Shares of General Mills Inc. (NYSE: GIS) were up 1.7% in afternoon hours on Wednesday after the company reported better-than-expected earnings results for the fourth quarter of 2021. The stock has gained over 3% since the beginning of this year.

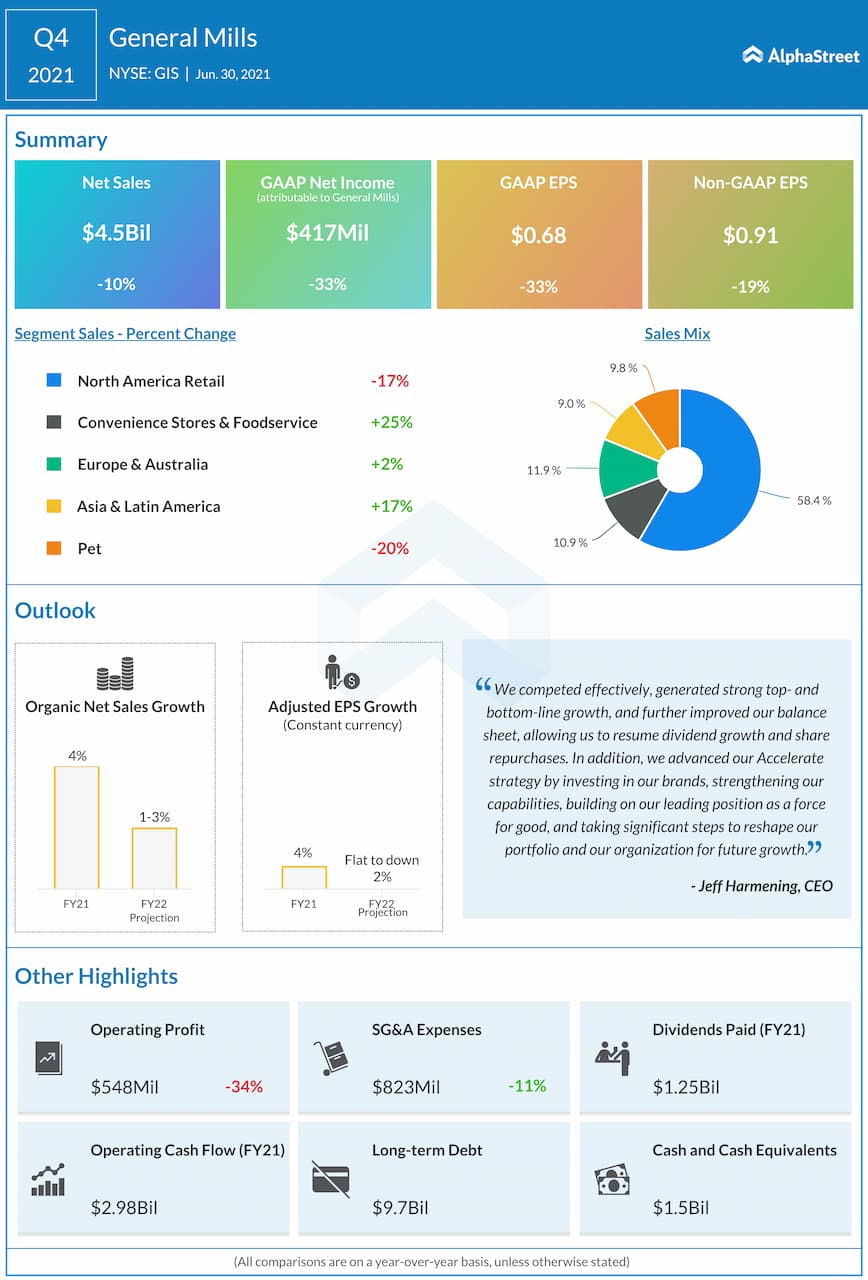

Sales dropped 10% to $4.5 billion compared to the year-ago period which had witnessed a spike in demand due to pandemic-related pantry-loading. Adjusted EPS fell 19% to $0.91, reflecting a drop in adjusted operating profit. Here’s a look at some of the highlights from the company’s report:

Demand trends

Over the past year, General Mills benefited from strong demand for packaged food products as people consumed more meals at home. This trend has begun to ease and this was evident in the quarterly results as sales dipped compared to year-ago levels when there was a massive surge in demand for ready-to-cook products.

In the fourth quarter, sales in the North America Retail segment dropped 17% year-over-year with a 30% decline in US Meals & Baking and a 16% decrease in US Cereal. US Snacks were also down 2%.

On its quarterly conference call, the company said it believes that some of the changes brought on by the pandemic like the surge in ecommerce, the trend of working remotely as well as an increased interest in cooking and baking are not likely to go away completely and are more or less here to stay.

However, as vaccines are distributed and restrictions ease and the economy recovers, the demand for eating at home is expected to see a drop compared to last year. At the same time, demand for eating out is expected to see a pickup. Still, neither of these are anticipated to reach pre-pandemic levels.

As around 85% of the company’s sales come from at-home food products, consumer demand is expected to be low across all its categories in FY2022. General Mills expects organic net sales to be down 1-3% in FY2022 versus FY2021.

Pet category

The pet food category in the US is growing rapidly and this presents a growth opportunity for General Mills. The company’s BLUE brand is seeing strong demand and continues to gain market share.

The acquisition of Tyson Foods’ (NYSE: TSN) pet treat business, which has brands such as Nudges, True Chews and Top Chews, is expected to complement General Mills’ BLUE brand portfolio as well as solidify the company’s position in the pet food segment. Tyson’s pet treat business generated annual net sales of over $240 million and has grown at a nearly 20% compound rate over the past three years.

Cost inflation

Input cost inflation continues to be a challenge for General Mills. The company expects input cost inflation in FY2022 to be at the highest level seen in a decade. Total input cost inflation is estimated to be around 7% of cost of goods sold in FY2022. General Mills is combating this situation with price increases and other cost savings.

Click here to access the full transcript of General Mills Q4 2021 earnings conference call