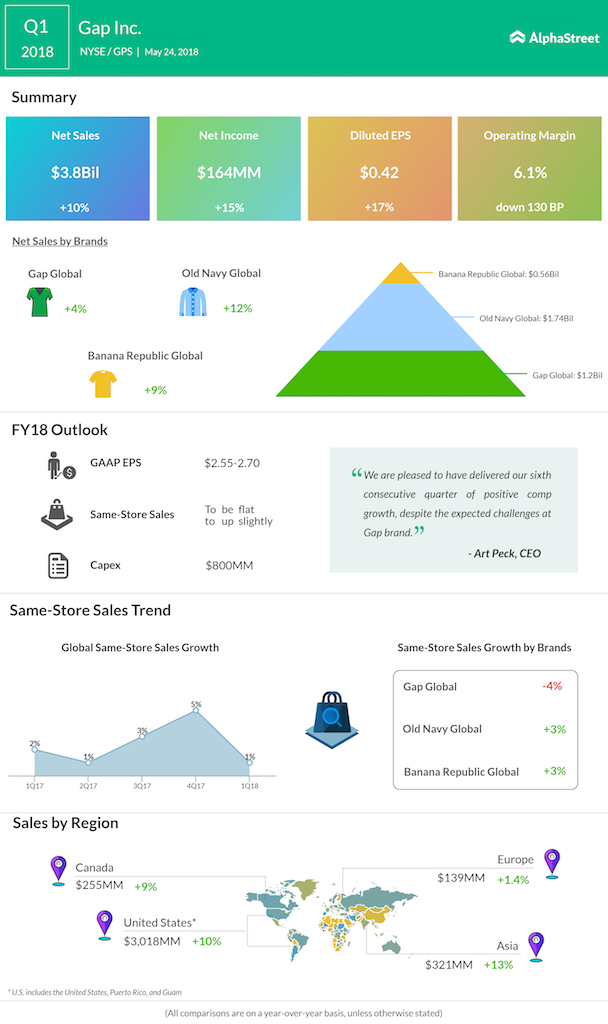

Clothing retailer Gap Inc. (GPS) posted better-than-expected top-line in the first quarter, while the bottom-line missed expectations. The stock dropped almost 7% following the results. The company’s reported profit gained 14.6%, while diluted EPS came in at $0.42. Revenue climbed about 10% to $3.8 billion.

Gap affirmed its fiscal 2018 diluted EPS outlook of $2.55 to $2.70 per share, while comparable sales for fiscal year 2018 are expected to be flat to slightly positive. The company believes that its brands Athleta and Old Navy would continue to add to its growth story, partly offset by a decline in the Gap brand. The company continues to expect repurchases of approximately $100 million per quarter through the end of fiscal year 2018.

During the first quarter, overall same-store sales rose 1%, compared with an increase of 2% during the same time a year ago. This marginal growth was stemmed from Old Navy and Banana Republic’s positive results. Banana Republic broke its year-long negative comp sales trend coming in at positive 3% in the quarter, while Old Navy also grew as much. Gap’s results were a negative 4%, flat vs. last year.

Old Navy has been the only bright spot for the company which has been covering up the negatives of Gap and Banana Republic in the recent past. However in Q1, Old Navy lost the momentum it has been showing in the previous quarters gaining just 3% compared to 9% in Q4.

“We are pleased to have delivered our sixth consecutive quarter of positive comp growth, despite the expected challenges at Gap brand,” said Art Peck, President and Chief Executive Officer

The stock has jumped over 43% over the course of the year, while it has slumped 6% since the beginning of this year. Gap’s competitors have had a mixed response to earnings with Macy’s (M) stock soaring about 11% to a new high and Best Buy (BBY) tumbling almost 7%. Gap gained on early losses post the release and was trading at $30.50.