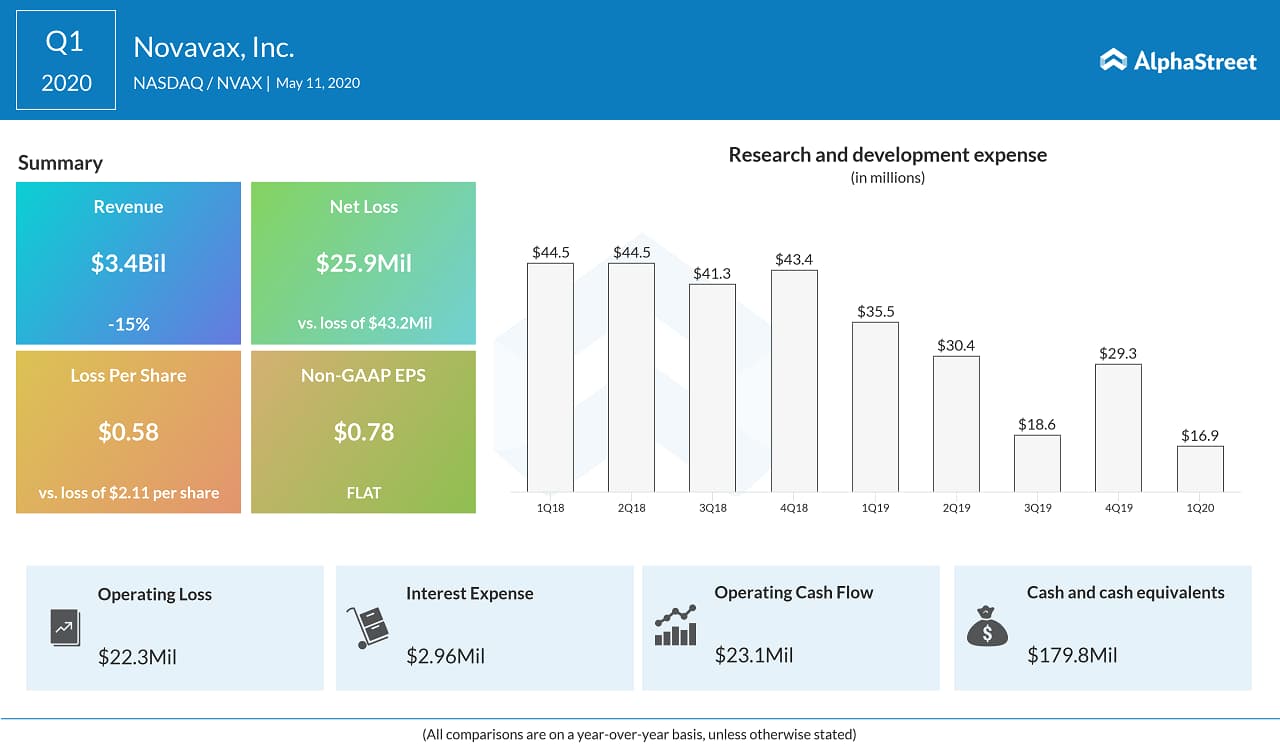

In the first quarter of 2020, earnings remained unchanged year-over-year at $0.78 per share. Meanwhile, revenues dropped 15% annually to $3.4 billion, the impact of which was offset by a double digit decrease in research and development expenses.

Stock Jumps

This week, Novavax’s shares traded at the highest level since last year, thanks to the post-earnings buying spree. The company’s market value increased five-fold in the past twelve months and gained steadily since the beginning of the year.

[irp posts=”61113″]

Vaccine companies have been in overdrive ever since Covid-19 was declared a pandemic. In the US, more than 82,000 persons lost their lives to the virus, while the worldwide death toll stands above 2,90,000. The FDA is reportedly fast-tracking an experimental preventative Covid-19 drug developed by Massachusetts-based Moderna (MRNA), a front-runner in the vaccine race.