Revenue Dips

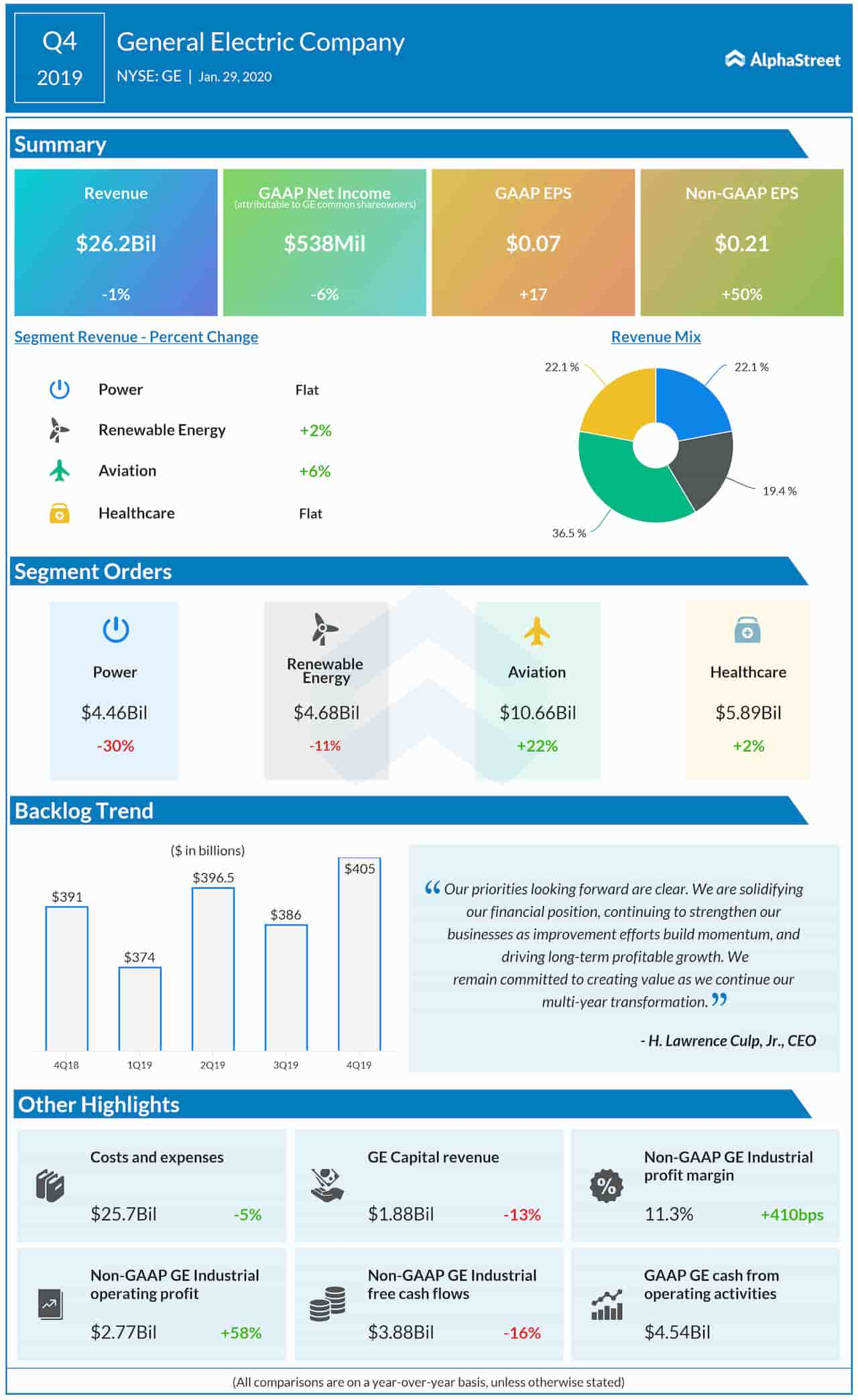

Revenues declined 1% annually to $26.2 billion but exceeded experts’ target. However, the key business segments registered top-line growth. During the three-month period, total orders declined 5% year-over-year to $24.9 billion, with organic orders dropping 3%.

“We’re proud of our progress in 2019, including decisive actions to reduce our leverage and strengthen our businesses. Our work continues, but GE’s committed team, exceptional technology, and global network make me more confident than ever that we can deliver,” said CEO Lawrence Culp, Jr.

Outlook

Looking ahead, the management expects GE Industrial revenues to grow organically in the low-single-digit range in full-year 2020. In the Industrial segment, adjusted profit margin is expected to expand organically in a range from 0 to 75 basis points. Earnings, on an adjusted basis, are forecast to be in the range of $0.50 per share to $0.60 per share. The company is looking for free cash flow of $2-$4 billion for GE Industrial.

New CFO

GE also announced the appointment of Carolina Dybeck Happe as Chief Financial Officer, who will assume office early 2020. Kevin Cox has been appointed as Chief HR Officer and Pat Byrne as CEO of Digital.

Also read: General Electric Q3 2019 Earnings Call Transcript

GE shares gained 3% since the beginning of the year and 20% in the past twelve months. However, the stock underperformed the industry during that period.