“

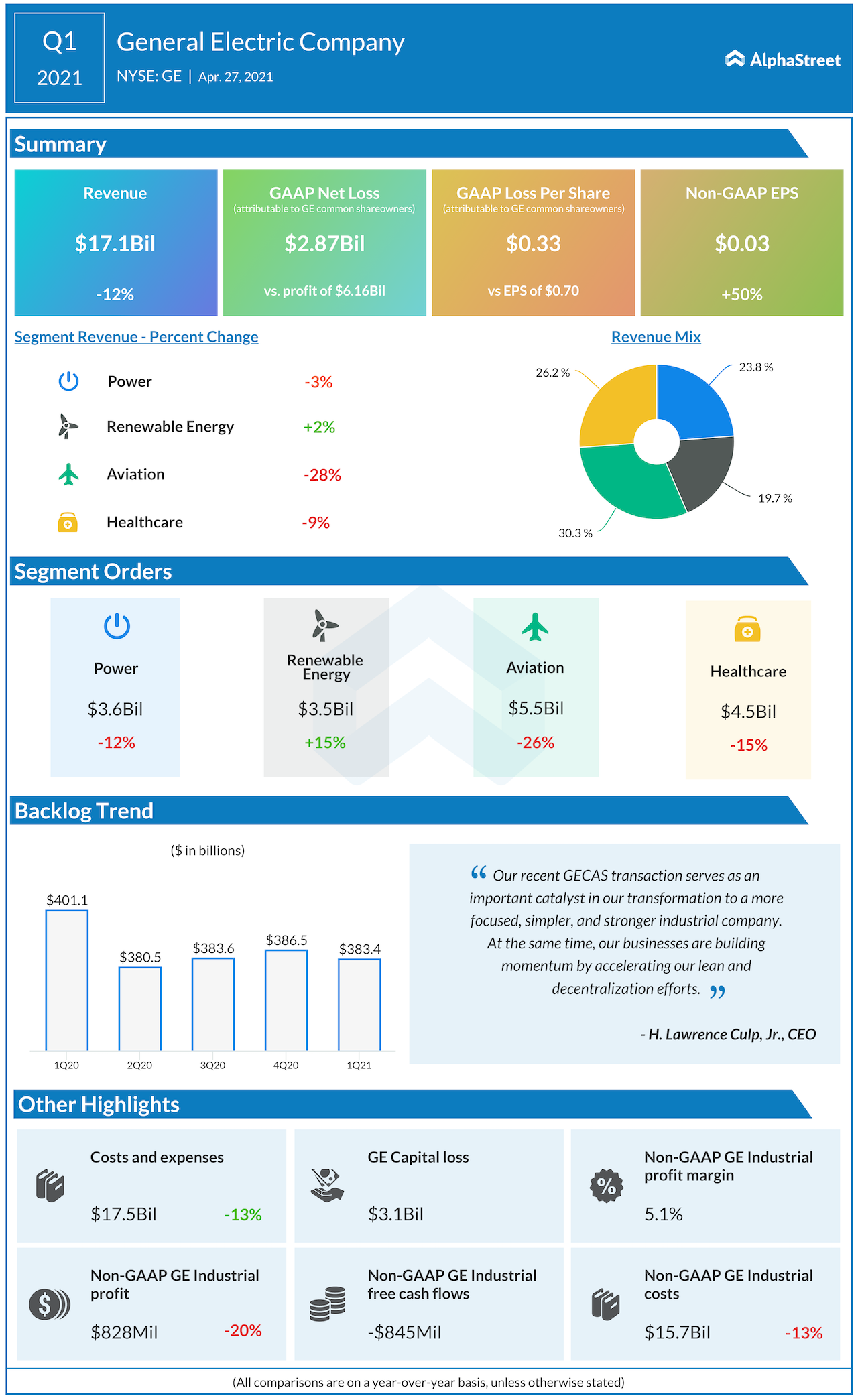

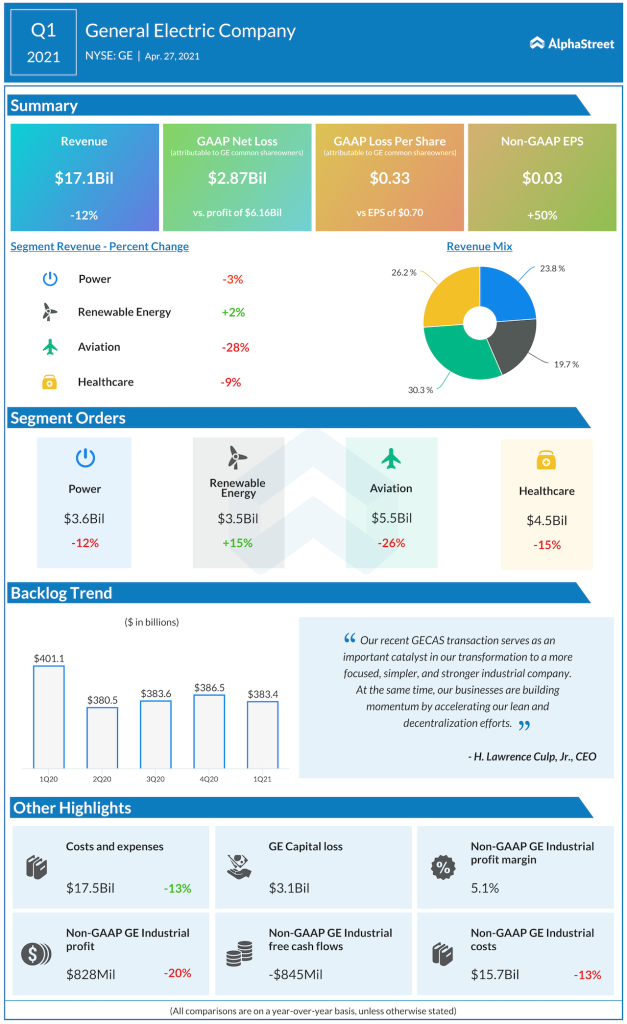

General Electric (NYSE: GE) reported first-quarter 2021 financial results before the regular market hours on Tuesday. The payment services firm reported Q1 revenue of $17.1 billion, down 12% year-over-year and below the Wall Street projection. Meanwhile, net income of $0.03 per share was two cents above the target that analysts had anticipated. GE shares fell […]

· April 27, 2021

General Electric (NYSE: GE) reported first-quarter 2021 financial results before the regular market hours on Tuesday. The payment services firm reported Q1 revenue of $17.1 billion, down 12% year-over-year and below the Wall Street projection. Meanwhile, net income of $0.03 per share was two cents above the target that analysts had anticipated.

GE shares fell 3% immediately following the announcement. The stock has more than doubled in the trailing 12 months.