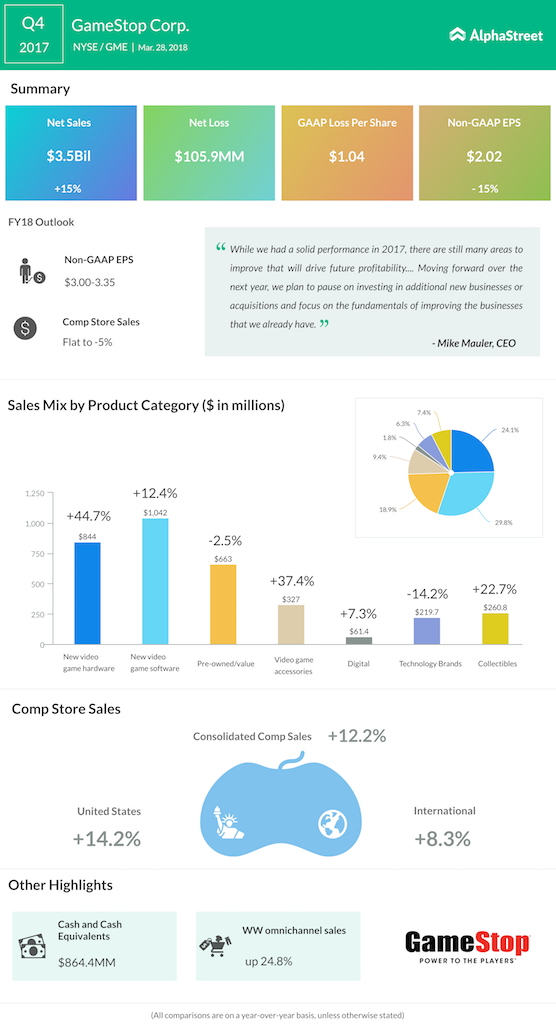

GameStop (GME) delivered strong revenue growth of 15% for the fourth quarter of 2017 beating analysts’ expectations and sending the stock around 2% upwards after market close on Wednesday. But in today’s pre-market session, the stock lost its momentum due to its fragile outlook for the year and was trading in the red. The company’s same-store sales also beat analysts’ estimates, rising more than 12%.

GameStop’s video game retail business, which accounts for around 30% of total revenue, increased more than 12% during the quarter. The company achieved solid sales during the holidays and in the fourth quarter, fuelled by strong holiday promotions, especially for Black Friday. Demand for the Nintendo Switch helped drive the approximate 45% growth in hardware sales. GameStop saw an increase in market share enabled by its strong performance.

GameStop’s net loss during the recently ended quarter was caused by an asset impairment charge. Earnings, excluding this charge, came in at $2.02 per share, ahead of analysts’ expectations.

Worldwide omnichannel sales grew close to 25% while pre-owned sales dropped 2.6%. The increase in omnichannel sales was helped by new hardware sales. Technology Brands sales saw a 14.2% drop due to changes in AT&T’s dealer compensation structure. The collectibles business, which saw good growth during the quarter, is expected to contribute further to profitability.

Going forward, GameStop will focus on its core Video Games, Collectibles and Technology Brands businesses and look for ways to improve their profitability.

In his first earnings conference call as CEO of GameStop, Mike Mauler said that the company will be taking a pause on investing in new businesses and acquisitions. He added that GameStop will focus on systems, remodeling, and maintenance rather than investing in new stores in the near future.

The gaming retailer, which currently has a market cap of $1.42 billion, saw its rating lowered to “sell” two days ago by some research firms, while others mostly maintained “hold” and “buy” ratings.